The Ultimate Guide to Financial Goal Setting In Your 20s

Alright, now that you’re all grown up (right?), you’ve got an education, and you’re on your way to a building a budding career, it’s time to get on your feet financially.

There are a few key goals you can begin to achieve right now that will set you up for financial success in life. By following these goals myself, I was able to go from having thousands of dollars of debt when I graduated college, to having a net worth of over $300,000 just 10 years later.

Let’s explore those goals here, with action steps along the way.

- Set up an aggressive credit card debt payoff plan

- Set up an aggressive student loan payoff plan

- Pay off the remainder of your debt

- Save for one upcoming large expense

- Get your first raise, without even negotiating

- Start a legitimate retirement plan – Seriously!

Set up an aggressive credit card debt payoff plan

While credit card usage by students has been declining in recent years due to the Credit CARD Act, a full 56% of college students still carry credit cards. Of these students, they graduate with an average of over $1,000 in debt that they carry each month, with 5% carrying over $2,500 in debt and 3% over $5,000.

Credit cards have ridiculous interest rates which add up horrifyingly fast. Even with a balance of just $1,000, this will cost you hundreds of dollars per year in interest.

Get aggressive with this debt bucket. Pay the minimum on everything else to avoid interest and late fees and pay as much as you can on your credit cards until they are paid off. This payment should be A LOT higher than the minimum.

Use a debt payoff calculator to help you figure out how quickly you can do this and what your payment should be. If you have more than one card, start with the one with the lowest balance and pay it off first, then stop using it.

Once you figure your monthly payments, set up automated payments by using your bank’s online tools. This will increase the chances you’ll follow-through on your plan.

Your goal is to pay off everything, then get yourself down to one credit card that you pay off each month in full. This will help you maintain a good credit score while ensuring you do not rack up additional debt.

TIP: Credit cards can get a lot of negative press, but they’re only bad if they’re not used correctly. They have a lot of benefits if you use them right, such as signup bonuses, travel rewards for every day spending, purchase protection, and of course simple cash flow management.

Check out some of the best credit cards to take advantage of these benefits.

From here, you can move onto the next debt bucket, your student loans!

Resources:

- Debt Payoff Calculator

- Top 3 Ways to Crush Your Debt

- Financial Automation Checklists (includes paying off debt)

- Seven Silly Personal Finance Myths That Are Making You Poor

Set up an aggressive student loan payoff plan

The reality of student loan debt can be hard to stomach, but for a lot of us at least some kind of loan is a necessity to get through college.

A lot of students fall into the trap of only making minimum payments on their loans, or deferring them for a higher rate down the road. This is a big mistake because it can come back to haunt you later.

Your expenses will only increase as you age, so start paying these off aggressively immediately after graduating while your life is relatively simple, and before you start getting tempted with additional forms of debt (cars, houses, electronics, furniture, etc).

While paying off 4, 5, or even 6 figures of debt in your 20s may seem like an outlandish task, I’m here to tell you that it can be done with the right plan.

I was fortunate to have scholarships, support from my family, and worked a few summers to keep my debt low, and ended up with only about $6,500 in student loan debt. I was able to pay this off in about a year after graduating (I also lived with my parents while working a full-time job, which allowed me to pay nearly everything towards my loans).

That said, even 10x that or more is doable with an aggressive plan.

At this point, I’m going to assume you have no credit card debt and you have a stable and long-term positive cash flow that you can put towards paying your student loans.

Everyone is different at this point. If you have a balance under five figures, you may want to consider going ahead and paying everything off in full before working towards any other financial goals, however if you have a five figure balance or higher, it may not be a bad idea allocate something like 70/30 so you’re not forfeiting benefits like tax deferment and 401k matching. Compounding interest is also most powerful while you’re young.

I recommend getting pretty aggressive here as well. While student loan debt isn’t as crushing as the fees associated with credit card debt, it’s usually a large enough amount that the interest can add up quickly, so do your best to allocate as much of your positive cash flow as possible towards paying off these loans.

Use this student loan payoff calculator I created to figure out the payments you need to make on your loans to meet your timing goal.

Again, as was the case with your credit card debt, use your bank or loan provider’s online tools to automate your payment plan. This dramatically increases your follow-through and allows you to put this completely out of your mind. Just check in every couple of months and watch your loans vanish!

TIP: When you’re working on paying off any type of debt, it helps to be able to earn extra money on the side as well. By hustling and making extra money, you can be free of your debt even faster!

