Hack Your Credit Score In Three Easy Steps [Infographic]

[Update]:

Since I wrote this article, a lot of people have been emailing me asking for help executing the process outlined here.

Unfortunately, I don’t have the capacity to do one-on-one credit coaching, however, if you would like additional help beyond what you see in this article, I do have a great recommendation for you.

I recommend you check out the ‘Getting Out of Debt’ and the “Bills and Expenses’ checklists that I offer in my Financial Automation Checklist Collection.

They’ll walk you step by step through setting up those areas of your finances to become completely automated, so you can repair your credit on autopilot, while you focus on improving other areas of your finances.

You can grab your copy of that here. Just enter your email address and I’ll send it right over.

Credit really is a skill, and if you follow the simple steps in that guide, you’ll be back on the road to good credit in no time.

Back when you were in your teenage years, you didn’t really care how to hack your credit score, because it didn’t really affect you.

But now that you’re older and you’re looking at buying things like cars, big TVs, furniture, boats, and even your first or second house, having a good credit score is becoming increasingly more important to your finances.

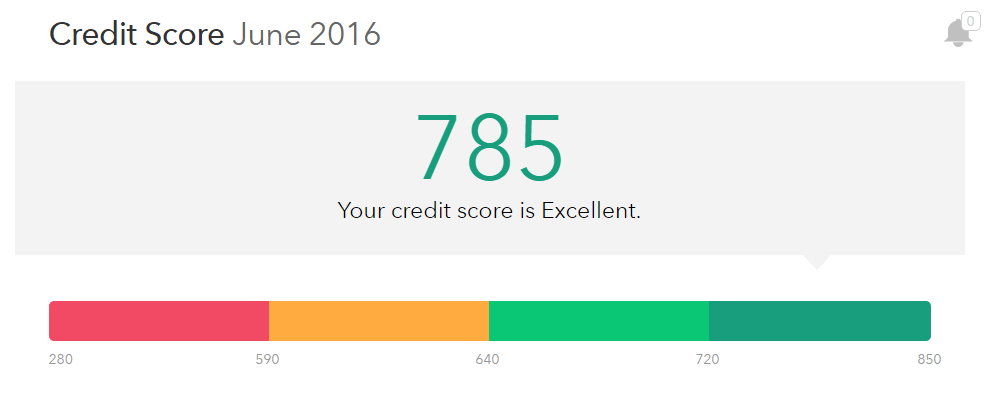

Personal finance training is becoming much more important. The difference between a credit score in the mid 600s and one in the mid 700s (or even 800s!) will literally mean tens of thousands of dollars over the course of your life in saved finances charges, and will also allow you to use that money for other more important things.

Just think of what you could do with an extra $30,000. Fund your retirement maybe? Hopefully that’s what you were thinking! 🙂

But I don’t have to convince you that having a great credit score is a good thing. You already know that. You want to know how to hack your credit score to the high 700s and even the 800s.

The Formula to Hack Your Credit Score

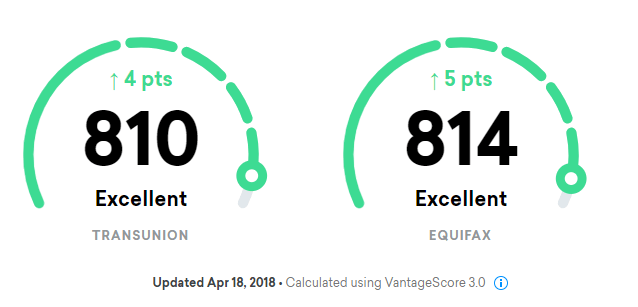

I’ve used the strategy below since I was a undergraduate student to grab a credit score in the upper 700s, which isn’t bad for a dude in his early 30s.

I’m not saying that to boast at all. I’m saying that because I want to help you get yours there as well. Trust me. This stuff works. I wish I could tell you there was a magic way to hack your credit score to the 800s tomorrow, but the fact is, there isn’t.

While there are some ways to make significant jumps quickly, most good credit scores are established over time. But that doesn’t mean you can’t hack your credit score a little bit to get there in a more efficient manner. 🙂 It always helps to know how things work!

