[Video] Myth 1: You can’t get rich working for someone else

This is a pretty typical myth that I want to bust wide open for you today.

In fact, a Google search for this exact phrase yields about 22 million results. Many are on top publications such as Business Insider, Forbes, and MSN.

This TOTALLY freaking blows my mind…

I don’t know what these writers were thinking, but I guess they forgot to break out their calculators when they came up with that idea. Or maybe they just have a really convoluted definition of what it means to be rich.

Most likely the latter. Poor bastards (by the way if you can’t handle me swearing from time to time like a few folks from my last post, I invite you to get your education elsewhere). 🙂

Me on the other hand – I’m not here to blow smoke in your direction. So let’s explore a little bit of this myth, why it’s totally bogus, and see if we can get you thinking a little bit differently about what you can achieve financially.

First, what does “rich” mean, for most people?

- Being able to park a private jet in your yard?

- Having solid gold fixtures put in for your 12 bathrooms?

- Rolling around in a Bentley with diamonds on your chain?

No. There are less than 1% of people in existence that are going to be able to do those things, probably quite a bit less. For the rest of us to succeed financially, we need to stop paying attention to all of that hype and be real.

Maybe you have a different definition of “rich,” but I think Brian Preston, host of the Money Guy podcast put it best on a recent podcast where he and co-host Bo were rapping about this same subject.

You might wonder how people can retire, and not work for 30-40 years and live solely on the money they have saved over the course of their lives.

The answer?

Their portfolios work for them, so they no longer have to. The money they have saved over time generates income of its own through interest that is paid on it’s value.

I like how Brian put it when he said,

“You are rich when your portfolio generates more money than you spend in a given year.”

So if you’re rocking a $2 million portfolio (easily doable in today’s world) and assume a flat 5% growth rate, you’re actually looking at making $100,000 a year.

Bump that up to 10% and you’re bringing in $200,000 a year.

You’re comfortable, you can spend without worrying, you’re protected from economic crashes, and you’re at a point where you’re generating more than you shell out. You’re not working, and you’re getting wealthier every year.

To me, that’s a pretty good definition of rich.

A rich lifestyle is completely within your reach

And there’s no reason you can’t get there “working for someone else,” or working a normal 9-5 job like 90% of people do, to put it in a different (less condescending) way.

In fact, it’s probably the easiest way because of all of the perks that come with it (we’ll discuss those in a few days).

For now, let’s do some quick math. Actually let’s let someone else do the math, because it’s just way easier that way 🙂

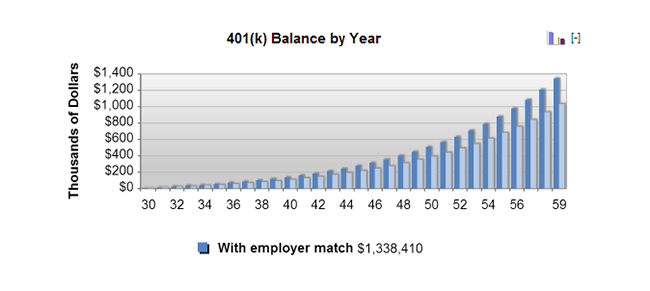

I’m going to use a 401k Calculator for this, because most 9-5 workers are rocking 401ks or something similar, but for those of you that aren’t, this same calculation works for any typical retirement plan. It’s all about growth of money over time.

Let’s say you want to hang up the suit and tie (or whatever your work attire may be) at age 60. Even if you get started at age 30, which is not particularly early these days, you can still hit about $1.3 million by age 60.

This assumes you’re making $50k, with a 3% employer match and 10% growth rate. This is a pretty highly likely scenario.

Not too shabby.

But even if you aren’t fortunate enough to get an employer match (about 75% of plans do), you’re still coming in with around $1.05 million, which is more than enough to create a portfolio that will earn more than you spend each year, and it’s likely that at some point in your career, your retirement benefits are going to improve.

Let’s crank that up a bit

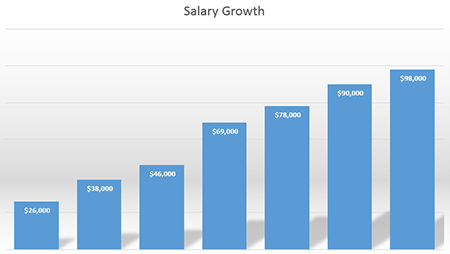

So now for shits and giggles, what if you take the Academy Success route?

- You educate yourself and find a higher paying job

- You negotiate raises throughout your career, and continue to improve yourself

- You make a little bit extra on the side

- You live a comfortable, yet non-excessive lifestyle

- You max out, or come close to maxing out your 401k each year

- You max out, or come close to maxing out your IRA each year

- You build a portfolio of other solid growth and stable assets

Throw employer matching into the picture and we’re talking the ability to save somewhere in the neighborhood of $30,000 a year you might be able to put back, if not more (you can see my own personal breakdown of this strategy in action here).

You’d be a millionaire in your mid 40s, and a multi-millionaire in your early 50s. By the time you’re ready to retire, you’re knocking on the door of 8 figures – almost a 10x increase within that exact same time period.

Is this feasible? Absolutely, and the more you believe it and can see it happening, the more it’s possible for you to do.

But what about those extravagant things you might want to buy? Your retirement home, your boat, nice vehicles?

You can make sure money will not be an issue

You do have to be smart to retire effectively, but the good news is, unless you’re planning to buy a Rolls Royce every two years, which if you are you probably shouldn’t be reading this site, the income that your portfolio generates for you will have you covered as long as you take the steps to build it up enough.

All you have to do is leave enough in it to continue creating wealth for you each and every year.

And that’s what the vast majority of “rich people” do. Give that some thought.

Next up in the series – Fear

In a couple of days, we’re going to continue this series by exploring another huge myth that a lot of people have about money and investing. This one is a huge problem, and it results in a massive amount of people simply turning down easy money.

I’ll give you a one word hint, but you have to show up next time to see the full story

Here’s your hint… “fear”

That video will be posted and in your inbox on Saturday, August 30th. Keep an eye out for it. I’ll talk to you then. Don’t miss it.