10 (Actually Legitimate) Ways to Save Real Money on Car Insurance

Normally I wouldn’t post something like this due to its “spammy” nature (hey just being honest), but having recently saved about $700 a year on my own auto insurance by implementing many of these same steps, this guest post by Tom Bartsch of Dairyland insurance makes perfect sense to get out to the world.

I’m all about big wins. If you can do a couple hours of work, and save literally hundreds of dollars every year, I think it’s far more worth it than doing things like saving $3 on your lunch every day.

Do the work once. Save money for life. This post exactly supports that principle. Take it away Tom!

—-

We all want to save money. Doing so opens doors to other opportunities in life.

Where many of us would like to save money is on our car insurance. The good news is there are multiple ways to help lower your auto insurance costs. However, many of them depend on you. Making sound decisions, planning ahead, and paying attention in life go a long way toward that goal.

But before telling you how you can save, here are some common factors that go into your car insurance rates:

- Where your car is garaged

- Age

- Driving history

- Miles driven

- Marital status

- Make and model of your vehicle

- Type of coverages you want

- Credit history

As a quick summary, your rate is based on risks relative to your garaging location, driving history, and risk level.

Now that you know what goes into car insurance rates, you can grasp some of the things you need to do to make them go down. Following are 10 ways to help you save money on your car insurance now and in the future. Some are easier than others, but all are feasible if saving money is truly important to you.

1. Improve your insurance score:

Your credit history plays an important role in your insurance rates. Your insurance score, similar to a credit score, is based on your credit history. Good credit attributes, like paying bills on time, are a measure of responsibility. Better insurance scores are often correlated with lower insurance premiums. The impact your insurance score has on your rate will vary by carrier.

2. Look for additional discounts:

Many of the discounts your carrier currently offers are found across the industry. But that doesn’t mean you shouldn’t seek out more. For instance, your carrier might offer paperless transactions or automatic drafting from your bank account that leads to lower rates. Discounts are great. But remember, more discounts don’t mean better coverage.

3. Change your coverage:

The amount of coverage you want (or don’t want) has a direct impact on how much you’ll pay for car insurance. Deciding on less coverage or lower limits means you’ll pay out less … until an incident takes place. Weigh the risks and choose accordingly to what you are comfortable with.

4. Go multi-policy with your carrier:

Most insurance carriers have a multi-policy discount. If you don’t already, you might want to look into adding home insurance or some other type of coverage with your current auto coverage.

5. Move / Relocate:

Sound harsh? Well, where your vehicle is garaged plays a large role in insurance rates. Those located in high density areas will pay more for car insurance than those who live in less populated areas.

6. Drive better:

Sounds simple, right? A clean driving record goes a long way in lowering your car insurance rates. If you’ve made some driving mistakes in the past, that’s OK. Most companies only look for violations in the past three-to-five years.

