How to Avoid Impulse Buying: The Deep Down Psychology That Retailers Use Against You, and How to Create a Rock Solid Emotional Fortress Against It

Before you dig into this training, if you’re looking for a simple “top 10 tips to avoid impulse buying” article for your financial entertainment, I’m sorry to tell you that this isn’t it. 🙂

But if you’re looking for something to really help you change your spending patterns and financial behavior, you’ve got it right in front of you.

This training is designed to help you really dig into buying behavior and psychology, and to help you understand how retailers use it to their advantage to snag your hard earned money.

It’ll also help you understand how to recognize these tricks and create emotional and behavioral defenses to make sure you don’t fall prey to them.

In a nutshell, if you have ever told yourself that you want to get control of your spending or you’re struggling to reach your financial goals because you spend too much, then understanding and internalizing the information and tactics in this training is written for exactly you.

So, with that, let’s get started!

Um… Why did I just buy that?

Have you ever went out to get something small… like milk, bread, and eggs, and 15 minutes later you’re walking out with $57 worth of stuff?

Raise your hand if so. And if not, stop lying! 🙂

Isn’t it interesting that while we tell ourselves things like…

- “I really need to save more.”

- “I’ve got to get out of debt.”

- “I should probably start thinking about my future.”

…that our behavior just doesn’t match those outcomes?

What the heck, right?

Well, impulse buying is a huge part of this, a nasty financial behavior that is based almost entirely on emotional control (or lack thereof).

This is actually a huge problem for a lot of people, and whether you know it or not yet, impulse buying is likely silently eating away at your bank account every day.

In this training, I want to help you understand why we make impulse purchases, and a few simple tactics you can use starting tomorrow to help minimize the amount of impulse buying you do in your life.

First, let’s get clear on what we’re talking about.

So, what exactly is an impulse buy?

An impulse buy is any unplanned purchase made based on your impulses, or your emotions.

We often rationalize impulse buying by saying things like:

- “What a great deal”

- “I’ll probably use that at some point”

- “It’s only a few bucks”

- “It’s OK. I can afford it.”

- “I’ll just put it on the credit card”

- “It’s got a great payment plan”

- “I’ll never find this price again”

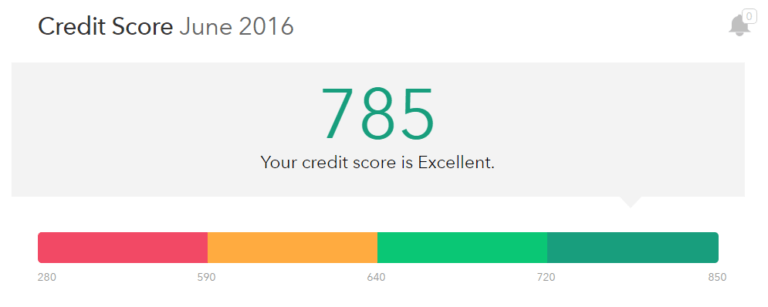

Contrary to what some might believe, these can be small or large purchases, both of which can wreak havoc on goals such as paying off debt, building your credit score, and saving for a large purchase, especially the latter.

In a survey at the end of 2014 which examined buying behaviors, 75% of Americans admitted to making an impulse purchase.

And not all of these were tiny things like retro Skull Candy headphones or a tabloid magazine.

Sixteen percent of these purchases were over $500 or more, and 10% were $1,000 or more!

That’s a lot of money to spend without planning to do it, but it happens to all of us, every single day.

In another survey by The Checkout, data revealed that the average American makes $200 of purchases every month based purely on impulse. Have you ever thought about how much unplanned spending you do?

READ: [INFOGRAPHIC] Three Simple Steps to Hack Your Credit Score

So why do we make impulse buys?

There is actually a lot going on here. See if any of this rings a bell.

An impulse buy happens based on your emotional state. These can be positive emotions or negative emotions. Take the following scenarios into account.

Retail Therapy!

