Let’s Optimize Your Spending Habits

A couple of days ago, we took a dive into debt, when it’s OK, when it’s not, and how to begin eliminating it.

You also used my Debt Payoff Calculator to figure out how much you need to pay per month in order to eliminate your debt within your goal.

If you haven’t figured that out yet, you can access that here.

Today, I want to help you conquer a huge step in eliminating your debt, but one that people often overlook very easily – optimizing your spending.

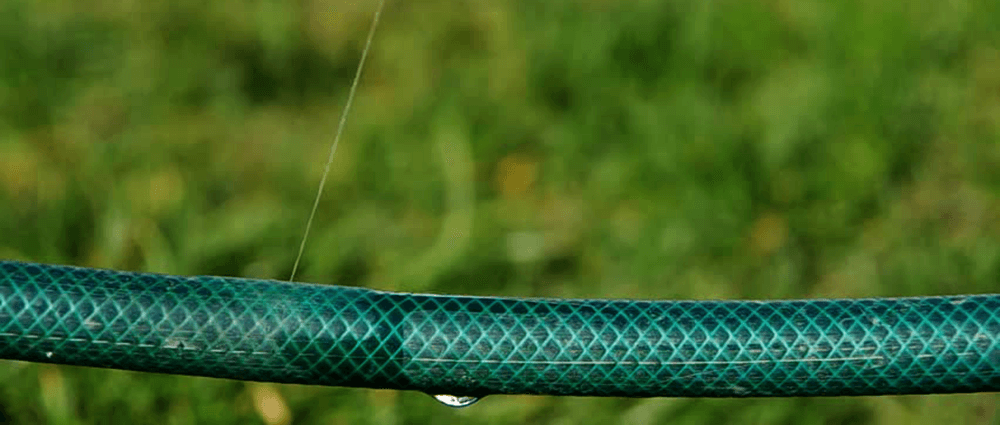

Are Your Personal Finances Getting Hosed?

Imagine for a minute that you’re holding a long garden hose, and you’re about to water your plants.

All throughout this garden hose are dozens of micro-holes. You can’t really notice them when the hose is off, but when you turn on the water, this hose leaks everywhere.

Some of it still gets to your plants, but not all of it. A good amount leaks all over the ground, you have one strip of tall grass, and the entire state of California shakes their angry fists at you.

It might not be much once, but over time this will result in hundreds of gallons of wasted water that could have gone to your plants.

The same thing happens with your money.

This hose full of micro-holes represents your spending habits. Most of us are doing an OK job getting money to where it needs to go, but we’ve got all kinds of small inefficiencies in our personal finances just eating away at our dollars.

- These are things we once needed, but might not anymore

- Maybe they’re little luxuries that we can honestly do without

- Maybe there are better ways to get the same result

- Maybe we can just be a little better disciplined or set up better systems

- In all cases, they’re unnecessary expenses, and they’re wasted money.

Your goal is to maximize the effectiveness of the money you make – or more specifically, put more towards crushing your debt – and in order to do that you need to plug these little micro-holes.

But how do you do that?

Budgets Rarely Work

Seventy-two percent of people cannot follow a budget.

I don’t myself because I have better things to do than keep micro-track of every penny I spend, and I’m not about to tell you to do so either.

Something like this takes a ridiculous amount of discipline to do, people and life are WAY too variable and unpredictable for this to work long-term, and to be honest, you’ve got better things to do with your discipline reserves.

Instead, let’s simplify the goal that budgeting accomplishes.

What you’re trying to do with budgeting is merely make sure you don’t overspend, and make sure you are moving towards your financial goals, right?

This is where spending optimization comes in. This simply means to spend on the things that bring you joy or that you’ve set financial goals for, and cut out all of the fat everywhere else – or plug all of those micro holes in the garden hose that is your personal finances.

This allows you to focus on figuring out how much to allocate towards those one or two important things, and makes sure you’re not wasting money in other places. It also allows for the much needed flexibility that you need in your financial life.

In the case of debt, a large priority for you is going to be allocating money towards the elimination of that debt. That’s what we’ll focus on here as your primary goal.

If you used my Debt Payoff Calculator to figure out how quickly you want to eliminate your debt, and what your payment needs to be in order to do that (again, be aggressive with this), then you know how much you need to allocate towards that goal already.

Your next task is to examine your spending in other areas, and cut back very aggressively. But of course make sure you leave room for some fun. 🙂

Start With Your Recurring Expenses

Your biggest wins in being able to pay more each month towards your debt will be lowering recurring expenses.

The beauty with optimizing your spending with recurring expenses is that you only have to do it ONE TIME.

Pull up your bank or credit card statements and examine all of your recurring auto-payments, bank drafts that happen automatically, and anything else you pay for every month or on any sort of recurring basis.

Compare that to trying to break your daily Red Bull habit or any other small expense which is a repeat occurrence, which is something you’ll struggle with every single day. It’s a lot easier to do something once.