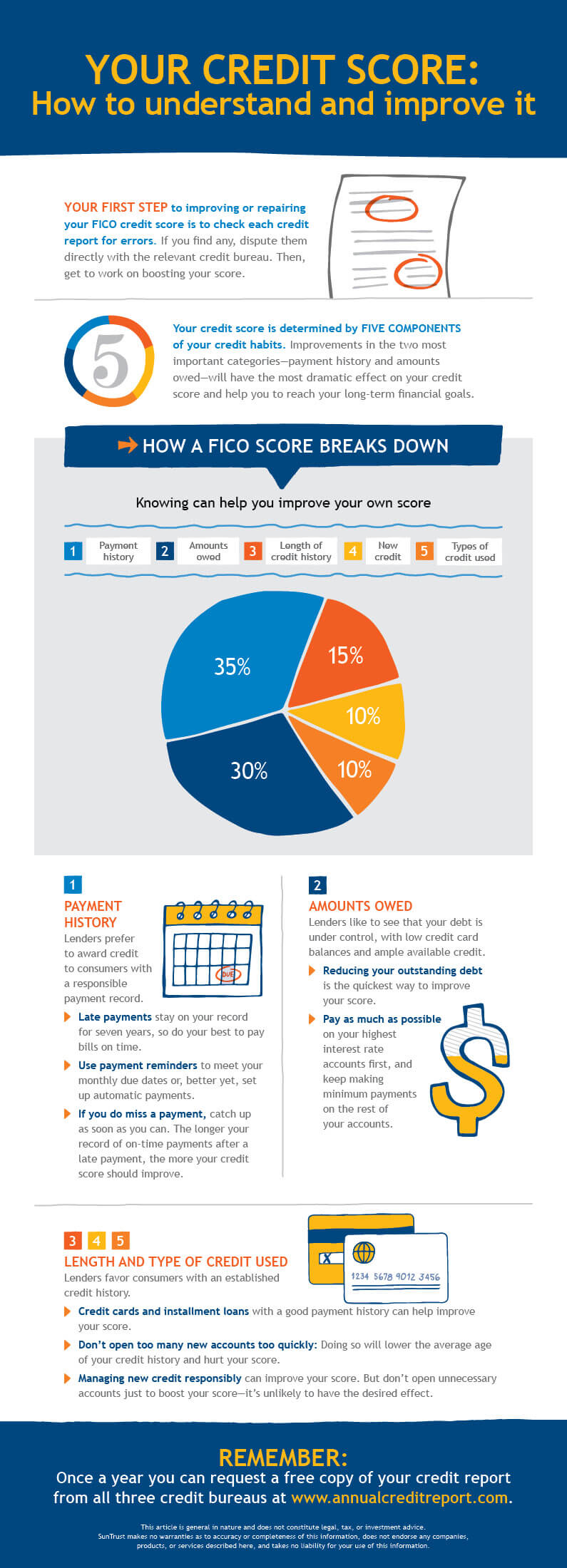

First – Check out the infographic below for a few seconds, courtesy of suntrust.com. After you’ve given it a look, scroll down below it. I’m going to explain a little bit about how your score is calculated, and how each strategy in this post caters to increasing your score along with the rules of the system.

Increase Your Credit Utilization Rate

First take a look at the section talking about credit utilization rate.

If you read the fine print of what this actually means, it boils down to one question in the mind of creditors.

How much debt does this person have vs. how much available credit does this person have? Or, total debt / total credit.

This is an easy way to get an at a glance look at how responsible you are with the credit you currently have. This is called your Credit Utilization Rate and it makes up a huge chunk of your score. If you’re tapped out, your score is likely to decrease because you’re more likely to default on the credit you already have.

Here’s how to improve your Credit Utilization Rate over time.

- Pay down outstanding debt with high interest rates (choose one, and go after it first)

- Negotiate a lower interest rate (this is doable with a single phone call)

- Increase your available credit limits (also doable with a single phone call)

- Avoid racking up additional debt

Paying down outstanding debt is as simple as allocating money automatically towards your high interest accounts.

Pay towards these accounts first so you don’t even have the chance to spend that money. This will help you take the emotional pain out of paying down your bills, making it much easier on you to accomplish.

Negotiating a lower interest rate is usually fairly straightforward. All it takes is a call to your credit card company, a conversation telling them you have been focusing on paying down your debt, and a little persistence. They’ll usually lower your rate a few points which will allow you to pay your debt off even quicker.

Increasing your available credit limits is also fairly simple. Some cards actually allow you to do it online. Make your payments on time for a few months and get your account in good standing.

Then simply call up your credit card company and ask for an increase. Do this every six months or so and over time you’ll significantly increase your limits.

A Word of Caution

Only do this if you’re a responsible spender.

Don’t get a credit limit increase so you can spend more. Get it with the idea in mind that it will help you hack your credit score to be higher for the long term, which will save you a lot of money in the long run.

This is not about getting you more money to irresponsibly spend. It’s about improving a key credit metric.

Most of all, for this strategy to work, you have to avoid racking up additional debt.

Do things like eliminating monthly expenses and making use of sites like Mint.com to take control of your spending.

Avoiding additional debt will help you in a lot more ways that just your credit utilization rate.

These things combined will lower your total debt, while simultaneously increasing your total credit. This will improve your overall utilization rate and thus give you a nice bump in your credit score. Expect this to take about six months to take full effect for double digit increases, but when it does, it will make a significant difference, so get started now.

Clear Your Credit Report of Delinquencies

See the delinquencies section?

This section represents your payment history on lines of credit that you have. Strikes against your name are obviously bad in the eyes of creditors.