Also, it might not be the most fun situation, but if it’s on the menu, you might want to consider living with your parents or somewhere you can live incredibly cheaply while you get on your feet. The last thing you want to do while trying to pay off any type of debt is increase your expenses even further.

Resources:

- Student Loan Payoff Calculator

- Five Simple Steps to Avoid a Mountain of Student Loan Debt

- Financial Automation Checklists (includes paying off debt automatically)

Strategically pay off the remainder of your debt

My dad, who retired comfortably at age 61, lives in a lake house, owns two boats, and goes fishing every day, always taught me that the only thing you should ever be in debt for is for a house, and even then to be conservative.

Otherwise life is a never-ending cycle of the stress of paying creditors every single month and you’ll never have any kind of financial freedom.

So now ask yourself, what else do you have financed that isn’t on student loans or credit cards?

- A car payment?

- Electronics? (cell phones included)

- Furniture?

- Appliances?

- Medical bills?

All of these and anything else that isn’t a student loan or credit card debt fall into that “other debt” category that is hindering your ability to save, invest, and become financially free.

Take the same approach with these. Pick the one with the lowest balance and use a payment planning tool like this one to calculate how quickly you can pay them off. Again, bonus points for automating your payments!

Now, of course you’re also going to have to stop financing things in the future as well.

You don’t have to follow this rule for life, but it’s a good practice at least until you have some significant savings under your belt.

TIP: When you’re paying off large debt buckets like these, or just optimizing your spending in general, every little bit helps. Learning to be frugal and save money can be a key to helping you get over the hump to being debt free. Check out these tips on how to save money to optimize as much as you can.

Resources:

- Car Payoff Calculator

- Financial Automation Checklists (includes paying off debt)

- How to Optimize Your Spending

- How to Avoid Impulse Buying

Start saving for one upcoming large expense

If you’re in your 20s, or even early 30s, it’s highly likely that you’re going to have some sort of large expense coming up in the very near future, especially if your goal is to be debt free.

Whether it’s a vehicle purchase, a down payment for a house, wedding expenses (trust me, you’ll pay for at least some of it), an emergency fund or something else that costs thousands or even tens of thousands of dollars, being able to pay for it without going into debt for several years is a very liberating and powerful feeling, and it also keeps you completely financially free.

I know what you’re thinking. “How am I ever going to save that much money?”

Well, think of it this way. Saving for a large expense is no different than financing something. Only you’re saving the balance in advance instead of paying interest for years.

Sure, you’ll have to wait a little bit before you can have the things you want, but you won’t have the burden of debt over your head for years, and if you get into a sticky situation such as a job loss or medical expense, you’ll be able to pivot and use that money for something else if needed.

The key here is setting aside a savings account specifically for saving for this large purchase that is away from your daily bank account. This way it will be more difficult to access and you won’t be tempted to spend it. Don’t even get a debit or ATM card for this account. You want to keep it completely hands-off.

Figure out how much you’ll need for your purchase and set up automatic deposits to work towards that balance. Don’t spend from this account until you hit your goal, or unless you have a financial emergency.

Use this savings goal calculator to help you with your planning.

Resources:

- Savings and Investment Calculator

- Financial Automation Checklists (includes how to automate savings)

- Seven Things to Do With Extra Money Without Blowing It

- Shit… Where Did My Money Go?

- How to Start a Useful Financial Emergency Fund

- [Video] How to Automate Saving Towards a Large Goal

Get your first raise, without the stress of negotiating

With my first job after I finished college completely, I was making about $26,000 a year.

Today, with all of my income sources combined, I have been able to quadruple that into six figures.

Steadily increasing your salary as you grow your career is a key to wealth generation. Don’t fall into the trap of going year after year without increasing your income. The biggest mistake people make here is assuming salary increases will happen on their own.

Trust me. Unless you’re doing an incredibly amazing job, it’s pretty unlikely someone is going to voluntarily throw more money at you.

Sit down with your boss and talk with them about how you can start working towards increasing your compensation. The key here is not to ask for a raise outright. You just want to plant the seed and start the conversation.

Then from there, you can work with your boss to figure out what you need to do in order to provide as much value as possible to the business.

Another key to remember here is that getting a raise is not about you. It’s about the business.

- It’s not about how much time has passed

- It’s not because you want to buy a new car

- It’s not because you just had kids and need more money

- It’s not because your co-worker makes more than you

The reason you’ll get a raise is because you’re doing a great job at providing a significant amount of value to the business, and your employer wants to reward and retain you for doing so.

Sit down and put together the documentation that proves this. Make a list of what you have accomplished with specific numbers. How have you saved the company money? How have you generated revenue? How have you provided legitimate business value?

