What To Do With Your Tax Refund to Improve Your Financial Position and Avoid Financial Peril

Here we are – right in the thick of tax season in the United States.

What to do with your tax refund is likely one of the biggest questions on your mind, and the dangerous temptations to make bad decisions are coming from everywhere.

- Banks are offering you crazy amounts of cash for new accounts

- Cell phone companies are offering ridiculous buyouts on your contracts

- What was once a Lee’s Famous Chicken is now a tax preparation office, who will obviously get you a “max refund” (they won’t and you’ll leave smelling like chicken) 🙂

- And some car dealerships are even offering to do your taxes for you, and match your refund as “cash back” on a new car (really…? REALLY?!?)

It’s like the holiday season 2.0 but without all of the lights an ornaments.

Everywhere you go, you’re being bombarded with a new offer to burn that pile of money that you’re about to come into.

And if you’re likely to get a nice tax return, you’ve probably got all sorts of ways lined up to spend it. Maybe you’ve even spent it already.

It’s possible you may not get as much as you thought. Then what?

It sounds a little counter intuitive, but it’s actually very easy to take a big chunk of money and make your financial position far worse than it is right now. I’m here with this training to help you make that position better, wherever you are on the financial spectrum.

But before you do anything, I want you to think carefully about how what you do now is going to affect your life in the future, and how it aligns with the goals you’ve set for yourself both developmentally and financially.

—-

What To Do With Your Tax Refund

Depending on where you are on the financial spectrum, what you do with your tax return money can make a big impact on your financial future. These are in order from at which point in your life you should be thinking about them.

For example, it may be a little silly to dump $5,000 into an IRA if you have $10,000 of credit card debt.

It may also be equally silly to pay off $5,000 of your low interest student loan debt if you can make twice the return in the stock market. It all depends on your specific situation.

1.) Pay Off Chunks of Debt

This one is pretty much a no-brainer, and is exactly why I put paying off debt first in my collection of financial automation checklists.

Paying off debt is one of the core financial goals to achieve before you can begin the process of saving for large goals, investing in yourself, and growing your money for your future.

The reason this section is titled pay off “chunks” of debt is because it’s not always the best idea to pay off the highest interest debt you have first.

It can often be more effective for your motivation to choose a small account of your debt that you can pay off in one large payment. This will give you a quick win, one less bill to pay, a nice feeling of accomplishment, and motivate you to pay off future accounts much quicker.

These can be things like student loans, car payments, furniture that you bought on credit and other small debt accounts. If you can pay these off with one big chunk, it’s nice not to have those additional payments due each month.

READ: How to Stop Paying Credit Card Fees (via I Will Teach You to be Rich)

READ: How to Hack Your Credit Score in Three Easy Steps

READ: Let’s Crush Your Limiting Beliefs About Money

2.) Reward Yourself With Something (Small) You’ve Really Been Wanting

Using all of your tax return money to pay off debt usually pretty hard to do for a lot of people, not to mention pretty boring. If you’re in major debt, it’s something to consider, but if you’re not buried, it’s fine to spend a little bit.

Life is for living after all, right?

Depending on how large your refund is, take a few hundred bucks of it, maybe 15-20% of it, and buy yourself something you’ve been wanting to buy, but haven’t been able to. Notice I say 15-20%, not half or all of it!

The psychology behind this is if you get yourself something small you’ve been wanting, you’ve rewarded yourself with your refund and satisfied your desire to spend. You’ve spent it responsibly on something you want, but you’ve left yourself 80% of it or more to be smart with it, which is what comes next.

What you want to avoid here is dumping your entire tax refund on something like a down payment for a car, and putting yourself into additional debt for years to come, and worse, increasing your tastes and lifestyle to the point where you can’t go back.

READ: Seven Awesome Things to Do With Your Extra Money Without Blowing It

READ: Seven Silly Financial Myths That Are Making You Poor

3.) Save For a Large Financial Goal

One of the next largest tasks after paying off debt in your financial life is setting yourself up for future success (and mitigating financial risk), which means saving for large goals without getting yourself into additional debt.

This could be something like a down payment for a house, a down payment for a vehicle, an emergency fund, or anything else in the upper four to lower-mid five figure range.

