Check out these new financial calculators and planning tools, built just for you

When it comes to vehicles, since I’m a frugal upper middle class white dude in his 30s, clearly I favor the superior reliability of Hondas, Mazdas, and the other Japanese made vehicles.

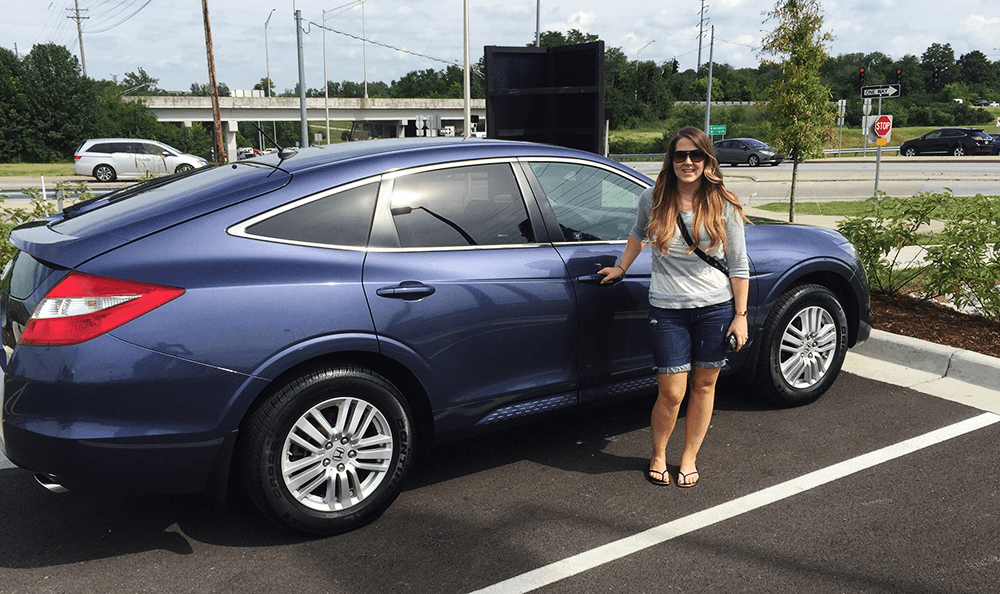

Recently my wife and I bought a Honda Crosstour (aka Totesmagotes – I’ll let you figure out why), which should be paid off close to the beginning of next year.

She’ll probably kill me for posting this picture, but here it is anyway 🙂

Anyway – When I was going through the process of trying to figure out how long it would take us to pay it off and how much our payments needed to be at certain interest rates, I ran into a whole bunch of online calculators, most of which were less than great experiences.

There were a few good ones out there, but most of those were loaded with super annoying flash ads and used unnecessarily complicated language.

I mean who the hell knows what crap like future value, present value, and discount rate means after they graduate college anyway? Keep it simple people!!

It took every bit of my MBA to figure out how to use these things, but fortunately I was able to suffer my way through my research.

Afterwards I vowed to create a better experience :). You’ll see what came of that in a second after this obligatory rant about setting financial goals. 🙂

The financial goals of your 20s and 30s

When you’re in your 20s and 30s, there are a few major financial goals and priorities you’re probably going after.