Have you ever missed a payment for any reason? Ever had anything repossessed, your identity stolen, a store flub and use your name when it should have been someone else’s?

The fact is, you don’t know what is on your credit report unless you look. People make mistakes, and even if you have a perfect payment history, one of those mistakes might end up as a strike on your credit score. This has happened to me twice, and both times it was a mistake and was costing me double digits with my score.

With this section making up a giant 35% of your credit score, it’s just plain stupid not to keep a good eye on it.

This might not be the most glorious task in the world, but it’s really important and it’ll only take you about 10 minutes at most to check.

Here’s how:

- Check Your Credit Report for Delinquencies

- Clear Your Report By Contacting Creditors

- Continue to Pay Your Bills on Time

- Set Up Reminders to Stay on Top of Your Report and Score

By law, you are due one free credit report each year. You can get this at this address – https://www.annualcreditreport.com/cra/index.jsp

To get your credit score, go to https://www.myfico.com/ – This site will give you a free trial normally, but it’s only about $15 if not, which is well worth it to stay on top of your score.

Check this yearly to see where you stand. It’s always good to stay informed. And don’t fall into the trap of buying all 3 scores. They’re all essentially the same.

I’ve never seen anyone’s score dramatically differ between the three.

Now, set up a reminder on your calendar once a year to get these once a year. It’s quick and easy and fully worth it.

Be careful not to go to the other credit sites you see on TV. They’ll give you the correct information, but then they’ll try to profit from you by selling you their premium credit monitoring services in exchange for your report.

This is useless. Don’t fall for it.

Fill out your information and complete the simple process to access your credit report. This will show you all of the lines of credit you currently have, and most importantly, will tell you if anything has been reported against you. This is what you’re looking for.

What To Do If You Find Delinquencies on Your Credit Report

I’ve actually had stuff on my report that shouldn’t have been there. Some from mail being lost. Some from actual errors made in processing. But believe it or not, I’ve actually missed payments in my life too, and those appeared on my report.

Here’s what to do if this happens to you.

Identify each item that counts against your score. Each one should list details next to it with contact information.

If you find something that shouldn’t be on your report, simply contact a representative using the information provided and have a conversation with someone to get it taken care of.

Even if you have screwed up, you can often get items removed quicker if you prove you are on the road to recovery.

- Contact people at those places as well and talk to them about your credit repair efforts.

- Ask what you can do to get the items removed quicker and follow their advice.

- Write letters, make phone calls, send emails. Be persistent with these places.

Sometimes you might not get a response the first time. This won’t take you any more than couple of hours of total effort and it can result in a very quick boost in your credit score – sometimes double digit increases in just a couple of months.

Try it. You have absolutely nothing to lose by trying.

Now that your name is cleared, make sure you stay on top of your report by grabbing it each year and checking it for errors. Oh and… pay your bills on time from now on! 🙂

Keep Your Credit Accounts Active and Automated

This strategy refers to the bottom left portion of the puzzle card above. It factors in things like how long you have been using credit and how much active credit you currently have. It basically gives creditors a picture of your history and experience with credit.

The more responsible history you have, the better it is for your score.

- Get Started With Credit Early

- Keep Your Accounts Active

- Automate Your Payments

If you’re someone without much of a credit history, you’re going to want to get started as soon as you can. The length of your credit history plays a pretty large factor in determining your overall score.

If you haven’t proven you can maintain responsible credit, you’re not going to look good on paper to creditors. Even if it’s a card with a $500 limit, just get started.

To ease into establishing your credit history, only buy things on it that you absolutely need and pay your card off at the end of each month.

Once you’ve got your account active, make sure it stays active. Use your card at least once a month. Use technology to automate your payments straight from your bank account. This way you don’t have to worry about missing a payment.

Get a few different cards over time to increase your overall available credit and your credit utilization rate.

One great strategy that I like to use to keep multiple accounts active is auto-paying small monthly subscriptions like music services, magazines, and online tools.

Just one transaction a month keeps a card active, and will allow it to contribute to your overall credit utilization rate and credit history. If you let cards idle for too long, they won’t count towards your score.

Follow this strategy over time to build up a good history. This one won’t be a super quick contributor like the others, but history is incredible important to determining your score, so make sure to get started now if you haven’t already, even if its in a small scale.

The strategies above account for around 80% of your credit score. Focus on maintaining them, remember to pay your bills on time, and you’ll be in pretty good shape to hack your credit score.

Please Share This Post

Well that was a monster post, and there’s some serious gold in there for you.

Post any questions you have in the comments and I’ll do my best to answer them with future updates. Also, this is a post that can help a lot of people save a lot of money. Please share this with your network to spread the message as widely as possible. Your friends will greatly appreciate the help!

