How to Get Started Investing in Stocks

In the last post, we talked about how a young and dumb version of myself lost thousands of dollars by doing some pretty boneheaded things when I started my “investing” career.

If you missed that one, you can check it out here. You’ll want to understand the lessons within that one before getting too far into this training.

Now I want to help you with your next question – how to get started investing in stocks.

In this training, I want to introduce you to a simple way to do just that without incurring much risk, while still being able to get a decent return on your money.

My goal here is to not overcomplicate things by tossing a bunch of terminology and jargon at you all at once.

I simply want you to understand:

- What it means to own stock

- What types of stock to buy to get started

- How much to invest, initially

- What to do next to keep going

Before we dig too far into how to actually buy a stock, I want to you to first understand what it means to own stock. You should note that we are going to be talking about individual stocks here, not index funds, mutual funds, or anything like that.

What Does Owning a Stock Mean?

When you buy stock in a public company, you are basically buying a very small portion of ownership of that company. In return, you are allowing that company to use your money to fund it’s business operations (and hopefully turn a profit).

So let’s say the “share price” of a company you want to buy is $50. A company’s share price represents the price of 1 single share of stock.

If you buy 5 shares of that company (I’ll show you how to do that in a minute), you pay $250 to own those shares, or $50 x 5 (plus a small commission to a broker who buys them for you).

So now the company has $250 of your dollars to use for it’s business operations.

A common misconception here is that the company absolutely has to make a profit for you to make money. That’s not actually true.

As long as the share price of a company increases (which is influenced by market demand), then your shares of stock will increase in value.

With the most basic investment, simple ownership of a stock, you’re betting that the “share price” of that company will increase over time, and that you’ll eventually make a profit from the money that you’ve invested.

So let’s say in one year, the share price of that company rose by $10 a share, which would be a pretty nice increase.

Now your shares are worth $60 a piece instead of $50.

Your initial 5 shares that were worth $250 are now worth $300 ($60 x 5).

Congratulations. You just made $50!

At this point you can either sell your shares (again, with a small commission cost), or you can let your investment continue to grow over time.

The action you would take at this point all depends on your goals, which we’ll talk about next.

Note: While profiting $50 isn’t a lot, imagine when you get to the point where you can invest sums 10x, or 100x that amount. That $50 becomes $500, and even $5000, which all snowballs with compound interest over time.

As a quick example, the methods of investing in this post are pretty simplified, but even if you just buy $1200 of stock a year ($100 a month) and do nothing else, and then let it compound on itself with the average growth rate of the stock market, you can easily have a stock portfolio worth six figures well before you retire.

You’ll of course want to have a more aggressive investment and retirement strategy, but this at least shows you the power of investing over time if you stick with it. And hopefully it will help inspire you to get started sooner rather than later.

You can visit Investor.gov to use this tool if you’d like.

Establishing an Investment Goal

Any time you make a financial move, you should have a legitimate reason for doing so. This reason is ultimately going to influence your future decisions with that chunk of money.

If you don’t establish a goal, you won’t have any sort of direction to take after your initial investment, and that is a great way to lose money.

Your goal can be any number of things:

- Saving for a future large purchase

- Learning the ropes of investing

- Working towards building a stock portfolio worth a certain amount

- Investing for your retirement

- The thrill of making money!

Whatever your goal is, be clear about it before you get started. In this case, you’re likely just investing to get started and learn the ropes. If that’s your goal, then let it be that and nothing else.

A common mistake for novice investors is to set aggressive income goals with their initial stock purchases. That results in getting way too caught up in short term thinking and investing way too much money for someone just getting started.

If your goal is to learn, just start small and get some experience.

How to Get Started Investing in Stocks

Ok – Now that you understand the basics of what you’re doing, let’s get you set up with an online broker so you can actually purchase stock.

As I write this training, my current favorite for this is Capital One Investing (formerly Sharebuilder). This tool is incredibly easy to use, and makes investing for beginners very simple.

