[Video] Myth 3: Investing Might As Well Be Gambling

Welcome back. This is myth number 3 in the Four Biggest Myths of Wealth Creation video series.

I hope you’ve been enjoying the videos so far. If you missed any or would like to watch them again, you can check out videos one and two at the links just below.

I recommend doing so if you missed them. They’ll reveal some very interesting mindset shifts you can make that can dramatically alter the results you can achieve with your personal finances and wealth creation.

Here are those links:

Now, let’s talk about today’s myth. Myth number 3 in the series, the myth that investing is just like gambling.

Investing is Just Like Gambling?

This is another one of the most misunderstood myths in personal finance. In this video, I want to prove that myth wrong, and show you how through taking a stable long-term approach to wealth creation, you can virtually eliminate the possibility that you will lose money with your investing.

But first, let’s take a look at what gambling actually is.

I have a quarter in my hand right now. Now, what I’m going to do is flip this quarter and I want you to guess what it is going to land on.

BUT… before I flip it, I want to give you a choice.

- Imagine that you have $5,000 in cash saved, and if you are correct, you double your current savings.

- But if you are wrong, you lose everything, and you have no opportunity to invest and grow your income until you save another $5,000

Would you be willing to take that risk?

Would you be willing to lose everything you have and the future potential to make millions on a coin flip?

If so, then THAT is gambling. This is what a lot of people do when they blindly throw their money at random stock tips hoping to get rich quickly. Many individual stocks can be very volatile. If you’ve ever heard horror stories of people losing money in the stock market, that’s what probably happened to them.

They weren’t thinking long term.

Focus on Safe, Long-term Wealth Creation

What isn’t gambling is investing in safe, solid growth funds in the stock market, like those that exist most commonly in IRA and 401k plans. These are diversified funds made up of many types of funds that are designed to be much more stable than individual stocks alone.

These types of assets aren’t going to have the huge 30% growth numbers that some stocks might have, but they also won’t have the huge collapses that individual companies might have. They’re protected from high risk because each individual companies make up only a very small portion of their total allocation.

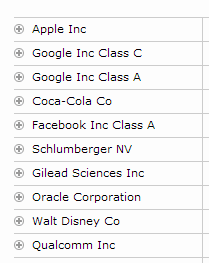

Take the Vanguard Growth Index Fund for example (I’m not recommending this fund. This is just an example).

It’s made up of several very well-known and stable companies that are still growing steadily that aren’t likely to go under anytime soon.

These are companies like Apple, Facebook, Google, Disney, Qualcomm, Coca-Cola, and so on. And if one of them does happen to fail, the others will protect the fund from losses, and the mutual fund manager will likely remove that from the fund’s holdings.

Holding this type of fund over the long-term is very safe and will likely pay off very handsomely.

Now you might be thinking, but “how am I going to get rich if I don’t buy stocks that won’t double in two weeks?”

Well, you think long-term. That’s how.

For the average investor, most stocks by themselves are no better than coin flips. You do have to know what you’re doing to invest in individual stocks.

But that’s the beauty of IRAs and 401ks. They are meant to be long-term investment vehicles. They live in these types of safe, index and sector based funds.

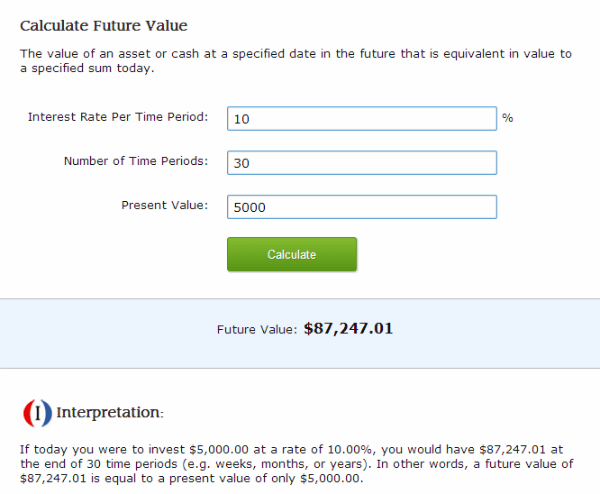

So before I flip my coin, consider that the stock market is up an average of 10% per year since the 1920s. That’s almost 100 years. But let’s just call this experiment for 30 years.

