Financial Automation: All of the Apps, Websites, and Services I Use to Drive My Financial Automation System

Until today, I haven’t gone into great detail about the inner workings of my financial automation system that I yap about so much, not because I’m hiding it or anything, but just because it’s a bit of a bear.

But I’ve been getting a lot of questions about how I pull it all off lately from a lot of eager readers – including my buddy Justin from Limitless365 who I just profiled in the previous post – so I’ve decided to pull back the curtains and reveal it all.

Here it is folks, in a glorious 4,400 word post.

Don’t let any of this scare or overwhelm you. It’s not all that complicated and can easily be done in pieces. In fact, I recommend doing just that. After reading this, I’ll recommend which piece you should do first to get your own system going.

One of the most common questions I get is how I set it all up, so that’s what I want to talk about in this training – the system I use, and the tools that drive it.

Before I go into this, I’ll tell you that there are a massive amount of applications out there pitching financial automation. Some are good. Some aren’t.

I’m always looking for new ways to handle things better, but I’m also not going to go out and use a certain new app if it does something my system already does well.

So if you don’t see something on this list that you’d like to try out, don’t think that because I didn’t mention it that you shouldn’t use it. There are many ways to automate your finances. This is just the way I do things – as requested.

The main goal is that you pay bills, save, and invest without lifting a finger, allowing you to focus your time in other more important areas of your life.

By the way, if you want to follow along with the checklists, pick up a copy of my Financial Automation Checklists Collection. It’ll walk you through this process step-by-step. I do recommend you still read the article though. It’s important to understand the “Why” behind the system and its parts.

Banking

Main Chase Bank Account

At the hub of my financial automation system is my Chase Checking account. This account has no fees associated with it unless I do something dumb, which as you’ll see later, the system guards against.

Almost all of my income from all sources (other than what I set aside to run Academy Success) is direct deposited straight into the accounts I have here. The only reason I ever go to a bank is to get cash from the ATM, which is just as easy at a no fee drug store ATM.

Chase is also nationwide, so I can get money anywhere I need it. This isn’t a must, but it’s nice when I’m traveling.

This account has two primary purposes.

- To be a distribution hub for money before it is deposited into other accounts.

- To be the main account I pay all personal bills with, such as food, entertainment, gym expenses, clothing, subscription services, etc.

I have a series of transfers set up from this account to feed my savings accounts, investment accounts, retirement accounts, etc. What isn’t deposited into those accounts is set aside for spending and paying every day expenses.

I have balance alerts set up on this account to notify me if it gets below a certain threshold. This way I know when I need to cool it on the spending.

Home Expenses Chase Bank Account

I also have a separate account that my wife and I use to pay our home expenses, such as our mortgage, electric, water, etc. The reason this is separate is because no money is spent from this account at all. It’s meant for paying only large home-oriented bills completely on autopilot.

These are usually pretty fixed, so this account is calculated very precisely so that I never put too little, or too much into it. The only fluctuations are from variable utilities such as gas and electric, which can go $100 in either direction depending on the time of year.

This helps me keep things organized and saves me from having to worry about any of these larger bills being lumped into my main spending account.

I also have alerts on this account to tell me when things are paid and at what amounts. This lets me know if anything is out of the ordinary. Missing a house payment is not a good thing for your credit score.

Capital One 360 Savings / Checking

I have several accounts with Capital One 360, all of which are meant for some type of savings. Their ease of use, organizational tools, and technology focus is very attractive. You can literally have an account open in a few minutes.

Each account has a specific amount that I transfer to it each week from my main savings account. This happens automatically via a scheduled transfer. These are pretty small deposits, but they add up over time, and help me keep progressing towards savings goals without having to think about it.

If these transfers weren’t automated, there is little to no chance I would remember to or have the discipline to do them all on time without missing one. I would also likely spend what I did not save, thus the importance of the automation. It guards against emotional spending.

Notice that this account is at a completely different location than where I locate my main checking account. There is a very good reason for this.

These accounts are meant for cash savings and cash savings only. I want to make it very easy to get money to these accounts (with automatic transfers each month), but very difficult to get money from them.

This goes back to a very common sense driven principle of human behavior. If you want to avoid something, make it harder on yourself to do.

If you were on a diet, you would probably get rid of your junk food, right? So it makes sense in this case that if you don’t want to spend, that you should get rid of your spending mechanism.