You can open an account for free and buy and sell for $6.95. You also get access to more types of securities than you’ll ever need.

(Note: I am not getting paid a single cent to recommend Capital One Investing. It’s just an awesome tool that is set up perfectly for novice to intermediate investors.)

One of the coolest features of Capital One Investing is that you can leave all of your money in a Capital One 360 account (my go to online savings account), and use their “Express Funding” feature to make trades instantly from your savings balance.

This avoids the need to leave money in your brokerage account, or initiate transfers 2-3 days in advance. Aside from the fact that this can be worth thousands of dollars in cases of market timing, it’s also a really convenient feature that other brokers lack.

If you’re looking to get started investing in stocks now, head on over to Capital One Investing now and open an account. It’ll take you no more than 10 minutes. Come back when you’re finished and we’ll keep going.

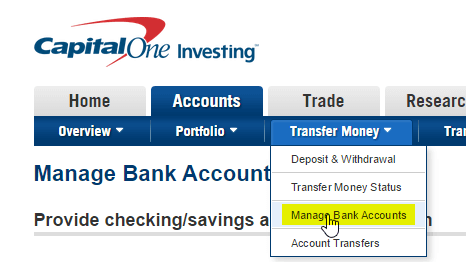

If you don’t already have a Capital One 360 account that you can link up during the signup process, you’ll likely need to link up your bank account before you can make trades, which you can do on the Manage Accounts screen.

You can either link up your account with a “Personal Finance Access Code” that will allow your bank to access the Capital One API, or you can link your accounts through verification of a couple of small transfers to your other account, which will take a couple of days.

If you’re stuck here until your account is funded, bookmark this post and come back when your funding is completed. Feel free to reach out to me with questions as well.

—

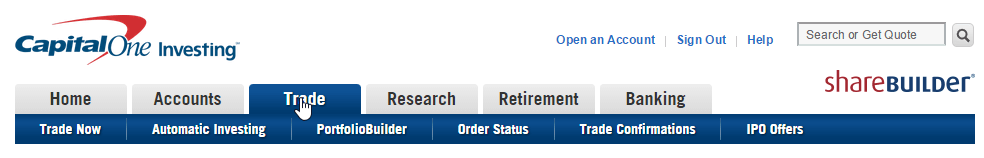

Ok – Now that you’ve got your account, let’s walk through buying your first share of stock.