Dropping the remainder of your tax refund into an account you’ve set aside for just this specific purpose is a great way to keep it safe from being spent, as well as automate future deposits into it so you never have to worry about manually saving.

READ: How to Continually Increase Your Financial Capacity

READ: How to Create an Actually Useful Financial Emergency Fund

4.) Buy Things That Make You Money

Is your high interest debt paid? Do you have your savings and financial automation in order?

If so, maybe now you’re ready to begin investing in assets that make you money.

Rather than buying thousands of dollars worth of stuff like cars, jewelry, electronics, get something small to satisfy your spending need, and consider buying investments that will pay you back over time.

Besides, the opportunity cost of your stuff is more than you think.

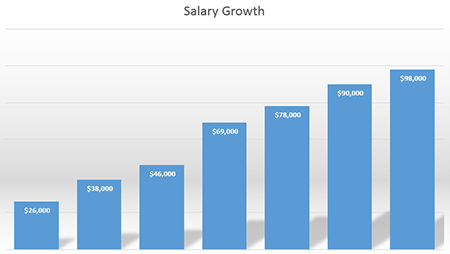

Nothing is a sure thing in the stock market, but over the long term it’s tough to go wrong with solid blue chip growth stocks from established companies. Even an average growth rate around 7% can pay you back several times over in the course of your life.

Start small and get comfortable. Once you get to the point where you know what you’re doing, you can invest more and make more with your purchases.

READ: Blue Chip Stocks Essentials (via Motley Fool)

READ: 10 Blue Chip Stocks With Fat Dividends (via Yahoo Finance)

5. Deposit Into a Retirement Account

You can deposit up to $5,500 of after tax money into an IRA or Roth IRA each year, and up to $18,000 into a 401k.

These are tax protected investment accounts that can grow tax free with other benefits depending on which one you choose.

Because these are tax protected, these have annual maximums associated with them, and there’s no playing catch up from the year before. Once one year’s opportunity to deposit is gone, it won’t come back. Invest in these while you can.

One cool unconventional strategy to take advantage of your tax return to pad your retirement accounts is by temporarily increasing your 401k contributions from your paycheck to deposit a couple thousand extra bucks for your future.

Most 401k plans won’t allow after tax deposits from an outside source other than your paycheck, so using this strategy allows you to take advantage of your cash influxes to get more into your 401k.

Once you’ve deposited enough, tick your contributions back down to where they were before.

I cover this strategy and MANY more in my full 401k Millionaire Video Course, or if you want a lighter quick start guide, pick up Six Figure 401k on the Kindle.

READ: Myth: You Can’t Get Rich Working for Someone Else

READ: Shit… Where Did All of My Money Go?

6. Take a Much Needed Vacation

Let’s face it. You work hard. You’re probably a little stressed, and you could use a break from all of it.

Plan a short vacation and get away from it all for a few days. A nice vacation can help you come back refreshed with a new outlook, higher productivity, and a heightened sense of motivation.

READ: The Buy Me a Trip Technique

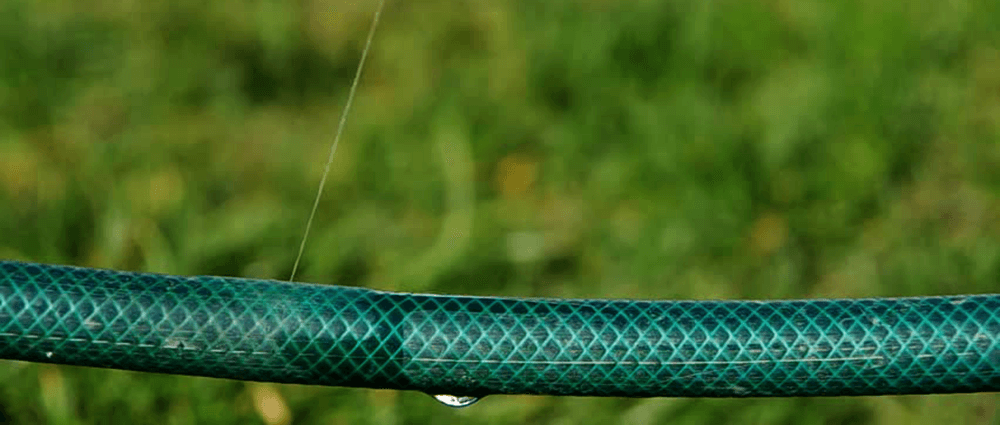

7.) Make Financially Sound Home Improvements

Home improvements usually cost a decent chunk of change. Tax season can be a great time of year to make these with this nice influx of cash.

