I’m just going to come right out and say it.

Most of the people you know have no idea what to do with their money.

- They probably have no idea where their money goes.

- They probably waste money on dumb things while saving very little

- They’re probably trudging towards a life of poverty in retirement.

My hope is that you have good financial influences in your life, because no matter who you are, you will inevitably pick up the habits of those around you.

So to that note, I want to address a question I’m asked pretty frequently – what to do with “extra money” (other than swim in it of course).

But before I go on, you should know that the choosing the wrong way to go about handling this situation can cause you to develop some destructive behaviors and habits and could spell disaster for you financial future.

“What Should I Do With This Extra Money?”

If you’ve ever been in a situation where you have “extra money” floating around, well… that’s a good problem to have.

We’re talking something like a few thousand bucks or more here, or a large and extended cash flow surplus.

If so, high five!

If not, it’ll probably happen to you at some point, and I want to be in the mindset that it will, so keep reading.

- Maybe it’s from a big bonus or settlement of some kind

- Maybe it was a windfall cash gift from a relative

- Maybe you got a nice inheritance

- Or maybe you’re just smart and you’re making a lot more than you have expenses

Whatever the situation, this can be one of two things along the spectrum of money.

It can fall towards the end of being a awesome opportunity to create a large amount of wealth for yourself in the future

OR

It can fall towards the end of being a gateway to opening up the flood gates of overzealous spending habits in your life.

The choice is yours to make.

How Your Extra Money Can Make You Poor

Before we get into the seven awesome things to do with your extra money, I want to throw you a very important warning.

If you’re about to just scroll down to the 7 strategies, I can’t really stop you, but if you really care about your money I urge you to heed my warning, young grasshopper (I’ve always wanted to use ‘heed’ in a sentence).

Before I go on a rant, here’s some data for you to back up this point.

When people come by a large chunk of unexpected money, there is a strong feeling in them that it’s not really theirs, and they have a license to spend it.

Just think about the last time you found any quantity of money. What were you immediately tempted to do? Spend it on something, right?

The same is true for any type of “found” money.

In 2009, Harvard Researchers found that when they gave participants of an experiment an extra $10 more than a peer group, the subjects spent 20% more after being told the money was “extra” in nature.

In financial behavior psychology, this is known as “mental accounting” where people assign economic values to their income often by what the source of it was (how hard they worked for it, for example).

What this means is, people are far more likely to value money less that they don’t feel they have put in a large amount of effort to earn.

Or to put it another way, they’re more likely to spend “extra money.”

How this is dangerous to you is, if you don’t realize and recognize this phenomenon when you have come into extra money, it can often result in a large amount of irresponsible spending, and in some cases, a large change in your financial behaviors.

For example – Let’s say you come into $10,000.

You’re all super happy skippy excited and decide you should put that $10,000 down on a new car that costs $30,000.

So now – instead of having $10,000 in the bank – you have a $350 car payment for 5 years, as well as probably higher insurance costs.

So not only have you taken what should have been a good thing and turned it into a five year expense commitment for yourself, but more importantly, you’ve probably also set a precedent for yourself that you really like $30,000 cars, and you’ll never go back.

It happens – all… the… time.

Can you see how this can be so dangerous?

How Your Extra Money Can Make You Rich

Ok, now with that out of the way (I hope you heeded my warning), let’s talk about the good stuff.

Let’s talk about how to make your new found money work for you – not the other way around.

If you take away one thing from this article, I want it to be this.:

It’s all good if you want to take yourself out to a nice dinner or something like that, but don’t do something foolish and get yourself into a bad situation.

First, immediately think of this as your money. Get out of the mindset that it’s just spendable income. It’s not.

It’s as much yours as the money from your paycheck that you worked so hard for.

It’s straight cash homie. The source of it doesn’t make it any more or any less valuable.

So now that you understand that, next, use this money to achieve a positive financial outcome in your life.

Here are seven awesome things to do with extra money… without blowing it.