I cut up the ATM / debit card from these accounts the minute they came in the mail, and set them up so the only way I can spend from them is if I wait 3-4 business days for a transfer to my main checking account. This has saved my bacon on a number of occasions when irrationality was about to get the best of me.

I only spend from these accounts when I have met a savings goal for a large purchase, or when something out of the ordinary comes up. That money is then quickly replenished.

These accounts are also organized by savings priority. I won’t go into all of them specifically, but there are a few there for various savings goals (house projects, vehicle purchases, education, etc) that the deposits go into.

Each account has a specific purpose. This helps me to stay organized with my savings and know at a glance how close I am to achieving a particular goal. I can transfer between these accounts easily if my priorities change.

Check out Capital One 360 if you’re looking for an easy way to manage your money online (full disclosure – I get a small referral bonus if you decide to mange your money with Capital One 360, at no cost to you of course).

Betterment

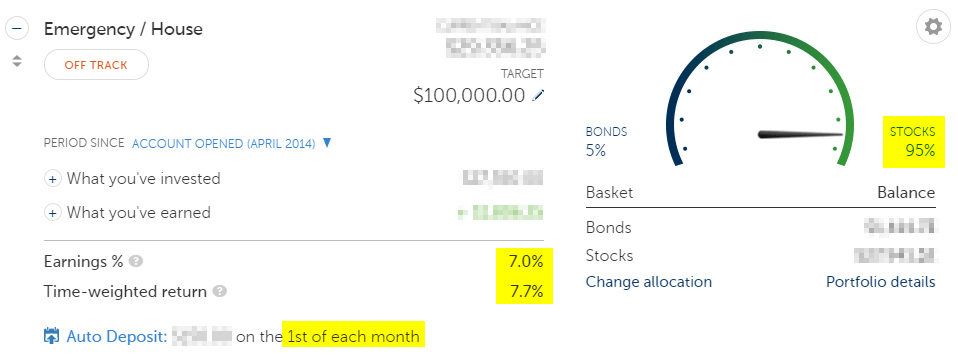

Even though Betterment is marketed as an automated investing service, I’ll list it here in my bank accounts category as well because I use it as a highly liquid bank account for my emergency cash / “pay off my house” fund.

TIP: If you missed the tip in that last sentence, it’s a good one. A great way to motivate yourself to establish an emergency fund is to give it a secondary purpose. It’s a lot easier for me to sleep at night knowing that my emergency fund will likely also help me pay off my house one day.

The deposits work the same way into this account. They’re automated via monthly transfers I set up through Betterment. I get an email when each one happens (which is very well done by Betterment by the way), and I can easily check up on things with their iOS app, or online interface.

The thing I really love about Betterment (well one of the things), is that all of the money I have invested with them is highly liquid. If I need to access my money for some reason, I don’t have to jump through half a dozen hoops before I can access it, and I don’t have to pay a bunch of fees or fill out complicated paperwork.

I just make a transfer just like any other bank account, and that money is ready for me to spend.

Even better, because Betterment uses low fee ETFs for these types of savings goal oriented accounts, and allows me to adjust my level of risk with a simple slider, my money can grow at a fairly high rates. This means I get the liquidity of cash with the compounding benefits of stock investments.

Of course there is some risk involved in this strategy, but since this is a long-term (10+ years) “spend it if you need it” type of account, I feel pretty safe about it.

Here’s a screenshot from my Emergency / House savings goal account.

I highly recommend Betterment if you’re looking for a simple way to automate your savings and get a solid growth rate along the way (full disclosure – I get a small kickback from Betterment if you decide to sign up through my referral link, at no cost to you of course).

Stock Trading / Brokerage Accounts

Now that we’ve covered automated savings and bill paying, let’s get onto the really good stuff – automated investing and growing money over time!

The following online brokerage accounts use an investing method called dollar cost averaging, which has several advantages, the main one being that it eliminates irrational buying behavior of stocks. All of my stock purchases are done automatically on a set schedule at a set dollar amount.

This is done through automated investing in a couple of different ways, which I’ll explain below. In a nutshell, this avoids the temptation to time the market, which every beginner investor falls victim to at one time or another.

Automated investing is one step above automated savings, only instead of just saving money, you are taking your savings and turning it into long-term investments.