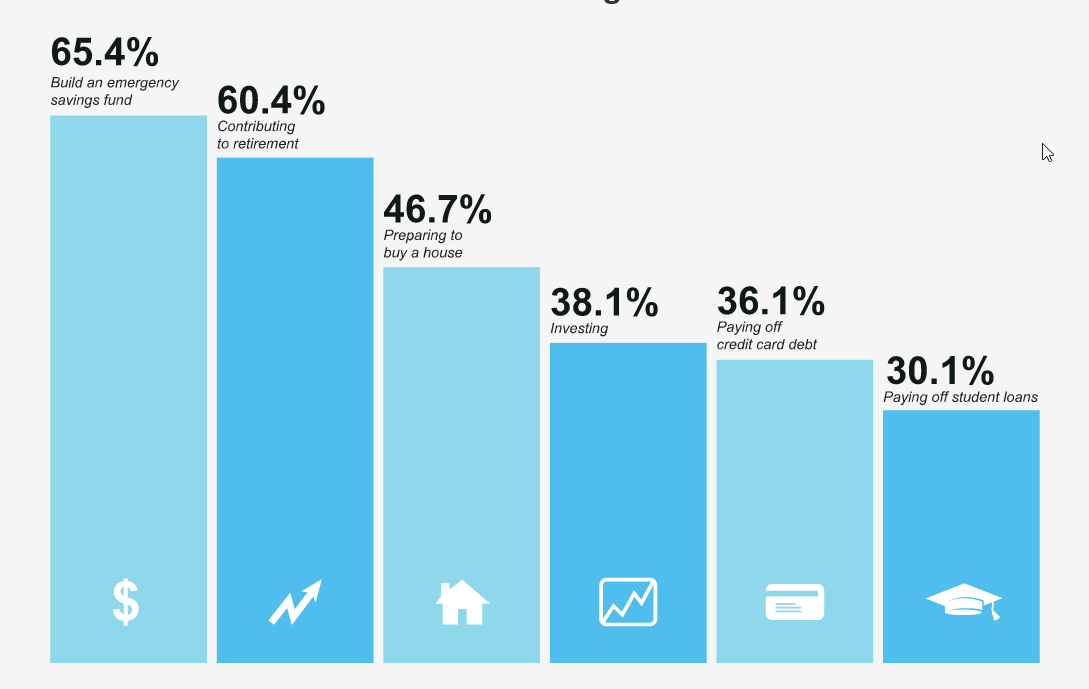

When people between the ages of 25 and 34 were asked what their financial priorities are:

- 65.4% are building an emergency fund

- 60.4% are beginning to contribute to retirement

- 46.7% are preparing to buy a house

- 38.1% are investing in stocks

- 36.1% are paying off credit card debt (this one still shocks me)

- 30.1% are paying off student loans

These are awesome goals, and the right things to be considering in this age range.

But anytime I see goals like these I’m reminded of a quote by Lewis Carroll, creator of Alice in Wonderland.

“If you don’t know where you are going any road can take you there”

― Lewis Carroll, Alice in Wonderland

Before you blindly go into executing savings, investment, and debt payoff goals, make sure you’ve got a plan to get there.

- How long will it take you to build your emergency fund? How much do you need to save each month?

- How long will it take you to have enough for a down payment for your house? How quickly can you do it?

- How long will it take you to pay off your credit cards, vehicle, and student loans with your current APR? Do you have a plan on which debt to pay down first?

- How much do you need to save each month for retirement, given your current base of savings?

So you don’t have to go through the same suffering I did when I was doing my vehicle payment research, I built a few simple calculators for you to use to do your own research.

All of them are completely ad-free, very straightforward with simple language, and will help you plan amounts and time periods to achieve your next financial goal without just guessing.

Before you dig in and play with these, they took me several hours to build for each one, I definitely lost some sleep, I probably cried a little bit, and they even required some help from a friend of mine who is an accountant. It wasn’t as easy as I thought.

Anyway – If you get some value out of them and they make your life easier, please give them a share. I would really appreciate it.

Here’s how you can access them.

Pay off any type of debt

This simple calculator will help you determine how quickly you can pay off a debt account and what your payments need to be over time.

Pay off your student loans

This tool is similar to the debt calculator above, but the language is geared specifically towards student loans.

Pay off your vehicle (down payment included)

This calculator is similar to those above, however it factors in a down payment option as well. Figure out how much you need to pay each month, and how long your payoff period will be.

Build your savings and investments

This calculator will help you with any type of savings and investment goal.

From saving for a down payment on a car to building your investment portfolio with a steady interest rate, this tool will help you figure out how long it will take you to achieve your goal and what you need to save each month to do so.

You can start with a zero balance or you can start with a pre-existing amount (which many calculators will not allow). Then you can add to that over time to achieve your goals.

Automate these goals using the financial checklist of your choice

Automate your financial plan

Here’s a tip. Once you’ve figured out your plan, automate it for the best chance of success. You can read more about financial automation in this post, and you can grab a copy of my Financial Automation Checklists below.