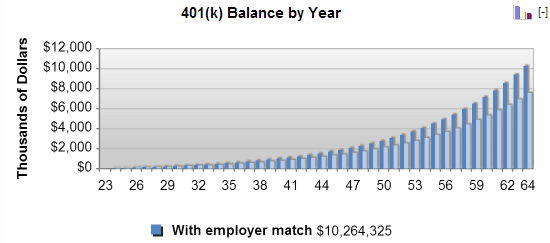

1. Deposit More Into Your 401k

Your 401k, if you’re fortunate enough to have one, can literally turn you into a millionaire several times over in your lifetime.

In fact, if you play your cards right, it’s totally possible to have an eight figure balance in your 401k by the time you retire, although most people will be thrilled with seven figures.

(I did that math and created that image by using the BankRate.com 401k Calculator, which is awesome by the way.)

What a lot of people don’t seem to grasp, is that even though you normally can’t deposit your own after tax money from other sources than your employer into your 401k (some plans do actually allow this), what you can do is increase the contribution percentage of your 401k significantly for a brief period of time.

This allows you to pump more into your 401k from your paycheck. Meanwhile, you’ll be using your extra money to replace what goes into your 401k.

And if you’re a traditional 401k investor, you’ll be significantly lowering your taxable income in the meantime.

2. Create an Automated IRA Investment Plan

Opening and investing in an IRA (individual retirement account) used to be a pretty huge pain.

Before online brokers burst on the scene, it could take several phone calls, meetings, snail mails back and forth, and many other hoops to jump through to get one set up and running.

But even online brokers didn’t solve the problem initially. There was still boatloads of paperwork to do.

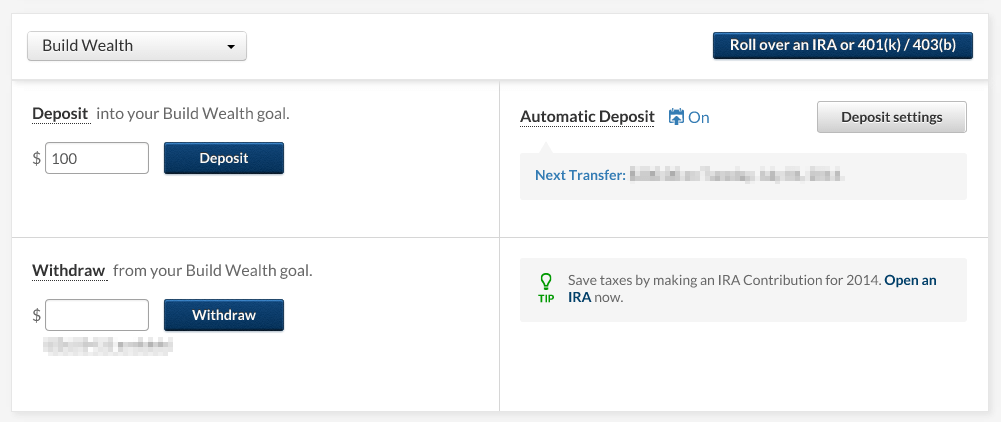

However, in today’s rapidly advancing world of online banking and investing, with services like Betterment (that link gets you $25 for free), you can literally be up and running with a new IRA in a matter of minutes.

They even go as far to offer complete hands off financial management, for a fraction of the cost of otherwise expensive professional money managers.

Use your extra money to make your initial deposit, and then treat this as a catalyst to setting up an automated IRA investment strategy that will make your money work for you over time.

Betterment’s tools make it easy to completely automate investing. You just link up your main bank account, input how much to invest each month, and let them do the rest for you.

PS: Grab yourself a copy of the Financial Automation Checklist Collection to walk you through this process step by step.

3. Buy a Safe, Blue Chip Growth Stock

Have you ever heard stories of old people who bought one share of stock in something like the 1950s for like eight bucks, and now they’re millionaires because of it?

