How to Continually Increase Your Financial Capacity

My buddy J. Money over at Budgets Are Sexy and Rockstar Finance, published a post last week titled, the Power of Doing Just ONE Thing (I encourage you to check it out).

In this post, he talked about several different ways to become a millionaire, and shared a few ways he is using in his own life right now. His progress has been great (queue applause)

The main point of the article was to teach you to focus on just ONE thing so you don’t spread yourself too thin. For example, focus on maxing out your 401k first before worrying about an IRA, making double payments on your mortgage, or investing in real estate, or any other strategy to increase your financial capacity.

This is a great strategy because it minimizes your worry by allowing you to focus, while still maximizing your financial results.

As I teach in Module 2 of my Output Overdrive course as well as with several points of research in my Changes That Stick guide, focus is an absolute key to succeeding with any life change.

If you try to do 5 things at a time, you’re very likely to succeed at 0 of them.

Big props to J. Money. I have to say, it was a very well written piece and will surely help a lot of people. With that said, I would like to add a little bit to what J said.

What Comes After Doing Your One Thing?

J alludes to this in the last third of the article, but doesn’t outright say it.

At some point, you’re going to get pretty good at your one thing and you’ll approach a point where you have the capacity to start doing more.

At that point, your goal should be to automate as much as humanly possible with the ONE thing before moving onto the next.

This will give you not only the mental capacity to do more, but also the time you need in order to add another managed financial asset to your life.

For example, let’s say you’ve opened a Roth IRA and are making monthly deposits to max it out, and are buying mutual funds each month as you make your deposits.

This is where you can really take advantage of the world of technology we live in.

Before you move onto attempting to max out your 401k, or whatever your next move might be, first make sure your deposits into your Roth IRA are completely automated. Rather than making manual transfers, go ahead and set up a direct deposit into your account if possible.

If you can’t, set up a transfer to automatically withdraw from your bank account a few days after you are paid.

Additionally, rather than managing a portfolio of 5-6 different funds, considering setting up automatic purchases of a single lifecycle fund like the Vanguard 2040.

This will eliminate the need for you to do any manual deposits, will put your diversification and re-balancing over time on autopilot, and will even automate your trading. All you’ll have to do is check in a few times a year and your investing will be on autopilot.

From there, you now have the capacity to move onto other things that continue to build your financial chops.

The Hidden Benefit of Automation

Not only will you now have more time to devote to your financial goals, it’ll also be very difficult for you to miss an investment deposit or trade for any reason because it will all happen 100% automatically.

This is huge in terms of your own psychology about money. We’re all wired to spend. In fact it creates a huge dopamine rush for us, and as I shared in a recent article, putting your savings and investing on auto-pilot ensures you don’t give in to the temptation to spend too much.

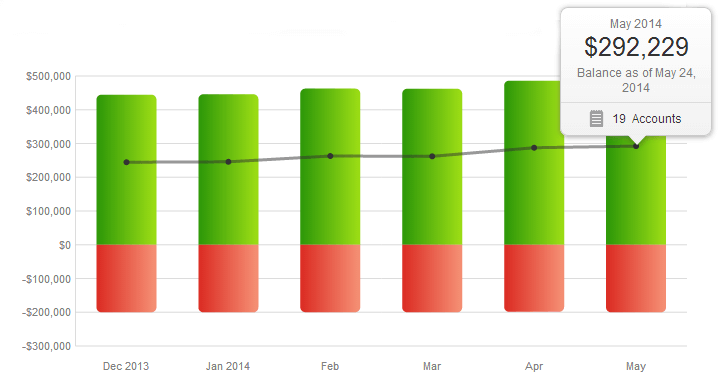

I’m fortunate to have discovered this early on in my financial career, and while I’m not yet a millionaire, I am approaching a net worth of over $300k largely because of it.

I know for a fact if I hadn’t set up automated financial systems to continue to increase my financial capacity, I would not even be close to where I am today.

Your Next Action

Hopefully you’re already working on your ONE thing from the post I linked from Budgets Are Sexy at the top.

My challenge to you now is to automate that ONE thing as much as possible. Master it and make it 100% hands off. Get it to the point where you hardly even think about it happening.

From there, you can move onto the next goal of increasing your financial capacity, and repeat the process into your future.

Images licensed under Flickr Creative Commons

Rock on brother, appreciate the kind words and the addition to where I left off 🙂 In fact, I recently called that area “wild card time” in a post, haha… Which is the ideal position to be in after maxing out your retirement accounts.

Here’s the article if interested:

https://www.budgetsaresexy.com/2014/03/what-to-do-extra-money/

And I agree – automation is killer with this stuff. Well put.