TIP: If you’re ready to start investing, just choose a few good blue chip stocks (established companies with lower risk and good growth) that you like, set up an automatic investing plan that you can afford for those stocks, and put it on autopilot.

You’ll waste months, if not years, and forgo thousands of dollars in profits trying to find the right time to buy in otherwise.

You can find a good list of blue chip stocks here if you want to read more about getting started. Also feel free to reach out in the comments if you have questions about this.

Here’s how this is all set up.

Scottrade

I’ve had this Scottrade account since my early 20s. I don’t even remember the first share of stock I bought with it, but I do remember it was for like $50, and it was terrifying!

Since then I’ve learned a thing or two, and today this account is mostly used for automated dividend re-investing in several blue chip stocks that will eventually help fund my early retirement (hopefully) :).

These dividend bearing stocks get reinvested automatically into either partial shares, or flexibly reinvested into full shares of other stocks (a pretty cool feature that Scottrade offers).

This allows all of the dividends I get paid to immediately become part of my stock portfolio in any stock I choose, instead of just sitting there in cash or only being reinvested into the security the dividend comes from.

This is a very powerful feature that compounds on itself, and is one of the primary reasons I’ve kept my Scottrade account over the past few years while many other competitors have emerged.

If you’d like to give Scottrade a shot, you can sign up with the code below. I wish I could tell you I get big bucks for that, but it’s just a few free trades – nothing to write home about. Either way, I appreciate you if you decide to do so.

Referred by: CODY WHEELER

ReferALL code: LDUL0916

Capital One ShareBuilder

ShareBuilder is an online brokerage owned by Capital One, that allows you to make investments with very low trading fees. I opened my ShareBuilder account not long ago because I wanted to experiment with a newer trading tool that would allow me to better automate my investing.

ShareBuilder is not quite as powerful in terms of robust tools like Scottrade, but for the entry-level to intermediate investor, it’s awesome. It’s quickly becoming one of my favorite investing tools due to it’s level of simplicity and ease of use.

They make it incredibly easy to do anything you need to do – from funding your account, to making purchases, to setting up automatic investments, and everything in between. They even let you set up multiple accounts within your main account, which is great because it lets you keep your investing goals organized.

For example – I have one investment account that is solely dedicated to my next vehicle purchase.

TIP: You don’t always have to save for high dollar purchases in savings accounts. If you’re savvy with investing, you can easily invest in a solid growth stock and have a lot more money saved after a few years than you would with just a savings account. It’s a little more risky, but the payoff can be large if done correctly.

You can do this through automated purchases at discount rates through an account like the ones ShareBuilder offers.

Actually as I’m typing this, I realized I needed to set up an automatic investment for a stock I had been looking at, and did it in about 90 seconds. With some other investing services, I would still have to fill out paperwork!

Wait – You want me to print something and fax it to you? What year is this!?

ShareBuilder fits very well into my system because it allows me to integrate easily with my Capital One 360 account and use their Express Funding option. This means I never have to worry about making manual transfers or being hit with “funds not available” fees when banks are slow, which has happened to me a handful of times with other brokerages. Very annoying…

When my automatic investment is ready to happen, ShareBuilder initiates the fund transfer for me without lifting a finger, and the purchase is made the next day. This would not be possible with other services, and this is one of the main reasons I use and recommend their service so highly.

Retirement Accounts

ADP Retirement – 401k

My ADP retirement account is my largest account in terms of overall balance. This is my Roth 401k, and will be my main source of retirement income / what I will buy a jet with (just kidding – maybe…).

I have a significant portion of my salary contributed automatically to my Roth 401k every time I am paid, which is then invested in securities that I picked within my ADP account. I also benefit from a solid employer match, which is also automated and invested the same way.

It’s important to note that these are two different “tax buckets.” The Roth 401k contributions from my salary are post-tax. The employer matches are pre-tax. I have a pretty large employer match and profit sharing benefit, so it makes sense for me to use the Roth 401k to diversity my post-tax distributions when I’m retired.

This will ensure I have a large chunk of money that will not be taxed again when I withdraw it. You can see more of how this breaks down with my other investments on my Millionaire To Do List.

If you have a traditional 9-5 job, which 90% of people do, you likely have access to a 401k, or some type of similar retirement plan as well.