Picture this. You just had a really shitty day at work. You weren’t very productive. You had a few bad meetings. And the day seemed like it lasted forever.

Now, you’re tired and worn down, but you really don’t feel like going home just yet.

What’s the solution?

Retail therapy! Yes, this is an actual recognized phenomenon. Retail therapy is shopping with the primary purpose of improving the shopper’s mood, and is a supremely wasteful behavior.

So instead of heading home after your crappy day, you go out and spend $100 without planning to do so, without needing what you buy, and with very little regard for your bank account or the future consequences of your reckless spending.

True… this actually does make you feel better for a short amount of time. We’re humans, and we like spending, mystery, and accumulating new things. Your brain gets a rush from this experience, and you feel better, but only for a short period of time – a few hours at most.

But then you start to feel the financial pain this causes you when you see your bank account, and this shitty day at work “made better” by some retail therapy turns into a bad financial decision that puts you $100 further away from paying off the debt you promised yourself you would get out of before the end of the year.

This is impulsive behavior at it’s finest, but is only one example of one side of the emotional spectrum.

Now let’s take a look at a positive emotion resulting in an impulsive buying decision.

By the way, bonus points for anyone that has a better solution to having a shitty day at work than retail therapy. Just toss a comment down below.

I prefer to drown my shitty days in booze, strippers, and gambling if you must know.

An Exciting New Gadget

You’re out shopping for a few new shirts (that you actually planned on buying – good job!), but then you lay your gaze upon a SWEET new gadget that just came out. It’s marked down from $199 to $179.

This is obviously an incredible deal that will never happen again.

So you say, “screw it, I can afford!”

And you ring that baby up, walk out the store, and do a heel click.

Classic mistake – the purchase, not the heel click…

So now you’re super pumped about your new gadget, you use it for about six months (if you’re lucky), the luster wears off, and then all of the sudden it’s worth half the price you paid for it just 180 days ago.

I am a nerd, and I do love electronics, but the depreciation cycle on them is horrendous given how expensive they are. You can spend $1000 a year keeping up with the newest smart phones nowadays.

Wouldn’t that $179 have been better off going towards a financial goal you’ve set?

We’ll go more into this in a moment. Just always think twice about how much you’ll really use something and how long before you make your final decision.

But Is Spending Always Bad?

Before we move on to the tactics, I want to clarify something.

Spending isn’t always a bad thing. I’m not going to sit here and tell you never to spend any money at all. Money is made to be spent and enjoyed. I’m sitting here typing this on a $2,000 dollar laptop for crying out loud.

In fact, I’m a big believer in creating a lifestyle that allows you to buy the things you want to buy and spend money on the experiences you want to create.

But if you’re going to spend money – plan to do so, and consider the long-term impact on your finances before you do.

Ok – So now that you’ve got a good understanding of what we’re talking about here, let’s switch gears a bit. In this next section, you’re going to learn some of the buyer psychology tricks that retailers use to get the best of you.

After that, we’ll cap things off with a few simple guidelines you can internalize to increase your defenses against the impulses of your life, and the world.

By the end of these tactics, you’ll have a good enough understanding of the world of buyer psychology and yourself to create a rock solid emotional fortress to defend against your previous impulsive buying behavior.

Couple that with some of the strategies I teach to increase your income, and you’re well on your way to hitting a financial goal fairly easily.

READ: Four Easily In Reach Tactics to Increase Your Income

Avoid These Commonly Used Retailer Tricks Designed to Drain Your Pockets

Listen to your internal dialogue

First, understand that your impulses are very powerful emotional responses.

Second, understand that retailers know this and exactly how they all work, and they have spent BILLIONS of dollars on systems designed to get you to spend money by taking advantage of impulsive behavior.

This is never going to change, so what you must do is change your behavior patterns to defend against it.

The only reason you should buy something is if you planned to do so in advance (we’ll talk more about lists in a minute).

I’ll say that again. The only reason you should buy something is if you planned to do so in advance.

