There’s a ton of talk out there about the many reasons for a “financial emergency fund” for times of financial need, but when the deep down “how to” of executing this critical area of your financial life comes into play, the Internet fails.

I won’t bore you and preach to you about why you need to save money for unexpected happenings. You can check any number of mainstream media blogs for that debate.

What I want to help you with is not just how to create a financial emergency fund, but how to create an actually USEFUL financial emergency fund.

There’s a lot of psychology involved in saving money. It can be a pretty emotionally painful thing to do simply because we like to spend the money we make.

(Also Read: The Three Money Principles You Need to Be Rich)

It can be fun to save up money for a large purchase. As the anticipation builds and you get closer to your goal, it’s emotionally rewarding.

So, what about when you’re talking about saving money for things that might not ever happen, as is the case with an emergency fund? It can sometimes seem like a pretty big waste to have unused cash just sitting around collecting dust in your bank account, not allocated towards any specific goal at all.

It’s this super lame fact that pretty much puts the financial emergency fund at the pinnacle of the “I don’t want to do this” financial checklist. This is a large contributor to the fact that a full 58% of people don’t have enough money to last even three months, not to mention six months (which is the recommended amount).

So rather than just tell you things that won’t work like “buy white bread instead of wheat bread and put that money into an account,” (which will not help you a single bit) I’m actually going to dig into the mindset issues behind achieving this financial goal and keeping it intact, and then I’m going to help you create a system to work through them.

So what’s the road to success here? How do you go about creating a useful financial emergency fund?

Make It Actually Useful

The reason I emphasize the word useful so much is because this is the strategy I want to you use to create an emergency fund.

Let’s say you never have to use your emergency money, or you only have to use a little bit of it, which is not only completely possible, but actually probable. Then what? It’s just sitting there, probably decreasing in value. That can be a tough fact to stomach.

Here’s the simple strategy I use to combat this feeling, which you can use as well.

Allocate that emergency money as a contributor towards a very large secondary long-term goal, something that you’re not going to hit for quite a while and something you don’t necessarily need, but would be really nice for your lifestyle to accomplish. This goal should also cost a lot more than you need for financial emergencies, so think big.

For me, this secondary goal is paying off my mortgage early.

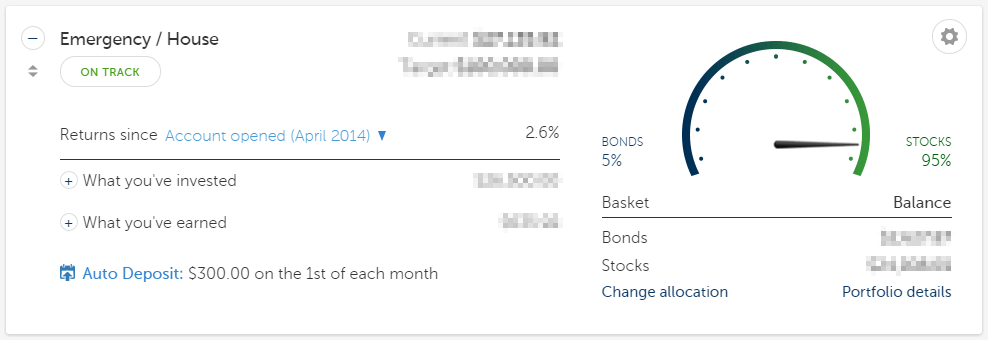

I used to have this account in cash, but have recently transferred that balance into a Betterment account that I set up for this reason. It’s difficult to access, but if I need it I can still get to it. It’s somewhat of a hybrid between a savings account and an investment account, since it’s still a cash balance that can be accessed at any time, but is invested in liquid ETFs which grow at a larger rate.

For a better explanation of Betterment and it’s benefits, check out this post, by my fellow financial blogger, Mr. Money Mustache.

The first goal of this account is for large financial emergencies. Once it got to the point where it had enough money in it to cover my ass in a bad situation, that account then became my “pay off my house early” fund.

By setting things up this way, if you don’t end up hitting that lofty goal, it’s not that big of a deal, but you still have a very large chunk of money for emergencies, which was your original goal.

I’d really like to pay off my mortgage early and I fully plan on doing so, but if it works out that I cannot for some reason, I’ll at least have this money for emergencies.

The magic in this strategy is it’s psychologically much easier to stomach than money that sits around just for emergencies only. If you don’t need it for emergencies it’s got a higher purpose that you actually want to use it for.

Setting Up The Logistics of Your Financial Emergency Account

One of the success principles I follow is this. Anytime you’re trying to accomplish a goal, always do everything you can to set yourself up for success in advance. So before you start your new account, I want to give you a few tips on the financial logistics involved here so you can be successful.

One of the biggest mistakes you can make with an emergency fund, or any type of savings account in general, is keeping your money in the same account as all of your other money… or even the same bank for that matter.

The point of a large savings account is to keep it intact, to not spend it, and to have it around at a later date. Because of this you need to make it difficult to access. Otherwise you’ll be tempted to spend it.

If you were trying to lose weight, you wouldn’t put cupcakes and soda at the front of your refrigerator would you? No, of course you wouldn’t.

Saving money is exactly the same. Don’t put your emergency money in an easily accessible account. Make it easy to deposit into, but difficult to withdraw from, and most importantly, make sure you automate it as much as possible.

So how do you do this?

- Choose an online bank with no physical locations. This way you’re not tempted to swing in and withdrawal your money. I like Capital One 360 for straight up cash savings accounts, and Betterment for high growth savings

- Link your main checking account to this account through online authentication in order to make deposits. This can usually be done immediately with any solid online bank (Both Capital One 360 and Betterment offer this service)

- Set a savings goal for at least three months of expenses should you have a financial emergency.

- Make an initial deposit to start your goal off right and immediately set up auto-deposits into this account so you absolutely never have to think about funding it. You’ll won’t even miss the money you save as you adjust your spending, and you’ll be thrilled at how fast it grows. Your deposits can be small at first, but increase them over time as you adjust your spending habits to hit your savings goal (Also Read: How to Continually Increase Your Financial Capacity)

- If you’re sent an ATM / Debit card for it, cut it up and toss it in the trash. You don’t want to be tempted to withdrawal from it with your card.

- Don’t order any checks. If you are sent checks, run those babies through the paper shredder. The only way you want to get money from this account is through an online transfer.

- And lastly, choose a large long-term secondary goal for this account, such as paying off your mortgage, etc that you can also use this money for in the far future. Remember, once you hit your three month goal that you set earlier, continue to grow your balance to six months, 12 months, and on into the future as you save for your long-term secondary goal.

Follow this simple process and you’ll find yourself conquering one of the most difficult to achieve personal finance goals that exists.

Grab Your Checklists

If you liked the strategy listed above, make sure to grab a copy of my Financial Automation Checklist Collection. It includes six separate checklists which will walk you through how to automate your financial goals such as paying bills and expenses, getting out of debt, and even investing for your future. This will also subscribe you for future updates to Academy Success, which you can unsubscribe from at any time. You can download that here and as always, toss me an email if you have any questions. I’ll be happy to help you out.

– Cody

PS: If you found this article helpful, would you mind sharing it with a couple of friends that might like Academy Success? Just use the sharing links to spread it around, or use this link to email it out directly. You’ll be doing them a favor, and I would greatly appreciate it as well.