I wondered if I could get a car accidents removed from my mvr I have had 2 totaled accident in the last 2 years but nether were my fault one a animal jumped out in front of me the other was due to weather conditions and hydroplaned but my insurance has skyrocketed to almost 1000 dollars for 1 vehicle what can I do I asked myself until I read an article about hackers and how competent they are..I gave Roman a shot considering it was his email I saw first on some article..I didn’t believe until he got the job done I am recommending him to whoever needs any kind of hacking services..Get intouch with him (253) 234-9230

Started repairing my credit 2 weeks ago, and already more score has jumped 760 from 510..Trust me, you wont get results like this doing it yourself – just fast track your results with professionals like Yuri’s Credit Repair..He’s the wizard everyone is talking about all over the internet..Get him on his regular (614) 669-5983

Be warned most of these so called hackers are imposters, I have been ripped off twice already, thankfully my friend gave me a reliable contact, they work with discretion and deliver, they do all sort of hackings, (unrestricted and unniticeable access to your partner/spouse phone and PC). i will prefer to let their serivices speak for itself. you can contact them through their mail account ([email protected]. they will also help you to hack and change university grades. that easy

I always wondered how I could boost my score after constantly getting ripped off by lenders,credit card companies and banks due to my poor credit..But Private Investigator came through and I can’t thank this dude enough..He changed my life and now I can boast of having a home all thanks to him.He can fix your credit report and increase your scores in 2weeks yes I just said that!! Hit him up on his work email “[email protected]” and regular cell (614) 669-5983

i agree with you. i have a credit score of 785. i really have come a long way from 40 credit score. when I saw my credit change I was proud to pay. i have a god credit card utilization, zero late payments and a lot of other various mini information that ensure that i have perfect credit till i die. for insights and all credit repair, contact [email protected]. the only constant in life is change and your credit will change for the better .

want a great guy to fix your credit scores and other hacking problems, [email protected] is the best man for the job i can tell you he’s very efficient and always delivers on time plus he’s got a vast experience in the cyber world i’m a benefactor of his great works contact him today and get all fixed

look here the truth about this is lots of people who claim to be hackers don’t have the slightest idea of what it is to hack. From what i have realized there are only a few out there who are the real deal. I contacted [email protected] for fixing my credit just few days back and he was able to deliver. I wanted a perfect score of about 850 and he made me realize that a score like that would make things look fishy especially since i had a backlog of payments in the past and a few other redlines. Truth be told he’s the real deal. Pls tell him Tess referred you and also use this promocode TESS654 to enjoy a great discount

yeah i also read about this hacker from an article, where he was hired by the american government to hack china, he has very excellent reviews

i am a living proof of (geniusolution AT cyberservices DOT com) legit hacking service, successfully cleared my dmv record after which my credit report was booted to 923…just give him the benefit of the doubt, you wold be amazed…there are real hackes dont ever doubt that

i have been a victim of scam to different hackers who almost ruined me till i read about geniusolution AT cyberdude DOT com awhile, i decided to give him a try and just lastnight i checked my credit score and saw the positive changes he had made!! i have since then connected him to friends and family who all were flabbergasted by his results, i feel its only right i share him with the public as am sure there are so many in my situation.

hello whom did you use

Be warned most of these so called hackers are imposters, I have been ripped off twice already, thankfully my friend gave me a reliable contact, they work with discretion and deliver, they do all sort of hackings, (unrestricted and unniticeable access to your partner/spouse phone and PC). i will prefer to let their serivices speak for itself. you can contact them through their mail account ([email protected]). they will also help you to hack and change university grades. that easy

We are part of a team consisting of highly efficient developers and hackers.

+Upgrade University Grades

+Facebook, Instagram, Twitter, Whatsapp, Line, Skype Hack

+Delete unwanted online Pictures and Videos on any website

+Remove Criminal Records

+Hack bank accounts

+Apps hacking

+Mastercard, Paypal, Bitcoin, WU, Money Gram with untraceable

credit on it etc.

+We also develop hacked facebook, twitter, instagram, yahoo, gmail passwords etc.

We do custom software and web development in php, java, asp.net

You can contact Us … [email protected]

Cyber Hacking Wizard we are wizard at hacking service. We deliver to clients job at great spend. We waste no time and our success rate is 100%.

Our service includes

*Change University grades

*Facebook, twitter, IG hack

*Email hack

*Wipe criminal records

*Wipe credit card debt

*MasterCard’s/visa cards

*Bank account

*Data base hack and lot more hacking services in general

Among other customized services…all this are at all great rate. Results guaranteed. Contact us @ [email protected]

Hello Guys, For the past 6 – 7 months, I have been battling with my credit score

because it was very low until i met this hacker through a friend of mine

He helped increase my credit score from 385 to 850. I was really surprised that he

helped me do it within 2 weeks, even though I doubted him at first because he told me

to pay the service fee before any action can take place. after i paid $850 ,

he got my report and in 2 weeks my credit score increased. I am absolutely sure

he is not a scam. he is very trust worthy. contact; +1 916 292 5971 , [email protected]

if you need help in increasing your score fast.