I’ll tell you right now that if you’re not taking advantage of this, you should start doing so as soon as possible, even if it means reducing your spending slightly to do so.

At the minimum, contribute enough to get your maximum employer match. Otherwise you’re throwing away free money.

If you have the ability to choose your own investments, a great way to automate a 401k account even more is by choosing a Target Date fund. These are funds with retirement years in the titles of them, such as the Vanguard Target Retirement 2045 Fund. I have a decent chunk of my own money in this exact fund, which has very low fees and pretty solid performance.

These types of funds will adjust for risk automatically as you age. The idea is to leave your money in these funds throughout your career. They’ll be aggressive when you’re young, and safer when you’re approaching retirement age.

On a side note, I manage my 401k using the system I teach in my 401k Millionaire course, which includes techniques to maximize employer matching, maximize tax benefits, maximize compounding interest, and my Ramp-Up Strategy, which teaches you how strategically increase your contributions to your 401k over time without significantly affecting your available spending income.

You can check out 401k Millionaire here.

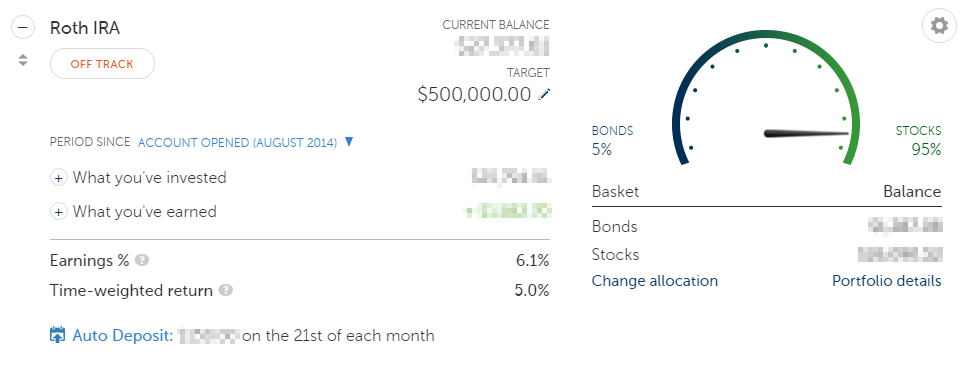

Betterment – Roth IRA

Once again, I roll with Betterment for my Roth IRA.

Previously this account was with Scottrade, which was great starting off, but it ended up being a little too much of a chore to manage there (there was no easy way to manage automated purchases and deposits), and I wanted more automation, so Betterment was the way to go for me for that goal.

A Roth IRA is set up with Betterment in a similar fashion to a savings goal, with the limitations that any IRA has on it (yearly contribution limits, withdrawal limits, etc).

This account is automated essentially the same way, with a monthly deposit of the amount I choose, when I choose it to happen. This one is set up at a slightly different time during the month so I can be sure I am paid again after my savings deposit takes places. This is important to balance available cash flow.

TIP: When you’re setting up your own system, make sure you’re taking into account when you get paid. You don’t want money coming out of your account when it may not be there.

You might be wondering why I have both a Roth 401k, and a Roth IRA. Well there are a couple of reasons.

- This account gives me another “after-tax” bucket of money to diversify my tax situation when I’m retired. Taxes are fairly low right now, and I’d rather pay them now than later.

- There aren’t a lot of ways to completely dodge taxes with investments. Having another method where my money can grow tax free is a no-brainer.

Here’s a screenshot of my Betterment Roth IRA, which is pretty similar to the savings account you saw from earlier.

Credit Cards

I have one main credit card that is a key part of my financial automation system, my Southwest Airlines Plus card, and a number of other smaller cards that allow me to accomplish sub-goals such as building my credit score and spreading out my cash flow.

Essentially all of my semi-large bills are paid for with this card through automated transactions when they are due. I never have to worry about mailing checks, filling out online forms, sending online payments, or paying any other bill manually.

Since this is my main form of paying bills and spending and I have so many automatic charges on it, I have a daily text message alert for this card to let me know what my balance is. I have a pretty good idea of what my balance needs to be and when for my expenses and income to line up. If it’s ever too high, I know when to cool it on the spending.

