The Only Three Money Principles You Need to Be Rich

I could easily pull a page out of every other financial blog out there, and toss you up a big list of 72 ways to make yourself rich, but while those articles get a lot of buzz, they’re just too complicated and shallow, and rarely help you think differently about the way you live your life.

As you likely already know, I’m not here to pull in billions of pageviews. I’m here to help you behave successfully, and make real tangible changes happen in your life.

So as I start to gear the content of Academy Success more towards helping you improve your personal finances this year, I want to make sure I make it simple on you. Because simplicity is going to make change much easier.

In fact, in 2006, Harvard University did an analysis of 129 different studies related to behavioral change. They found that the behavioral changes that were the most effective were those that were simple for the subjects to understand and implement into their lives.

So to that tune, I’ve combed through dozens of financial lessons I’ve learned in my life through various methods – those that have helped me do things like:

- Pay off tens of thousands of dollars of (necessary) debt

- Buy my dream house before I turned 30

- Accumulate a six figure net worth several times over

- Set myself up for a cushy retirement on a tropical island of my choice (ok maybe I won’t own an island, but you get the idea).

I don’t tell you these things to brag. I tell you these things to get you to realize that this behavioral psychology stuff that I continuously preach works for everything, including money.

In analyzing the lessons I’ve learned, I’ve been able to narrow financial success down to three main themes, each which builds on the previous.

If you follow these themes in your financial life, you’ll breathe a lot easier when considering your financial future, and maybe you can dream of buying an island one day as well 🙂

- Houses are larger than they have ever been

- Over 35% of households have more than two vehicles

- Mobile phone and cable bills are in the hundreds of dollars per month

- Fuel costs are once again nearing an all time high

Our standard of living is increasing at an alarming rate.

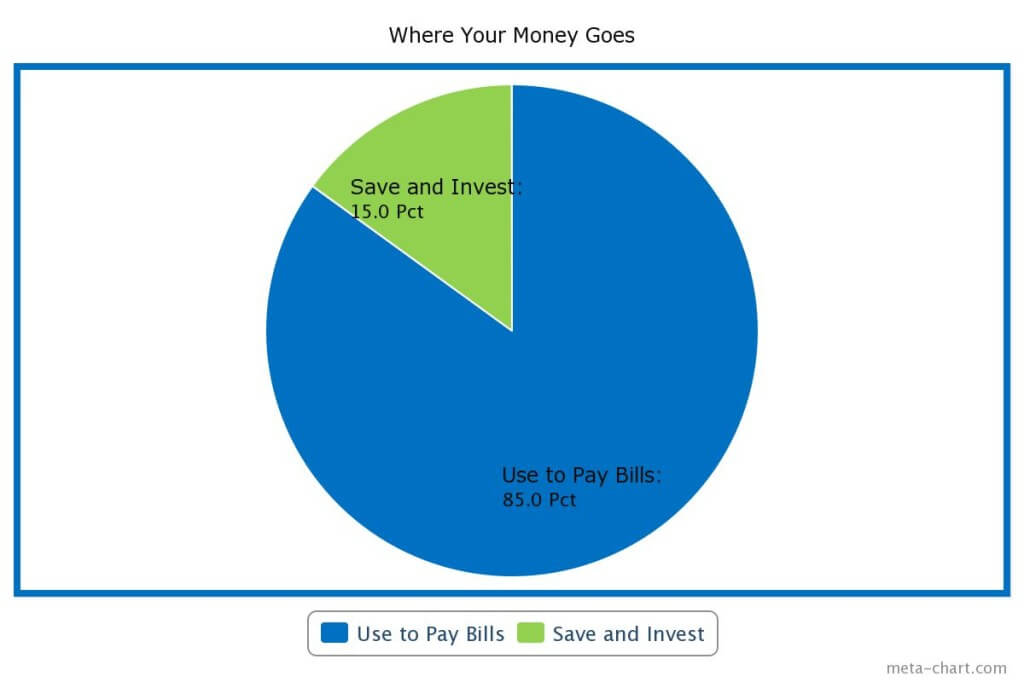

In fact, according to Forbes, nearly 65% of Americans fail to save any money after paying their bills. And many are going further and further in debt every month.

I don’t have to break out a calculator to tell you that this is a recipe for financial disaster, especially if this is the behavior you exhibit from early on in your lifetime.

In order to become rich at any point in your life, you quite simply have to make more money than you pay out in bills and other expenses. Or to put it another way, you have a continuous positive cash flow.

(Read: Four Ways to Increase Your Income)

The easiest way to accomplish this is to think about 15% (or more) of your take home income as “hands off.” You save and invest this chunk of money, and you use the rest to pay your bills.

If you’re wondering what you’re going to do with this money, you’ll find out in a few paragraphs. For now, just keep this image in your head and keep your pants on.

This brings us to the next point, which is very closely related.

Pay Yourself First

So let’s say you do manage to get yourself into a positive cash flow situation. You’re making more money than you’re spending. That’s awesome.

Now I want you to make certain you establish the habit of “paying yourself first.”