Personally, I’m an advocate of making home improvements for improving the experience of your home as well as improving the value, but certain home improvements can pay off far more than they cost. You may want to consider focusing on these first.

If you can do these types of home improvements within the realm of your goals, you not only get to enjoy them, but you also add to the value of your home.

READ: How to Save Money and Stay Warm During the Cold Winter Months

8.) Improve Yourself – Sharpen Your Axe

There’s a famous quote from Abe Lincoln that goes something like this – “Give me six hours to chop down a tree and I’ll spend the first four sharpening my axe.”

Or maybe it was to kill vampires? Who really knows? 🙂

The point is, the more you can sharpen yourself and your own skills, the better you are going to do in life.

A tax refund can contribute to the mental part of sharpening your own axe by allowing you to invest in your education.

- Take a training course and learn a few new skills.

- Buy a few books and commit to reading them.

- Hire a coach to help you with a goal you’ve been struggling with

You could also use your tax money to increase your physical capacity. Hire a personal trainer to improve your health and overall output, or an accountability coach to develop a workout plan and help you stick to it.

Richard Branson (who once tweeted me), is well known for “working out” being his ultimate productivity hack. I can attest to this as well, being a big fan of fitness.

One of the main reasons I have a fitness coach aside from holding me accountable and making sure I don’t hurt myself 🙂 is to help me increase my productivity capacity.

READ: 30 Lessons Learned From 30 Years of Change

READ: How to Think Differently About Money This Year

READ: How Tim Ferriss Taught Me to Do Double Unders – The 10,000 Double Under Challenge

So, Let’s Review

When you get a large influx of cash, it’s easy to just go out and spend it right away. You can even get yourself into financial trouble this way.

But with just a little bit of thinking and planning, you can still satisfy your desire to spend while also drastically increasing your financial position.

Depending where you are on the financial spectrum, consider the follow tactics while making your decision for what to do with your tax refund.

- Pay off chunks of debt

- Reward yourself with something small

- Save for a large financial goal

- Buy things that make you money (invest!)

- Deposit into a retirement account

- Take a much needed vacation

- Make financially sound home improvements

- Improve yourself – Sharpen your axe

If you read this far (nearly 2,000 words later), first I just want to say thank you. I appreciate each and every one of you. Academy Success would not be here with you.

If you enjoyed this post, would you mind doing me a favor and sharing it with your friends using the social sharing buttons on this page? It will help me out and help them as well.

You can also email it to your friends just by clicking here.

We’ll talk soon!

Cody

That’s awesome Matt. Sounds like you’re doing a great job following a plan.

Check out Motley Fool for some great beginner investing information. I’ve made $1,000s from following their advice.

If both you and your wide open an IRA, that’s an extra $12,000 a year you can put back.

Keep up the good work bud. Thanks for following and thanks for the kind words.

Hey, thanks for another great article. Reading this was almost like you listened in to the conversation that I had with my wife last week when our refund hit the bank. Funny enough, paying off a large chunk of her student loans was our first priority. Then, paying off our new fridge was the next demon extinguished, the old one died after 26 years of service. We each took a chunk to buy something, and the rest was divided with half going in a savings account. Broken down we probably used about 70% of our refund on debt, and the rest for entertainment and investment. If we stick to our goals this year and next we’ll have my wife’s student loans paid off next spring, and all our credit cards will be paid off and several of those will be closed. Our big debts left will be our house, cars, and a visa card that is paid off every month. We got the visa card because it helped drop our car insurance rates nearly $100 a year, it might not be a good idea but its paid off every month and we can close it anytime. Also, we’ll be setting up additional retirement accounts because what ford offers isn’t enough. Then, we’re getting our life insurance policies set up, and we are looking into possibly buying some stock.

Reading this basically reinforced everything we are doing and it tells me what we are doing is correct and leading us in the general direction of financial success.

BUT, keep writing these articles, I use the advice and it really does work. Thanks, Matthew Rochner.