I also have a few other credit cards that I’ve acquired over time that I keep active by paying very small bills on them, such as Spotify, Dollar Shave Club, and Netflix. This helps me increase my credit utilization rate, which increases my credit score. This part is purely an optimization and is optional.

So why use a credit card over a debit card?

The answers are very important to the effectiveness of this system.

First, my Southwest Plus card allows me to earn rewards points for spending that I am going to do anyway, so I might as well take advantage of it. I travel fairly frequently, so it makes sense for me to have a travel rewards card. I earn points for every single purchase I make, and rarely pay for plane tickets.

Second, and most importantly, I can set up with my bank the exact day I pay my credit card bill (obviously not possible with a debit card, since the money comes out of your account immediately). This allows me to time my payments a few days after my paycheck and other forms of income hit my account, which are all 100% predictable.

As I mentioned a little bit earlier, I have a calendar alert set up a week before this bill hits my account, so if I do need to transfer any money to cover things, it’s a single one-time deal.

This means I can spend freely throughout the month without having to worry about overdrafting my checking account. I know exactly when money goes in, and I know exactly when money goes out. This drastically reduces my stress throughout the month. It’s a great win/win.

Credit cards aren’t all glorious though. They can be dangerous if you don’t use them correctly.

The two main things to remember when using credit cards are:

- Always pay them off at the end of every month. Running a balance on these is expensive and wasteful. Never do it under any circumstances.

- Understand your income and expenses (see Mint below) before setting up your automated bill pay system. You can easily overdraft your checking account if you don’t understand your cash flow situation.

Note: You can still run an automated financial system without using a credit card. If you don’t feel comfortable using one, then don’t.

Others

These don’t really fit into any other category, but are still important to the system as a whole.

Mint

Mint is a very powerful and free online financial tracking software solution that allows me to automatically keep track of my spending. I’ve been using Mint for close to five years.

Every time I use my credit card, Mint categorizes my spending for me. This allows me to keep track of how much I spend on things like groceries, gas, restaurants, shopping, entertainment, etc. If I get close to or go over a certain amount that I have pre-configured in my Mint account that are based on what I allow myself to spend, then my system alerts me.

This allows me to never have to keep track of what I spend on more than a 10,000 foot level, because my Mint account does it for me.

Mint also has a lot of other great features like long-term analysis of spending, net worth tracking, credit score tracking, etc.

This software alone saves me several hours per month of otherwise pain-in-the-ass financial tracking.

Wells Fargo HSA

This is a simple Health Savings Account (HSA) that my wife and I maintain through my employer, which gets an automatic deposit that is deducted from my paycheck. I check it once every few months to make sure the balance is good. There is also an investment option within this account, which I’ll likely use at some point in the future.

It has an incredibly low premium and a very small minimum monthly deposit. My employer also puts a decent chunk of money into it each year for me as an incentive for them to keep their costs lower.

I won’t get into a huge HSA vs. PPO argument in this post. All you need to know is that my wife and I are very healthy people, and it would be incredibly silly for us to pay hundreds of dollars per month for health insurance we don’t use.

This account allows healthcare costs for both of us to be around $1,100 a year, which is 1/3 of what it would have been with a traditional PPO. If you have the option to get an HSA, I highly suggest you consider it before you write it off as too risky.

The nice thing about this account is that it’s deposited on a pre-tax basis, which means everything I put into it, I do not have to pay taxes on. This allows me to reduce my tax liability while also putting back enough money in case something happens to either one of us.

—

As you can see, this system takes into account all of my financial goals, and supports them through 98% financial automation. Manual transactions are very rare, and I literally spend less than a couple of hours per month managing and maintaining this system.

It has helped me save tens of thousands of dollars and hundreds of hours worth of time. And the best part is, all you have to do is set it up once and sit back and reap the benefits.

Now, Set Up Your Own System

Ok. So this post was a lot of effort to put together. So I can make sure all of that time and effort doesn’t go to waste, I now have a call to action for you.

Now that you’ve got a playbook of how the whole system works, the easiest way to get started is to set up a single piece. I want you to set up an automated savings plan of your own.

I’ve created a free screen capture video to show you how to do this. To access this, just click below and enter your email address in the lightbox.

You’ll also get my Financial Automation Checklist Collection that will walk you step-by-step through five other financial automation processes.

If you have questions, just toss me an email or post a comment below. I read every single one.