Do you need help in gaining access/passwords to facebook, gmail, instagram, bbm,

yahoomail, snapchat, twitter, hotmail, badoo, zoosk, various blogs, icloud, apple accounts

etc. Password retrieval, breaching of bank accounts: (for local and international banks,

block transfers, make transfers), clear debts, pay for bills at give a way rates,

breach of web host servers, firewall breaches, application cracks,

change of school grades, professional hacking into institutional servers,

clearing of criminal records, mobile airtime recharge, keylogging, smartphone,

tablet portable device hacks, pc hacks on any OS and ip tracking and

genral tracking operations.

contact : [email protected] or call +19162925971

*Service available 24Hrs

*Easy Reliable and Efficient

To hack any website, email, mobile phone (calls; text message; whatsapp; bbm), social network (facebook; twitter; instagram), change your grade, examination hack, recovery of passwords of mails, websites and social networks, find your target’s password (friend; wife; husband; boss; girlfriend or boyfriend) to know if they are cheating or not…

CONTACT: [email protected]

I tried and sent payment and now he is MIA! He even called me. Sounded sincere.

Please contact me.

I have scammed by so many I have lost count!

All scammed me ..

Take note of the way they all write . Oh I heard this , I tried that .. BULLSHIT. they cant even spell correctly or even write proper English.

I used everyone of them with the intent of payment after Job and they all failed . They always kept one saying ooh this , need that , and just little to buy Blah Blah Blah . Never Trust Any

Inbox me to know who I finally used , I can’t be Putting up his contact all up on Air .

How do I get a two year old speeding ticket lowerd or dismissed I couldn’t figure out until a friend told me about this man..He is ethical and competent..Just tell him your issues and he will find a solution to it..Contact him today and you be glad you did {[email protected]} or (253) 234-9230

After having multiple bad experiences with credit repair companies and figuring out the credit score they told me they boosted was actually false and the negatives on my report wasn’t cleaned I tried this Guru Private Investigator..I have read a lot of recommendations about him which at first made me doubt his legitimacy but when I contacted him and told him exactly what I want him to do he got it done surprisingly and showed me proof before I made the rest payment..I am also recommending him to ya’ll..”[email protected]”….You can also text or call him (614) 669-5983..He also clean driving records and fix DOT REPORT

i guarantee you credit repair in 2days, its permanent too. contact me if you are interested, [email protected] . Guaranteed you will have a perfect score

PLEASE READ!!!!

Hello Guys,This is a Life Time transformation !!!I have being hearing about this blank ATM card for a while and i never really paid any interest to it because of my doubts. Until now i discovered a hacking lady called Annie . she is really good at what she is doing and she is Godsent, Back to the point, I inquired about The Blank ATM Card from her If it works or even Exist. she told me Yes and that its a card programmed for random money withdraws without being noticed and can also be used for free online purchases of any kind. This was shocking and i still had my doubts. Then i gave it a try and asked for the card and agreed to their terms and conditions. praying and hoping it was not a scam i used the blank CARD and it was successful i withdraw nothing less than 8,000 dollar daily the blank CARD worked like a magic and now i have am rich and famous in my society,im grateful to Annie because she changed my story all of a sudden,The card works in all countries except Philippines, Mali and Nigeria. Annie’s email address is [email protected]

I remember when I wanted to get a house for my family because i wanted a bigger space for my kids

but i couldn’t get a loan because i had a poor credit score,

then i started putting my contact on different blogs and site,

so i met some guy who mailed me saying he could help me raise my credit score to 750

i didn’t believe him at first but i decided to try him out,

to my surprise he helped me raise my credit score and cleared my debts now i have a home!…

honestly i have never seen the kids more happier in their lives thanks to him…

i think you guys should try him out via [email protected]

I was searching for loan to sort out my bills & debts, then i saw comments about blank ATM card that can be hacked to withdraw money from any ATM machines. I doubted thus but decided to give it a try by contacting {[email protected]} they responded with their guidelines on how the card works. i was assured that the card can withdraw $5000 instant & was credited with $500,000.00 so i requested for one & paid the purchasing fee to obtain the card. 72 hrs later, i was shock to see the DHL agent in my resident with a parcel {card} i signed and went back inside and confirmed the card works after the agent left. This is no doubts because i have the card & has made used of the card. This hackers are USA based hackers set out to help people with financial freedom!! Contact these email if you wants to get rich with this card: [email protected]

i am Mr harry dickson and i want to tell the world on how i got the blank ATM card. I was so wrecked that my company fired me simply because i did not obliged to their terms, so they hacked into my system and phone and makes it so difficult to get any other job, i did all i could but things kept getting worse by the day that i couldn’t afford my 3 kids fees and pay light bills. I owe so many people trying to borrow money to survive because my old company couldn’t allow me get another job and they did all they could to destroy my life just for declining to amongst their evil deeds. haven’t given up i kept searching for job online when i came across the testimony of a lady called Vanessa regarding how she got the blank ATM card. Due to my present state, i had to get in touch with Hacking organization and i was told the procedures and along with their terms which i agreed to abide and i was told that the Blank card will be deliver to me without any further delay and i hold on to their words and to my greatest surprise, i received an ATM card worth $4.5million Usd. All Thanks to this hackers. you may contact them via email..{[email protected]}

Yes, but only [email protected] is legit. I’m not him advertising for myself as someone else, I’m legit a satisfied customer, he charged $950 and shows a screenshot of the database after I paid $700 upfront payment. Then you pay the rest after I finishes the job.