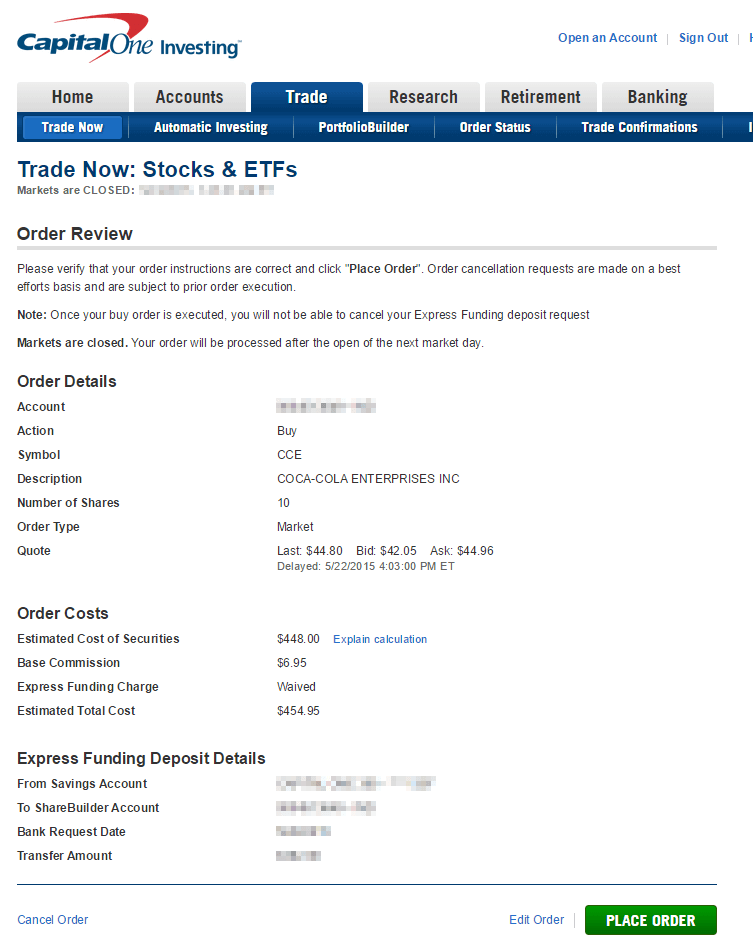

I’ll walk you through it with a few screenshots. If you chose Capital One you’ll recognize the screens, but the process should be pretty similar with any online broker.

- You’re looking for the “Trade” section of the site.

- Once you’ve found it, you want to select “Buy.”

- Then you’ll enter the ticker symbol of the company you want to purchase (each company has a corresponding abbreviation called its “ticker”).

- Next, you’ll enter how many shares you want to buy. Remember that how much you spend will be number of shares x price per share.

- You’ll then enter how you want to buy the stock. Just choose “Market”. I’ll explain that below.

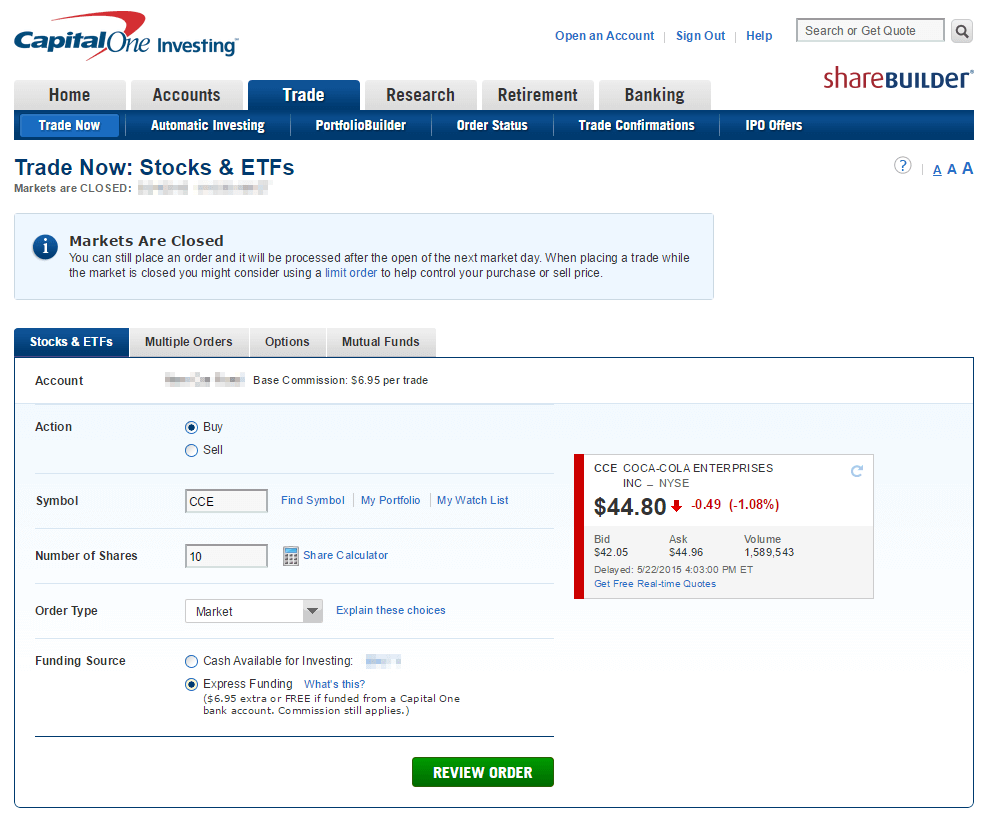

So in this example I am choosing to buy Coca-Cola (CCE) at $44.80 per share.