Paying yourself first means before you do anything with your money each time you get paid – whether you have a steady income or a variable income – the first thing you do is take that 15% off the top.

This means if you’re bringing home $1000 every two weeks, toss $150 in an account that you don’t spend from. This is what you’re going to use to get rich. I’ll explain in a minute.

Now let the excuses roll in. I know what you’re thinking – “But Cody, that’s a lot of money. How am I going to buy my 80″ TV or the $2000 watch I’ve been eyeing?”

Don’t worry about that right now. How you’ll still be able to buy those things will make perfect sense once you understand the psychology of what happens when you do this.

After you’ve put that money aside (chill out, I’ll tell you what to do with it in a minute), you are allowed to pay your bills and spend on leisure.

If this sounds backwards to you, well, it is to most people as well, so don’t worry. The reason for this has everything to do with human behavior.

Simply put, people LOVE LOVE LOVE to spend money. It makes us temporarily happy (e.g. retail therapy – yes, this is actually a thing). The act of spending actually activates the pleasure center of the brain. It releases dopamine and makes you feel good, but only for a small period of time.

This means in order to keep feeling good, you have to keep spending and spending in a never-ending cycle.

Don’t get me wrong. There’s nothing wrong with spending money. In fact, denying yourself life’s simple pleasures like your morning coffee, or a drink after work is no way to live. That’s not what I’m suggesting.

What I am suggesting is that you establish this 15% safety net from the start (or more if you can) so you don’t have to worry about spending that chunk of money. This ensures you’re always putting money back for the future – even if you’re very undisciplined.

The interesting thing about this chunk of money is, you won’t miss it at all.

Yes, you will have slightly less money, but it’s such a small amount, you will adjust your lifestyle easily. And once you establish this habit, you’ll begin to understand that in order to afford the things you want, you’ll need to make more money – not spend every last dime you have.

This is a big difference between how the poor think, and how the rich think.

- The rich understand they must pay themselves first, and they compound their savings over time

- The poor pay others first, and they spend every last dime they have and are left with nothing

As you make this adjustment, you’ll spend a little less on routine expenses, be slightly more frugal, and buy less junk. In the end, you will not notice a difference at all.

The reward over time is a significant chunk of cash you can use to turn into a lot more money in the future.

Huge Tip: Make sure you automate this process so you never have to think about it. Take advantage of modern technology to use direct deposit and automatic transactions so you never have to worry about performing manual deposits.

Take that 15% you save every time you get paid, and make intelligent investments that compound over time to add up to hundreds of thousands, if not millions of dollars over your lifetime.

- Personally, I have made some smart stock market investments that have resulted in the most financial gain for me

- I have friends who are doing well in real estate

- Others have started side businesses, and even full-fledged businesses of their own.

There are multiple ways to make your money grow over time.

- Invest into a 401k and IRA

- Invest in blue chip stocks, dividend stocks, and mutual funds

- Invest in real estate

- Start a side business, or maybe even a full-time business of your own

- Educate yourself to increase your earning power

The details of each of these are beyond the scope of this post, but I promise we’ll get into that in a bit.

But for now, just understand that even a little bit of savings from early on in your lifetime can go a really long way with helping you achieve your financial goals.

When you grasp how to compound money over time, even $100 a month can be the difference between $0 in your bank account, and a sizable six figure (even seven figure) chunk of cash – and that’s if you just play it safe.

It’s not uncommon for people to do things like:

- Parlay a small amount of savings into a down payment on an investment property

- Fix up and sell that property to invest in the stock market

- Liquidate their investment gains to start a business they’ve always wanted to

- Then become a millionaire doing the things they love

A future like that is possible for you as well, if you just change your thinking and behavior to make your money work for you over time.

Millions of people do these things every day. You can do it too. Believe it.

- You’ve gone from the possibility of not saving anything at all and living like every other person in a massive about of debt to

- Reducing your expenses to a level that allows you to save just a small amount of money on auto-pilot each time you are paid

- Making sure you pay yourself first so you do not succumb to the temptation of spending unnecessarily

- And taking that money to make it work for you to turn it into something much larger over the course of your lifetime

These are the only principles you need to follow to build wealth over the course of your life.

There is a lot that goes into them, which I’ll help you continue to learn, but if you always stick to these three rules, it’ll be difficult for you to go wrong.

Thank you for the information.

Really good article….I must admit it is simple to comprehend and almost easy to implement…????

Have you ever considered about including a

little bit more than just your articles? I mean, what you say is valuable and everything.

Nevertheless just imagine if you added some great graphics or videos to give your posts more, “pop”!

Your content is excellent but with pics and videos, this site could undeniably

be one of the most beneficial in its field.

Good blog!

Thanks for finally talking about >The Only Three Money Principles You Need to Be Rich | Academy Success <Loved it!

It’s an remarkable paragraph in favor of all the internet viewers; they will

take benefit from it I am sure.

Fine way of describing, and good piece of writing to get information on the topic of my presentation topic, which i am going to deliver in academy.

Well stated! I wish I had been more focused in watching my money instead of just working for it, because although we’ve done #2 and #3, #1 we failed miserably on. Congrats on getting it right!