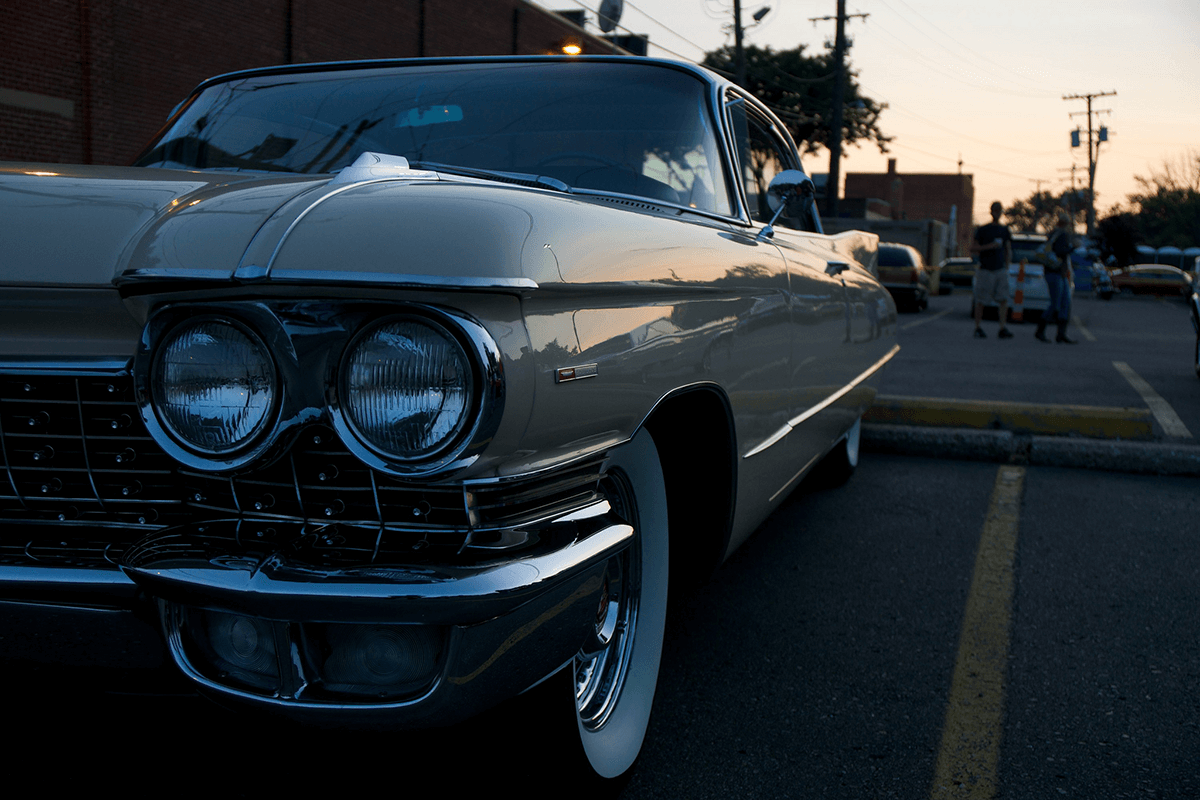

7. Go old school:

We’re not talking about fashion or breaking out some disco moves. We’re talking about your ride. Typically, an older model vehicle costs less to insure (and less to drive as well).

8. Pay in full up front:

In some cases, you’ll receive a bigger discount for paying your total premium at one time. If you can swing it, it beats having to remember to make a payment every month or every six months.

9. Look long-term:

Choose an annual term over a six-month term for coverage. The longer your policy term, the longer your current rate is locked in. Carriers may adjust your rate on renewal.

10. Consider a Broad Form Named Driver policy:

In some states, you can insure only yourself in the vehicle you drive. Lots of limitations are at play here, and you might need some clarification, so contact your agent to discuss this policy option.

And we’re not done yet. There are still more ways to save

Additional Tips:

Be sure to shop around – Premiums vary by company. Some companies cost less, some cost more. Your circumstances might be looked at more favorably by one company vs. another. You don’t buy a car without shopping around. You shouldn’t with your car insurance either.

Editor’s Note: If you are a Costco Executive member or a member of another large group of people such as a large employer, you may have access to heavy discounts on insurance for home and auto. Definitely check into this. It’s one of the easiest ways to save money. I might put this higher up the list.

Remove drivers – You might also reduce rates by reducing the number of drivers on your policy. A word of caution with this route—if you exclude a driver or drivers, they won’t be covered if something happens while they’re behind the wheel.

Avoid lapses – Another easy was to save money is to have consistent insurance coverage for your vehicle. Avoiding lapses in coverage proves to an insurance carrier you are responsible in meeting your state’s car insurance cover requirements, and that you make payments on time.

Some of these money-saving tips might work for you, some might not. But there are options available. Choose what works best for you.

—

Tom Bartsch is a communications specialist for Dairyland Auto®, offering insurance nationwide for non-standard auto customers.