How I Lost Thousands of Dollars in the Stock Market, and How My Grandma Saved Me From Myself

I’ve been answering quite a few questions on Quora lately from novice investors. I guess it’s good that people are at least asking questions rather than sitting and doing nothing, but either way, it’s a little bit scary what’s out there.

These are the wrong questions to be asking. They’re all centered around getting rich quick – which I’m sorry to tell you, doesn’t happen with investing unless you’re hustling and have a lot of money to throw around.

But then I think back to how stupid / misinformed / delusional that I used to be, and it makes me just want to help – because I was there once too, and as you’ll read in a moment, it took a very wise person to set me straight.

So let me start this one off by saying this.

The last few trainings I’ve done for you have been behemoth 3,000-4,000 word posts with a whole lot of explanation and detail. I thrive on understanding everything about a topic, but I also know that’s not for everyone.

So this post is going to be smaller, and more to the point.

If you hate it and want more detail, let me know. Otherwise I’ll likely start creating more of these smaller posts that teach important concepts, but don’t go quite as deep as some of the others.

I can create a lot more of these types of trainings for you because they require far less time, so it could be a good win/win.

I’m Going to Make So Much Money!!

I don’t know exactly how old I was – probably not even 20 – and I decided I was going to get rich in the stock market (I think we all have this dream at some point).

(That’s probably exactly what I looked like when I was 20 by the way —->)

My thought process was, all I had to do was pick one winner to start off, then I could snowball that money into a fortune in the next couple of years.

Sweet! Retirement, here I come!

So I started digging, and found all of these websites pitching “penny stocks,” or otherwise known as a great way to lose your money (too bad I didn’t know that at the time…).

The websites all had free newsletters that would give you a stock each month that was going to “pop,” so I signed up for all of them, and started to watch the stocks.

Each month the wizards that were behind these newsletters were right! These stocks were all doubling, tripling, quadrupling, and some were even going up 10x! (what I didn’t know what they were immediately crashing a day later because I never watched long enough).

So I was convinced. I decided to take $2,500 that I had saved up for my next car and turn it into a million. Screw a Honda. I’m buying a Lambo – or so I thought…

Fast forward two months later and that $2,500 was pretty much gone…

What I had failed to realize about this newsletter I had become a part of was the only way you could make money with it was if you already held shares of the “hot stocks” when they were released to subscribers.

These newsletter owners were running a scheme.

They would announce a penny stock that they already owned to their list of tens of thousands of people, drive the price up, then they would sell their own shares and make a killing before trading was locked down for price manipulation.

I didn’t know how this worked at the time until I got burned by it, but finally figured it out and decided to move on.

I’ll Just Be Day Trader

My plan with day trading was to figure out how to make $50,000 a year. Then I could live fairly comfortably, and figure out how to make more from there.