Well, it happens. I’ve seen it first hand.

A lot of people, when they think of stocks, they think of getting rich quick, because that’s what the talking heads on the media like to glamorize the stock market as.

But the real magic is in long term growth over time. Just a little bit of money now can turn into a whole lot in the future.

Let’s take our $10,000 example from earlier.

Instead of dropping that $10,000 down on a car that, as I’m sure you remember is going to make you poor anyway, let’s say you invested it in one really solid blue chip stock, and you left that stock alone until you were ready to spend it’s earnings.

If that stock grows at a rate of just 8% over the course of your life:

- In 30 years, you would have about $132,000

- In 40 years, you would have $314,000

- In 50 years, you’re looking at a cool $743,000 – over 70x what you originally had.

That’s the power of compounding earnings over time. And it can be an absolute reality if you let it happen.

Check out Scottrade or Sharebuilder for simple online trading.

4. Create an “Experience Fund”

My wife and I have a vacation fund that we both deposit money into every month in order to save for nice vacations. We actually have a pretty good system that allows us to put a lot of money into this account if you want to take a look at that as well.

She doesn’t know this yet, but I’m about to change it from our vacation fund, to our experience fund.

The older I get and the more people I meet, the more I am learning that life is about creating experiences.

The best stories and conversations with friends revolve around life experiences, not a bunch of stuff that looks pretty.

If you’re not doing this already, I highly recommend putting money aside that is strictly for recreational “experience-creating” use only.

What I mean by this is not just going on vacations, but using it for weekend excursions, social events, and basically anything you can do that you can come away with a good story.

As Mark Twain once said, “Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover.”

To do this, just set up an automatic transfer from your checking account to a savings account at a bank other than where your checking account is located (that way you won’t be tempted to spend it).

Personally, I love Capital One 360 (there’s free money in that link for you too) for this. It’s ridiculously easy to get signed up, they usually give you free money when you do, and it’s really easy to use.

They also allow you to set up sub accounts which you can use for certain goals – experiences, for example. 🙂

This strategy alone has resulted in tens of thousands of dollars in savings for me over the course of my life – and several vacations that I may not have otherwise taken.

This technique is also outlined in The Financial Automation Checklist Collection, step by step, if you would like help getting it set up.

Grab a copy. It’s free.

5. Safely Invest Towards a Future Goal

Sometimes cash savings isn’t enough to meet whatever future goals you have. If you require larger amounts of money for a future financial goal, a safe investment that has a very high chance to grow at a reasonable rate might be a better decision for your extra cash.

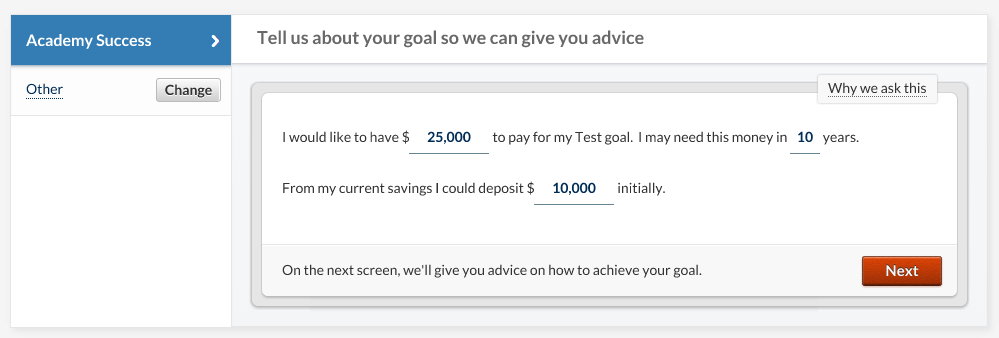

Again, I have to recommend Betterment for this as well.

To me, they have one of the best tools available for hands off money management, with a full spectrum of goals in mind.

One of the features I love about this service is the Goal feature.