If I buy 10 shares, that’ll come to $448.00 + $6.95 commission to make the trade. So it should be $454.95, plus or minus a few bucks for share price fluctuation when the trade occurs.

A “Market” order means to buy the stock at the best possible price that the shares come available on the market. These are almost always executed immediately and will usually only vary a few cents at most from the current price, depending on the timing of your quote.

I rarely use anything other than Market orders unless I’m setting up automation or am worried about a large fluctuation after hours. For getting started, you’re safe with Market orders.

Don’t worry too much about the other types of orders for now. If you want to read about them I encourage you to do so down the line, but doing that now will just confuse you.

My Trade screens would look something like this throughout the process.

(Note that I’m not recommending you buy CCE specifically. Although this is a good solid stock, I’m just using it as an example and advise that you make your own decsions about what to buy. I’ll help you with that next.)

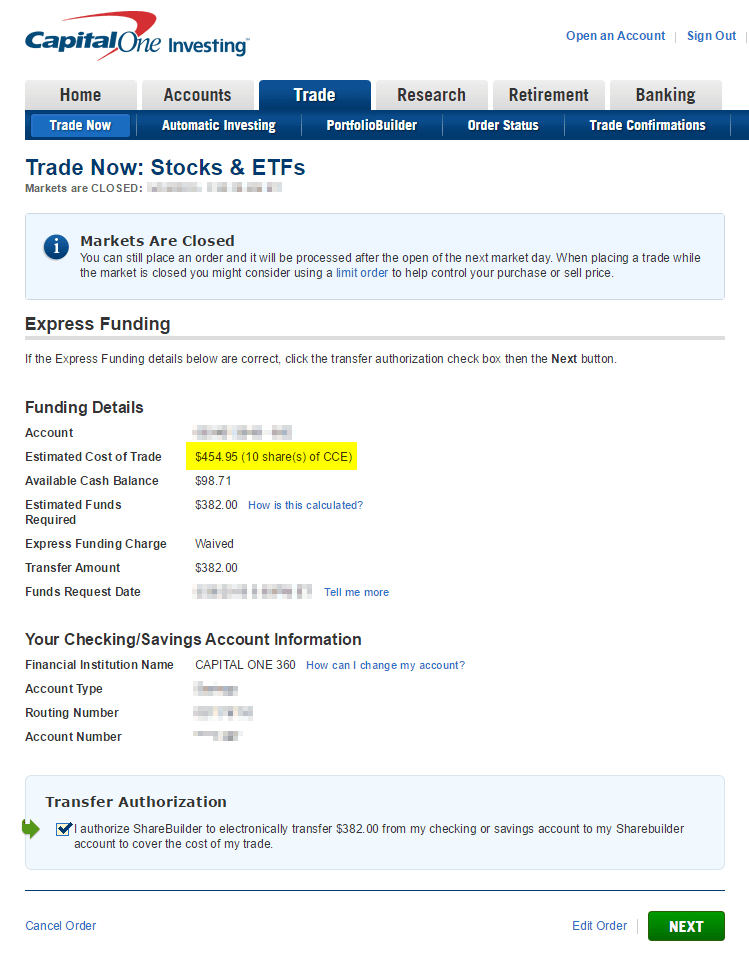

On the second screen, you want to pay attention to the estimated total cost of the trade, which will include the share price and commission cost.

Once I hit Next, I’ll get a confirmation screen, click “Place Order” and I’m done! Now when Coca-Cola shares increase in price, I make money, and I don’t have to feel as bad when I drink the occasional soda (as long as it’s a Coke product) – although I’m sure my fitness coaches would tell me otherwise 🙂

What Stock Should You Buy?

Legally, I’m not licensed to tell you what to buy specifically and I don’t intend on ever being in that position. Your investments will be made at your own risk.

What I can do, however, is help to point you in the right direction to make your own decisions, which I think is much more powerful.

Teach a man to fish – as they say.