Here are some typical monthly costs where you may be able to save (and pay more towards your debt):

- Costly Car Payments – Aside from your home, you car is your next largest financial drain. You can literally save hundreds of dollars every month by downsizing your vehicle. Do you currently have a car payment, or have a car worth more than $10,000? If so, you may want to consider your priorities. If paying down debt and saving money is really a big deal to you, considering downsizing your vehicle for something more simple.

- Cable / Satellite + Premium Channels – You can often pause these services when you’re not using them, or cancel them altogether and use alternatives such as Sling TV or Playstation Vue. Or if you really don’t want to do this, at least try ditching your premium packages. These can be upwards of $30 a month or more. Use this technique to lower your bills.

- Netflix / Hulu / Amazon Video / iTunes – It’s easy to rack these up because they’re so cheap. Pick one and stick with it (Netflix is the clear winner IMO).

- Tanning Beds / Salons – Yes, these can be nice, but again, you’ve got to prioritize

- Health Club / Personal Training – It’s important to stay active, but gyms can be costly. Check out less expensive alternatives like home workout DVDs, or free fitness groups around town.

- Magazine Subscriptions – Who reads magazines anyway?

- Niche Website Subscriptions – These can often be $5 – $10 a month, but they add up if you’re not careful

- Music Services such as SiriusXM, Spotify, etc – Again, pick one and stick with it, or just use something free like Pandora or iTunes radio

- Your Expensive Ass Cell-Phone – Cell phone providers are extremely competitive. Negotiate a better deal, or use a cheaper alternative like Republic Wireless or get in on Google Project Fi. Many employers also have great corporate rates or will pay for your phone altogether. It’s worth asking about. Also, data plans can be cut down now with WiFi being so ubiquitous.

- Club Memberships (Golf, Swimming, Tennis) – This stuff is great and hard to give up, but can save you literally hundreds or even thousand of dollars. Again, examine your priorities.

- Software Services – Are you paying for any software monthly that you don’t need? Might there be cheaper alternatives?

- Video Game Services – Many game systems have monthly or yearly fees now. Are you using them enough to keep them?

Go through this list and deeply question if you REALLY need these things you’re paying for every month. In most cases you can either do without them completely, or find a less expensive or even free alternative (including DIY options).

This list alone can save you sometimes in the hundreds of dollars per month in some cases, and that’s a lot to put towards your debt and savings goals.

Tackle Your Impulsive Spending

Once you’ve eliminated recurring expenses, the next step is to get control of your impulsive buying behavior. This can be a HUGE money saver, and can also keep your house a lot cleaner 🙂

We all make impulse buys, and retailers have set up incredibly effective systems to make sure we do.

Here are some of the tricks they use to take your money:

- They provide systems such as “one-click ordering” to remove as many barriers as possible to spending

- They allow very relaxed return policies to get you back in the store

- They use the “mark-up, mark-down” strategy to make it seem like you’re getting a deal

- They attract you to their stores with rotating deals, and rely on you to purchase other full price items while you’re there

- They intentionally create long and slow lines, so you have to kill time by looking at low-priced “easy-to-buy” items

- They give you “points” or tiny discounts for using their store loyalty card, which tracks your behavior and sends you coupons to get you back in the store

- They essentially require you to use massive shopping carts so you can fill them full without carrying things

- They sell gift cards, which get you back to their store and always result in you not spending it all, or you spending extra money, both of which are wins for them

This topic can get pretty deep, but is also hugely important for you to understand in your financial life.

For deeper details on how to fight back against retailer tricks like these are more, check out this post:

Your goal here is to understand why impulse buying happens and to take steps to minimize this as much as possible.

It might seem like a $10 or $20 here and there doesn’t really matter, but if you do this a couple of times per week, it can add up to hundreds of dollars per month very easily.

Again, this can all go towards paying off your debt accounts.

Finally, Examine Other Fixed or Variable Costs:

- Health Insurance – You can often save by switching to a different type of plan with a larger deductible. See if your employer offers an HSA or FSA. These can save you thousands per year in many cases.

- Car Insurance – Again, if you’re a safe driver, you may be carrying too much insurance. Most car insurance is highly oversold. You can often save several hundred per year by lowering your coverage just once.

- Homeowners Insurance – Same as above. Make sure you’re getting all of the discounts you deserve here.

- Lawn Care – Taking care of a lawn can be a pain, but this can also save hundreds if you can make the time to do it. Even just a few months can go a long way.

- Vehicle Maintenance – Learning to perform simple vehicle maintenance tasks such as changing your oil and rotating your tires can grab you a couple hundred a year

- Cleaning Services – Cleaning services can be expensive. If you use a maid service, perhaps you could arrange a deal where they come less frequently

- Dining Habits – Dining out is one of life’s pleasures and conveniences. It’s tough to eliminate altogether, but being disciplined to one meal a week can go a long way as well.

The items above can literally save you several thousand dollars a year. Take a deep look and get intentional about optimizing every area of your spending. Your goal is to plug all of your financial leaks and make sure your money is going where it should go.