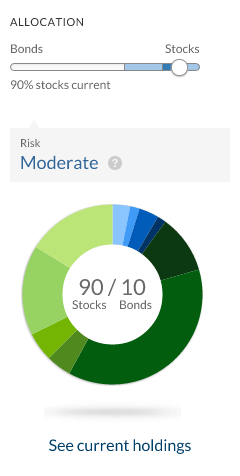

Betterment will allow you to set a goal, then will adjust all of the parameters and risk of your account so you have the best chance of staying on track to hit that goal.

From there, they handle everything else for you. It’s totally hands off for you.

And if you don’t like their choices, you can always adjust them yourself with a simple drag of the allocation slider in your account.

Of course you can do this with other ways as well, such as buying government bonds, etc, but Betterment is just so easy, their service gets my recommendation all day long.

6. Start a Banana Stand… Err.. Side Business

According to a study done by the University of Phoenix, 63% of those under the age of 30 want to start a side business of some kind (probably not banana stands, but you get the idea).

The number does dwindle as people age, with only 22% of those over 60 having a desire to make side income, but this is still a pretty large chunk of people, even at 60.

Beyond that, many people state that they want to start side businesses not just to earn more income, but to bring more fulfillment to their life purpose. Doing something that creates income that is fun for you as well – that’s an awesome win/win.

The barriers to entry have never been lower to start earning income on the side.

- With sites like Etsy, anyone can sell their own homemade wares at any scale

- With tools like Squarespace, websites have never been easier to create

- And with the world in the middle of the social media boom, it’s never been easier to spread a message

So, full disclosure, you might actually be spending some money here, but I prefer to think of it as more of an investment in your future.

You’re not buying a $30,000 car, after all.

Just be wary not to fall into the trap of “playing business.”

As Noah Kagan of AppSumo (formerly of Facebook and Mint) says, “Prove your idea first. Logos and business cards can come later.”

7. Pay Your High Interest Debt

So I saved this one for last because it’s probably the least sexy of all, but it’s also important as hell if you ever want to create a positive financial situation for yourself.

People usually flip out when I say this, but I’m a free thinking dude and I totally think that some debt is fine. Correctly managed debt allows you to enhance your lifestyle while not heavily impacting your financial situation.

Just don’t be stupid about it.

Your mortgage is fine as long as you didn’t get a really crappy rate and it’s not causing you a huge financial hardship.

A super tiny car payment is even OK as long as you plan on paying it off quickly and driving that sucker for 10 years.

But if you have high interest debt – say over 5%, take your extra money and just pay that shit off before doing anything else.

I don’t have to do the math here to tell you that there’s really no significant point in investing if you have a crap load of debt eating away at your cash flow.

You don’t have to pay it all off at once, but at least pay down a big chunk of it, and set up an automation system to pay the rest.

Again, paying down debt is another topic covered in The Financial Automation Checklist Collection that you can grab a free copy of.

Now, Pick One and Roll With It

At this point I have to remind you that it’s now up to you to take action and behave successfully.

If you just skim through this list and take no action at all, your life will be absolutely no different than it is today.

- Deposit more into your 401k

- Create an automated IRA investment plan

- Buy safe, blue chip growth stocks

- Create an “experience fund”

- Safely invest towards a future goal

- Start a side business

- Pay off high interest debt

But if you really commit to doing even just one of these seven awesome things to do with your extra money, your future self will very likely be incredibly grateful.

So if you read this far (nearly 3000 words later), first I just want to say thank you for the support. Would you mind doing me a favor by sharing it with your friends using the social sharing buttons on this page?

You can also email it to your friends just by clicking here.

I would really appreciate it.

—

PS: As I write this post, I just released The Financial Automation Checklist Collection, a series of easy-to-follow checklists that walk you, step-by-step, through setting up a completely automated financial system for any of your financial goals.

They have been the secret sauce to helping me set up the financial system that resulted in my growing six figure net worth.