A lot of advice you read or hear is going to tell you to buy things like index funds and mutual funds, which are basically investments made of a bunch of different companies.

While this can be a good strategy and I own a ton of these myself, I don’t think it’s really a good way to learn.

If you want to learn how to invest in stocks, buying individual companies is the way to go at first in my opinion.

You have much more control over things this way and you’ll get the most exposure to the lessons you’ll need to learn along the way. There are just things you can’t learn without experience in this game, and buying individual stocks will help you learn those things.

That said, I don’t think it’s a good idea to just throw darts and pick random companies either, and it’s also not a good idea to pick companies just because you like their products.

If your goal is to make money, or at least not lose money, then you’ll want to put your eye on established companies that have a few characteristics:

- Have been around a few decades

- Have great brand recognition

- Have very loyal customers and repeat business

- Pay a quarterly dividend

It also helps from an emotional standpoint if these companies have a business model you understand, a product you understand, and a company culture and mission you believe in.

These are typically known as “blue chip” stocks.

If you hone in on these types of characteristics with your first few picks in your portfolio, you’re going to have some decent stability, and a good chance to make a little bit of money. You’re probably not going to double up, but your money should have a good chance of increasing in value.

To get a list of top blue chip stocks, I highly recommend this list of blue chip stocks from The Motley Fool. You can click each one and read more about them. The Motley Fool is a great learning resource and I can’t recommend them enough for their investing content.

Any one of those stocks on that list is likely to be a solid investment. Of course there are no guarantees with the stock market and you’re always investing at your own risk, but if you’re looking to get started investing in stocks, blue chips are a great way to go until you’re comfortable.

I recommend picking 3-4 different companies to get started. If you can only afford 1 or just want to take things slow, that’s fine too. As long as you get started, that’s what matters.

How Much Should You Invest?

Your goal here is to just get started, so I recommend you start small. As with anything you’re just learning you’re probably going to make some mistakes. I wouldn’t go over $1,000 total with your initial few purchases, and you may even want to go lower.

It’s probably not going to happen, especially if you choose blue chip stocks, but with any amount you invest you should be comfortable with the possibility that you might lose it, especially if you do dumb things like I did when starting out.

Spread your money out over a few stocks and see what happens. Just get your feet wet, make a few trades, and get a feel for what it’s like to own stock.

Again, this is just a guideline. Invest at your own risk and make your own decision about this. 🙂

So… Now What?

This is the tough part for most novice investors. We live in a world of instant gratification for nearly everything. You can buy stock in literally 30 seconds!

But as quick as some things are, you can’t rush business. You’ll be tempted to peak in on your stocks every single day to see how they’re doing.

Here’s some advice that should stick with you for life. Don’t babysit your stocks.

You’re not a day trader. The more you look at them, the more you’re going to freak out emotionally. If they go down a few points, you’ll freak out and want to sell them. If they go up a few points, you’ll be tempted to cash in.

The average stock rises around 9% a year, give or take a couple of percentage points. This means you’ll need a full year before your stocks are making anything significant.

This is where you’ll need to be patient. For the most part, the stock market is a long-term game.

Your goal is to get experience being a stock owner.

- Check in on them once a month or so and see how they’re doing.

- Read about the companies you own and take note of their numbers and product activity.

- Hang out at Yahoo Finance and keep up with them.

After about six months, if you’ve made some money, that’s awesome! Either leave your money invested or sell your shares and decide what to do from there.

Just be sure you give this new endeavor some time before you make any judgments. I’ve seen a lot of people fail to become investors because they couldn’t handle the long-term nature of the market, which is an incredibly costly outcome.

Be patient. Be smart. Be methodical. Leave emotion out of it.

If you can do all of these things, you’ll be a solid investor and will make a lot of money over the course of your life.

Hi Jane. I prefer Yahoo Finance for their simplicity. If you want to go a little more in detail, Morningstar’s tools are great as well.

May I know, which stock chart(s) do you rely on? Thank you! 🙂