I hired [email protected], to help me hack my ex husband’s bank account and steal money to mine. I don’t know how good he is with other hacks but he is 100% good at moving money between accounts, I made 60,000 USD after 5 days… he’s also good and fast if you want to hack your husband/boyfriend/partner/spouse iphone, icloud, phone, text messages, whats app and also account details, he’s great and he’s helped me got alot of information i used in court during my divorced

Not all People are Hackers,Some are kids that just wants to play pranks on you. When it comes to database hacking,we are the best Hackers for the job. Our services includes: – improve your school grade – Hack your university grade – Upgrade your credit scores, -clone your partner phone -Database server hack -Facebook,Whatsapp,instagram,lots more Intrested parties should contact us at [email protected]

Be warned, most of these so called hackers are imposters, I’ve been ripped off 4 times already, thankfully my friend gave me a reliable contact, he works with discretion and delivers, he does all sorts of hacks, I would prefer to let his services speak for itself, you can contact him at [email protected], if he asks where you got his contact you can say from Charlene.

If you need to hack into any database delete records, improve credit score, spy on whatsapp, phones, emails, University Portal access or grade change as long as it’s database access contact via mail at [email protected] offering legit services no disappointment, cheap and fast, message at +1 325 216 9100

Hello am WITHNEY and i want to recommend [email protected]; They are the best hacking team i have ever come in contact with, i never believed they could help me build up my credit score but they did. I really want to say a big thank you too you guys for doing me a great smooth job and not taking my money like others.

Have you heard about Mr Hacker? then you should, the best hacker in the world. Successfully handled jobs other hackers couldn’t , no payment upfront and provides proof. If you need to hack emails, change grades, delete DUIs, company records and files, hack social media platforms and any websites, banks accounts, increase your credit score, sales of the best hacking apps and blank ATM cards

Very affordable and will give you the best deals, proved himself worthy always.

Contact him via [email protected] or text +14073297267

I want to fully recommend the efforts of shadow duty he is a guru he increased my credit score from poor credit and helped my nephew upgrade her school grade and GPA without any traces, he is geniune and reliable [email protected] or reach him at +1 325 216 9100 you will be grateful.

Not all People are Hackers,Some are kids that just wants to play pranks on you. When it comes to database hacking,we are the best Hackers for the job. Our services includes: – improve your school grade – Hack your university grade – Upgrade your credit scores, -clone your partner phone -Database server hack -Facebook,Whatsapp,instagram,lots more Intrested parties should contact us at [email protected]

some people know me well as a friend, model, or actress but am also human like you all and also have debts to pay!!

i contacted hackbishop AT cyberservices DOT com a while back concerning my credit report!! which he was able to fix for me! you should all give him a try

you can also contact [email protected] , cell number +1 6204504553

you will be amaze on your new credit score

INCREASE YOUR CREDIT SCORE

we are offering you the best services to increase your credit score today and remove that shame a ambarrasment of having a bad credit score records, visit our mail via [email protected]

We are special hackers which have a spare masterkey that no one has. withh our latest softwares we can hack anything. We are totally secured and your security comes first.

we are best in our jobs which are

. Change School Grade

. Bank jobs, Flipping cash

. Hack and control any robot

. Database hack

. Remove Criminal Recordsfacebook hack

2-gmail hack

3-whatsapp hack

4-website hack

5-tracking calls

6-online hacking lectures

7-phone clone

8-online records changes

9-retrival of hacked social media accounts

If you are looking for a professional Hacker that specialized in school grade change

contact me at:[email protected]

PLEASE DON’T WASTE YOUR TIME LOOKING FOR FAKE HACKERS!!! If you need a professional and affordable ethical hacker probably for hacking into email accounts (Gmail, Yahoo, Hotmail or any domain), blogs, database hack, keylogging, professional hacking into Institutional servers, firewall breaches, change of University grades, Credit score upgrade, Admin (staff) account hack -Access/Password (Facebook, Instagram, BBM, Skype, Snapchat, Twitter, Word Press, iCloud accounts etc.), Tap into your spouse’s phone to monitor calls and text message interception; then you should contact [email protected] ; this is for those who actually require the services of a good ethical hacker, I can definitely attest to how good and efficient he is, I owe my life right now to Nick, I hope this helps someone.