Even if you had only $5,000 to invest, just one single time, it would end up multiplying several times over at this rate.

It would be over $87,000 in 30 years.

Would You Rather

So I ask again, would you rather risk losing $5,000 for a 50/50 chance of having $10,000 now?

OR

Would you rather invest that $5,000 at 10%, leave it there, and have essentially a 95% chance at having $87,000 or more in 30 years?

And remember, if you lose, or worse, you choose to spend that $5,000, you have nothing but a pile of stuff.

As you can see, the upside is much larger than the downside when invested safely and correctly. That’s how to create wealth over the long-term without gambling.

So let me flip my coin. You decide if you’re going to play or not. I’ll be here on the sidelines watching my money grow.

Did you play? If so, did you win?

If you won, well, congratulations, but that’s called a short-term win. Sometimes they do happen and you can make some good money, but here’s the thing.

If I flipped this same coin 100 times, I would have something extremely close to 50 heads and 50 tails (if you don’t believe me, read this and be prepared for heavy nerdiness), which means if you won and kept playing, you’re either going to lose eventually or break even.

Most investors, when trading in and out of funds like this, and freaking out over short-term market fluctuations, end up making really bad decisions, and because of it get returns in the 2% range.

By staying invested for the long-term, taking advantage of high growth index funds, following strategies like dollar cost averaging, and trusting the history of the last 100 years, returns of 10% annually and higher over the long-term are possible.

We’re Not Gambling Here. We’re Following a System

One of my favorite movies is “21” with Kevin Spacey and Jim Sturgess crushing Vegas with a professional blackjack system, which actually happened several times, and still does.

Kevin Spacey’s character has a quote in this movie that says:

We’re counting cards, we’re not gambling. We’re following a specific set of rules and playing a system.

In the movie when the team “gambled” and didn’t follow their system, they lost. When they did, it paid off handsomely.

And that’s my point with this exercise.

Investing is not gambling when done correctly.

Wealth creation is not about tomorrow, next week, or next month.

You don’t get rich by predicting the next Microsoft or Amazon, no matter how much you dream about it. People that do that get lucky, or have information that normal people do not.

We’re not gambling here. We’re following a system. We’re investing.

Creating wealth is all about the results you achieve over long-term. It’s about making smart and educated decisions that benefit your long-term future and taking consistent action to continue growing that wealth.

Don’t fall into the trap the financial press sets for you, trying to get you to trade in and out of the next big things.

Warren Buffet, the most legendary investor who has ever lived, and the 3rd richest person in the world, said it best.

Someone is sitting in the shade today because someone planted a tree a long time ago.

If you really want to create wealth in a smart, and proven way, understand that an 8 – 10% growth rate over time that has extremely high odds of working out for you, is far better than tossing all of your money on red and crossing your fingers for a good number to come up.

Take it from a guy who likes to play blackjack at the $5 tables for fun. I’ve made 1000x the money in the stock market than I ever have at a casino, and it was a whole lot easier too.

Coming Up Next in the Four Biggest Myths of Wealth Creation

Next up, is the final myth in the Four Biggest Myths of Wealth Creation series, and is the most important one of all that holds people back from creating large amounts of wealth in their lives.

I personally see this myth wrecking the financial lives of dozens of people on a daily basis, although I’ve been able to help save many of them from it recently.

I’m excited to share it with you. That video will be coming your way on Sunday, September 7th at about 8:30am.

I’m also going to make an announcement towards the end of video regarding my newest flagship course, 401k Millionaire. I am going to be opening it up for enrollment on Sunday morning, September 7th. During that video, you’ll find out what you need to do in order to get registered for the course.

If you’ve enjoyed this series, you’ll love what I’ve put together for you in 401k Millionaire.

Again, the final video is coming your way in a few days, on Sunday, September 7th. It’ll be in your inbox if you’re an email subscriber. If not, you can get signed up anywhere on the blog. Don’t miss it! I’ll see you then.

—–