Then compare your job title to existing jobs in the area using websites like salary.com.

These two pieces of information will show that you’ve done your research, you know the facts, and that you’ve put in the effort to get a raise, which will make it much more likely to happen, all without the stresses of an awkward salary negotiation meeting.

Even if you get an initial No at first, remember that all that means is, “not yet.” Ask what you need to do to make it happen and keep working towards getting your first raise.

Resources:

- [Course] How to Get a Raise in 90 Days – Without the Stress of Negotiating

- [Video] Leveraging Your Raise to Grow Your Wealth Significantly

Start a legitimate retirement plan

If there’s one thing most people will probably gloss over in this post, it’s this one. Retirement seems so far off that it’s hard for short-term thinkers to even fathom.

But I’ll say this. If you don’t think about it now, and start a legitimate retirement plan, you absolutely will be one of those people who are still working in their 70s, and maybe even until the day you die.

If you want to quit working while you’ve still got some life left in you, take a few minutes to read this section.

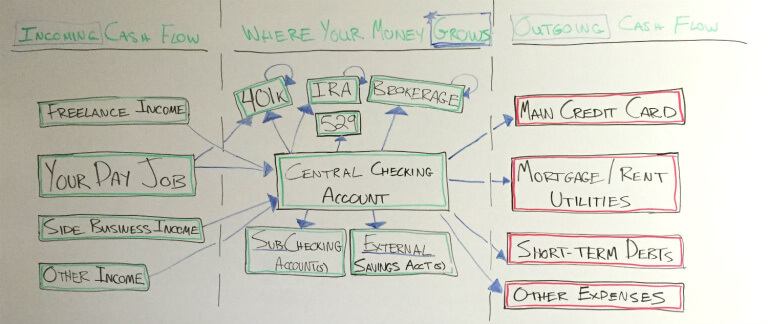

Once you’ve got your debt paid off and have established good savings habits, learning how to invest and getting a retirement plan set up is your next major milestone.

The longer you are in the market, the more you can take advantage of compounding interest to make your money work for you. The difference between starting at 25 vs starting at 35 can easily be six figures.

The most simple automated retirement option is an employee-sponsored 401k plan. This is because the first part of the setup, auto-deposits, are essentially done for you since these are simple a portion of your paycheck. It’s also very simple to increase your deposits by clicking a few boxes.

One of the best benefits of a 401k, however is the fact that they are tax protected, meaning that you will not be taxed on what you earn in your 401k like you would normal stocks. You only pay tax on either what you deposit initially (Roth 401k), or what you withdraw during retirement (Traditional 401k). This benefit can also result in a massive difference in the amount of money you have when you retire.

The last major benefit of a 401k is employer matching, which is a bonus that your employer pays into your 401k to encourage you to participate in it. It’s basically free money as long as you remain invested. Employer matches can range anywhere from nothing (some don’t do them at all) to as much as 15% for world-class 401ks. Most are in the 3-5% range.

Still, even at 3-5% extra per year, this can easily earn you another six figures over the course of your lifetime. Check with HR to make sure your account is set up for the highest match, and then steadily increase it from there year after year.

Check out the incredible earning power of the 401k Quadruple Threat

If you don’t have access to a 401k, use a Roth IRA with any major online brokerage and simply set up auto deposits into a broad market index fund. This will give you a similar form of tax protection, and is almost as simple to automate.

If you really want to get aggressive here, use a 401k, an IRA, as well as stock equities to fund your retirement as much as possible. The more you save, the sooner you can be free!

Resources:

- Your Top 11 401k Questions Answered

- How to Get Started Investing in Stocks

- 5 Things Blackjack Taught Me About Money

- [Course] 401k Millionaire – How to Create a 7 Figure 401k

- Millionaire Calculator!

- Financial Automation Checklists (includes automation of retirement accounts)

Seriously though. Just get started.

There is a pretty clear timeline here – from getting out of all types of debt, to learning how to save money, to increasing your income, to setting up your retirement fund, and everything in between.

Don’t worry too much about the deep down details right now. This can stop you right in your tracks.

The most important thing to understand is that no one is going to take care of your money for you. It’s on you to make it happen, so wherever you are in your financial life, look forward to the next goal and just get started!

Early investing is important. One of the best books I’ve read on the power of investing growth is “Save a Million Dollars and Retire Early” by Christopher Brathmill. The growth potential is astounding.

Super helpful!!!! Thanks for the advice.Very informative tips thanks for sharing.

http://www.mindvalleyacademy.com/blog/impact/financial-goals