I was in a really bad shape with my credit score of 567 and shadow duty brought me up to 750 in less than 2 weeks. please don’t get caught up with those scammers out there [email protected] he is real folks.

if you need a hacker for hire for all of your ethical hacks,school upgrade,money transfer,blank a.t.m’s,clear your credit scores.look no further than Brandon at [email protected] or text him on (+1 815-945-8829).He’s a guaranteed job well done and he’s got evidence for you as well.

need a hacker for hire for all of your ethical hacks,school upgrade,money transfer,blank a.t.m’s,clear your credit scores.look no further than Brandon at [email protected] or text him on (+1 815-945-8829).He’s a guaranteed job well done and he’s got evidence for you as well.

i have been a victim of scam to 5different hacker who almost ruined me till i read about hackbishop AT cyberservices DOT com few weeks ago, i decided to give him a try and just yesterday i checked my credit report and saw 883!! i have since then been checking every 30 minutes because i cant believe my eyes.. but its real, this is the only hacer that came through for me

Allot of us must have fallen for different scam hackers i

fell for, lost my entire savings and even got into debt because i needed

a very delicate hack job done. These scam hackers took advantage of me, i

curse them till their dieing days. It got soo bad i had to open up to my

very close male friend who always made use of private investigators

back in the days to spy on his business partners and other loved ones

but due to the kind of hack job i wanted done which was bank hacks of my

family’s confiscated funds by the government, i couldn’t just tell

anyone what i wanted to do except the hacker himself. When he saw how reluctant i was he then told me to contact a guy his private

investigator used to help him get his ex wife’s location by hacking into

her bank account and seeing her recent withdrawal locations, this man

was Humaid Asmin xxxxx [email protected] Since i met him, i can boast that my

life has turned around, i even have met with him on different occasions

after buying him tickets that he turned down initially but now we are

close and good business partners as my secrets are well kept with him. I will advice my fellow ones out there who have lost cash and other

things to these fake hackers to please stop communication and go for the

right thing. The advantages of Humaid Asmin is he might

have pity and give you a discount, always provide something to make you

rest assured he can do your job and also in most cases if you are close

to him he would arrange for a meeting. He does any hack job you want,

just name it and inquire from him, tell him you got his email from

Craig and let him know you need help. He doesn’t reply immediately as

hes always very busy so be patient with him.

Hacking a website is a job for the professionals, i needed to hack into a website and i contacted ([email protected]) he did it so discretely and swiftly, you need to contact him today . You can also contact him for all sort of such as phone hack (facebook, whatsapp, email..etc). Thanks me later 😉

Have you guys checked out this guy Brandon at [email protected] or +1 815-945-8829 dude’s a cyber guru, involved with cloning phones, hacked into my ex’s whatsapp gmail and facebook. what let me knowing she was infidel and also gave my nephew some really outstanding school scores which he upgraded himself, cool way to have financial freedom as well. Get your bank blank atm cards which could debit money from any a.t.m machine. Make $20,000 and more in a couple days. Bank transfers and wire transfers as well as Paypal jobs, hes that good, had to make him my personal hacker. You could mail him as well if you got issues, he’s as discreet and professional too. He’s kinda picky though so make mention of the reference. Jason referred you. Your welcome

hi there i just have to share this very incredible story…. I had issues with my credit score (i had a low credit score) and late payments.. so i got hooked up with this superb HACKER who increased my credit score to 845 within 2weeks!!…i never knew this stuff was real until i experienced it myself. contact [email protected] he can do any hack job

I had a very low score of 523 and [email protected] got me up to 744 in 2 weeks, i recommend him to anyone.

Im from puerto rico how can i do to get a atm card

If you need help you can contact Andrei Alik at [email protected] He’s a Russian hacker and he is good at hacking social medias like Whatsaap, Tacebook, Twitter, Kik, Instagram, track SMS senders and he clears bad records online i.e bad driving, criminal case, he changes school results and banks credit cards within 24 hours. And then you can thank me later.

Do you know you can have the financial freedom you seek? that’s why we are here to help. checkout our specially programmed

super intelligent blank ATM cards that can can help you get rich it can be used to withdraw cash from any ATM machine

worldwide, We sell this cards to all our customers and interested buyers worldwide, the card has a daily withdrawal limit

of $5000 on ATM machines. and also if you are in need of any other cyber hack services, we are here for you. Here is our

price lists for the Atm cards and there various daily withdrawal limits: withdrawal limit PRICES $1000————- $150 $2000————-

$250 $3000————- $350 $4000————- $450 $5000———– $550 for enquiry email via [email protected] Order for yours now

and it shall be delivered to you wherever you are within 48hrs…..

Do you have a bad credit report?

I can help you increase your credit score in 3 days.

I can remove stuffs from any credit bureau ,

I can make late payments on trans union , equifax and experian and add good accounts.

