How Can New Or Expecting Parents Keep Their Finances In Check?

Everyone has heard that after you have a child, your life will never be the same. While that’s absolutely true, the saying itself doesn’t really go into any useful details. In addition to having a sporadic sleep schedule for the next few years, one of the areas that a new child impacts the most is a couple’s finances.

According to multiple estimates, the cost to raise a child over the course of eighteen years is around $300,000. If that figure didn’t make your jaw hit the floor, it’s worth noting that it doesn’t include paying for college!

Although seeing that number can be intimidating, keep in mind that it’s spread over the course of almost two decades. Even though you won’t suddenly be hit with that amount of debt, a newborn is an expensive addition. Because you’re going to have a lot of new expenses, it’s important to properly prepare yourself.

To help you get on the right track, here are some of the key things to keep in mind:

Make Saving a Priority

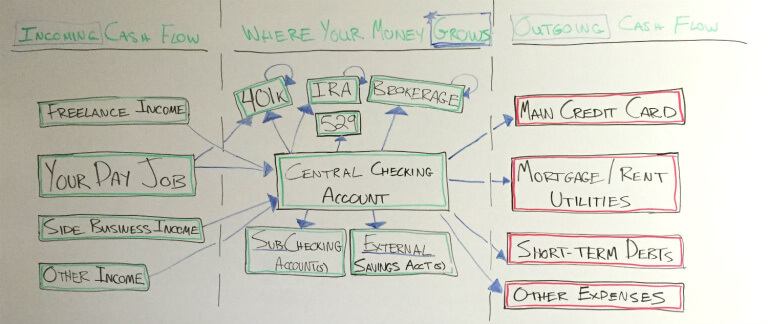

Even if it doesn’t happen at first, it’s common for households with two incomes to eventually decide that they want to transition to one income after having a child. Because that change has a major financial impact, it’s a good idea to put saving at the top of your priority list.

And even if you and your partner both continue working, you’ll have a nice safety net in the event that an unexpected major expense comes up.

Think Through Your Budget

From a crib to diapers to formula, you’re going to have lots of new costs. Since you want to have an accurate projection of those costs, take time to actually look up their current prices when you’re putting together your new “parent” budget.

Don’t Put Off the Paperwork

It’s important to have a good life insurance plan, as well as an updated will. If you need to get or update either, don’t put off doing so. Additionally, you should get a social security number for your child as soon after they’re born as possible. You’ll need this number for things like claiming a dependent on your taxes, as well as the next point we’re going to cover.

It’s Never Too Early to Start Thinking About College

While you probably can’t even imagine what your life is going to be like in eighteen years, that doesn’t mean it’s too early to start saving for your child to go to college. Given the ever increasing cost of a quality education, the sooner you start something like a 529 College Savings Plan, the better off you’ll be over time.

Now that you have a better understanding of how your new bundle of joy is going to impact your finances, you can start taking steps to get prepared for this major milestone.