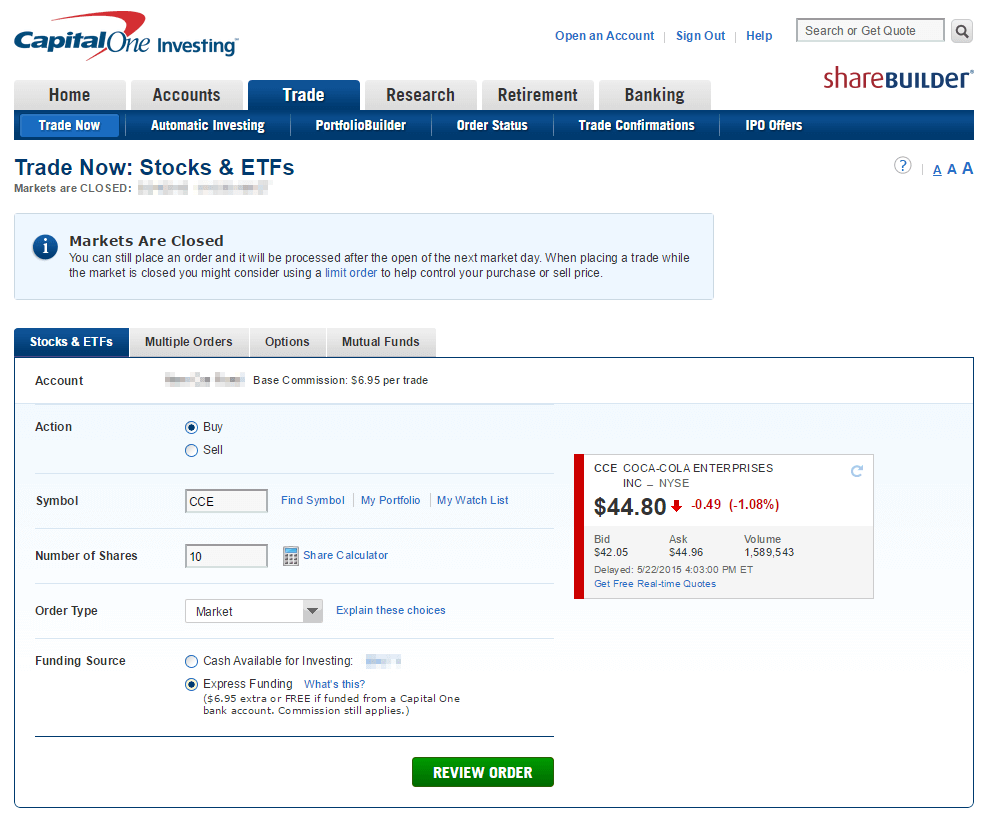

It wasn’t much of a plan. What I didn’t realize was to be a day trader, I had to have WAY MORE money than I had at the time to handle the commissions that I had to pay for trades.

I saved up another $1,000, but a 1% return on $1,000 is $10 – minus $7 per trade x 2 = $4 loss.

Even if I made money, I lost it because commissions were eating my profits. The only way to make money doing that was going to be with a lot more money to start, and finding a way to eliminate the broker fees (which meant I had to be a broker myself – nope!)

I also had to have a lot more knowledge. I had no idea what stocks were going to do what, and it took a lot more than watching the garbage financial news shows to figure it out (don’t waste your time).

I didn’t lose all of my money, but quickly realized I would if I kept this up. My day trading career lasted about 2 days. Most do.

Then I did something smart. I talked to my Grandmother.

Buy and Hold Cody. Buy and Hold.

My Grandmother is a pretty smart lady, and I don’t know this for a fact, but I also have a pretty good suspicion that she’s sitting on a huge pile of cash.

I started talking to her about my dealings with the stock market and she immediately told me “that’s a good way to lose all of your money, Cody.”

I wouldn’t have listened at first being the dumb kid that I was (Lambo – remember?), but since that very thing had already happened, I decided to give her a shot.

“What should I do, Grandma?”

“Buy and hold Cody. Buy and hold.”

She then proceeded to tell me how she and my Grandfather have had many of the same shares of stock since the 1950s!

- Some were oil stocks

- Some were telecom stocks

- Some were retail stocks

- Some were car company stocks

Which therein lies another lesson – always spread out your risk through multiple industries.

Some of these stocks had split 10 times or more, and many of them pay hefty dividends. She told me how she got paid tens of thousands of dollars per year just for owning them (you do the math of how much she must have to make that much from dividends).

She told me if I wanted to make money in the stock market there are two ways to do it for the average person.

- Become a stock broker (or financial professional of some sort) and get paid to sell stocks and investment advice

- Keep a portfolio of stocks and hold onto them for your entire life

I was pretty sure I didn’t want to do #1, so I decided to follow my grandma’s “buy and hold” strategy from then on.

10 (or more) Years Later

Fast forward to today, and I’ve learned quite a bit through experience, reading, and talking to financial professionals, but one thing that hasn’t changed is I am still buying and holding like Grandma told me to do.

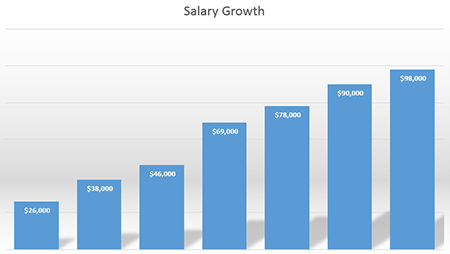

I’m no world-class investing expert or anything, but I have managed to make tens of thousands of dollars with a fairly conservative strategy, and am set up to make hundreds of thousands more in the next 20+ years.

All it took was a little bit of re-framing of how I thought about investing.

And that’s what I want you to do as well.

When you think about stocks, investing, and your future, don’t think of ways to get rich tomorrow.

Investing isn’t about what happens today, tomorrow, next week, or next month.

It’s about building up a solid financial position over time that will be there for you 20 years from now.

That’s your takeaway from this training, and that thought will set you up for a solid financial future of your own.

Getting Started Investing

The natural follow up to this post is how I got started investing after that great advice from my grandmother.

That training is one that’s going to take a little bit more time and detail to create for you, but I’m willing to do it if you want it.

If you’d like to learn more about getting started investing, toss me an email, share this post, and/or leave a comment with your question, and I’ll do my best to answer it in the upcoming post.

The more you participate, the more you learn and the more everyone wins.

Even – You can check out this post for some starter tips.

https://academysuccess.com/how-to-get-started-investing-in-stocks/

Great story overall. I would love some suggestions to help get started as I just learned the hard way you did. Getting scammed by those penny stocks sucks.

You’ll see a follow up coming in the next couple of weeks Tanner. This will help point you in the right direction with how to get started.

your story is great and I’m at that crossroads myself. But education is my priority before spending a dime