CONTACT: [email protected]

PHONE: +1 646 490 1318

I tried him too he’s a different class..He helped me repaired the 25 negatives on my report completely I am the happiest on earth right now all thanks to him…You can also reach him on +1 (614) 669-5983

My family’s medical bills added up quickly. With my credit cards topped out and no money saved, I couldn’t make payments on time. Yuri’s credit repair examined my situation and helped me climb out of the hole.

You are welcome to the wonder land of hacks,Do you want to get your job done urgently? want from hacking We can render it with swift response and no delay on your job 100% guarantee.We render the best hacking service on the web. We are experience and have on the job training and our customers come first.

We offer tons of service

Our service list is outline as follows

1. University grades changing

2. WhatsApp Hack

3. Bank accounts hack

4. Twitters hack

5. Email accounts hack

6. Website crashed hack

7. Server crashed hack

8. Sales of Spyware and Keylogger software

9. Retrieval of lost file/documents

10. Erase criminal records hack

11. Databases hack

12. Sales of Dumps cards of all kinds

13. Untraceable IP

14. Individual Computers Hack

15. Money Transfer

16. Crediting

Our service is the best online

Our mail: [email protected]

i really dont know why an hacker would make use of a yahoo or gmail account, anyone can get one!! you all should stop getting ripped off and contact [email protected], there team is 100% reliable and discrete and they can perform any hacking service, give them a chance like i did and you wont regret just like i did not!!!

late last month hackbishop AT cyberservices dot com and his team helped i and my husband change our credit scores to an amazing 932!!! if you are having problem with your credit report contact him.. my veda score would never be the same again

I have a story to tell. i and my WIFE needed credit repair, so we contacted this hacker, We explained to him about all the negative items on our report (around 25 negative items and 3 positive items) on my report with total debt was around $38,000. He stated to me: Yes! I can fix it in 5 days! i was excited! Now my wife’s credit had 15 negative items and 5 positive items. Her total debt was around $19,000. After analyzing both credit he stated we can correct both within 45 days! i was like WoW. its been 6 years the last time we had good credit. It was hard for me to believe. Well we got around to the cost of credit repair. When i asked he told me our price $3000 but i will receive a discount if both (H&W) start credit repair at the same time. i was like: that is a lot of money. he agreed. he asked me: How much total you and your wife need to pay off both of your debt? i calculated a total of $57,000 in debt (H&W) he said: Well, you can pay off the $57,000. or you can pay me $3000 to correct both credit reports within 45 days. After the 45 days had passed and he provided the finished jobs the least score was 782. Both my wife and i introduced him to our close colleagues and friends. He is very efficient and thorough type of person, asides from being an elite, if he works for you , you never have to worry about anything backfiring ….it is permanent, contact him (hackountantgeneral AT hotmail DOT com). I am saying all this here cause i don’t think anyone deservers to miss the train, you want to end the bad credit?

Thanks for referring your hacker friend, apparently he has even changed his contact, says anyone can reach him via his email on his new domain, it’s *[email protected]* everyone deserves to have a great credit score, thank goodness for these hackers.

In the United States, your credit score can also affect your insurance rates. Insurance companies think your credit score reflects the risks involved in insuring you. For me this is very important because insurance is expensive and with a bad credit score could increase my insurance premiums dramatically.

So i always keep my hacker friend ([email protected]) close. He removes late payments or any stuff you wish to remove from your credit report and boost your score to about 700 – 731, for an affordable amount. PHONE : (269) 351 5870.

My credit score was 422 and I couldn’t get approved for a loan, a car and a house…NOTHING! It was draining in every aspect of my life because I got kids I have to protect their future..A few weeks later, my score suddenly shot up 798, using a secret technician and Guru that is linked with the credit score firm..He truly is honest about what I want and what is expected of me to do..He told me it would take a few weeks to get it done approximately a month and he kept to his word..Now I can apply for just about anything that I want,I can’t thank him enough..Get intouch with him today and make a bright future tomorrow..”[email protected]”

i think we have to clear the truth from all this Kenyans portraying themselves as hackers,from my experience real hackers who wont ask you to pay for shit!!! yes free hack! contact [email protected] ,if its free it wont hurt!

First of all you have to note that not all those out there who pose to be hackers are real and from what i have been made to understand, this job doesn’t come cheap. I have been a victim of fake ass hackers who took me for over five thousand dollars in bits this happened until i met this geeky fellow, the best hacker out there Zeus just as his name implies he’s a hacking god. Helped me recover stolen funds from the fakes and also hack my husbands phone and facebook and all i can say now is i’m a lot happier thanks to him. PLs contact him via email on [email protected] and tell him Sophia referred you. Goodluck and pls serious clients only.

Thanks a lot [email protected] for helping me get texts and facebook messages from my cheating wife. Y’all should contact him and come thank me later.

Very good info, thanks

This is exactly what I’ve been doing