- Don’t buy things because they’re on sale

- Don’t buy things because they’re 2 for 1

- Don’t buy things because you can probably find a use for them

The “Mark-up, Mark-Down” Strategy

Retailers LOVE to capitalize on the rationalizations we make and the havoc they wreak on our emotions. One of the most blatant implementations of this is the “mark-up, mark-down” strategy used by department stores.

Take a $20 shirt for example. What looks better to someone about to make a buying decision?

- A: $20 retail price tag that isn’t marked down at all?

- B: $35 retail price tag that is marked down to $20 “for a limited time.”

The answer is B.

The $35 price tag places a higher initial value on the item, making you think it’s worth more than it really is. Then the $2o “marked-down” price makes you think you’re getting a good deal on it, which makes you want to buy it even more.

It creates a double-whammy of emotional frenzy in your brain and is a huge driver of buying behavior, when there is actually no difference at all in reality.

Many places are notorious for actually running their entire stores this way.

It’s impossible to go into them without them being in the middle of a huge sale. They want to make you think you’re getting a great deal, but you’re really just paying what the value of the item should be in the first place before they marked it up, then back down again.

They’ll also do things like send you coupons in the mail to get you in the store that look like really nice discounts, but the catch is that you can only use them on certain items and the margins the store needs to make a profit with the coupons are already built into these.

You think you’re getting a great deal and coming out on top, but you’re really just doing exactly what the store wants you to do. They win. You lose.

And while you’re there, if you do end up buying something that isn’t on sale or eligible, then guess what – you just overpaid.

JC Penny is well-known for operating this way, and actually tried to change this strategy to one resembling “every day low prices” back in 2013 as a branding move.

The result was a financial disaster for the company. Even though items in the store were priced exactly the same (just like the shirt example from earlier), people stopped buying because they no longer had coupons, over-hyped sales, and huge events to create emotional buying buzz.

This is a perfect example of how powerful emotions can be and is the exact type of thing you should pay attention to when making buying decisions.

If you catch yourself saying anything along the lines of these rationalizations we talked about earlier, it’s pretty likely you’re making an impulsive decision.

- “What a great deal!”

- “I’ll probably use that at some point”

- “It’s only a few bucks”

- “It’s OK. I can afford it.”

- “I’ll just put it on the credit card”

- “It’s got a great payment plan”

- “I’ll never find this price again”

This is nothing more than your emotions playing tricks on you, and a retailer about to capitalize on it. Be careful not to fall victim to these tricks.

Can you think of any more to add to the list? If so, toss them in the comments.

Ok – Let’s go over a few more.

Give yourself a “no return policy”

Returns are awful. Not only did your purchase not work out for you, but now you have to take it back if you want your money back, sometimes to only get in-store credit.

So not only are you using valuable time out of your day you could be using for far better things, but you’re also going to the exact place that failed you the first time, probably tempted to buy more things with either the money you just got back (and now feel more free to spend), or you get in-store credit which means you have an otherwise worthless piece of paper unless you buy something else.

It’s the perfect impulse buying setup because you feel like if you go in and don’t buy something, you’ve wasted a trip.

Retailers know this as well, which is exactly why most of them have such relaxed return policies. They want you to come back to the store to buy more stuff, and what better way to get you to do this than by offering you a risk-free way to make a poor buying decision! 🙂

Here’s a simple rule. If you’re not 100% sure, beyond a shadow of a doubt, that what you’re about to buy is exactly what you need, don’t buy it.

- Do not let yourself use return policies as a replacement for your inability to make a decision

- Do not say things like “if it doesn’t fit, I’ll just return it.”

- Do not buy things without asking your family or significant other with returning it as your backup plan

- Do not buy cheap crap that is likely to break and need to be returned

- Do not buy WAY too much of something and have to return what you don’t use

Avoid returns like the plague!

If for some reason you fail at all of these things and must make a return, consider the consequences. Is that $7 shirt you don’t like all that much really worth two hours of your day, and probably buying a bunch of other stuff you don’t need?

Probably not. Donate it to someone who needs it more than you, and move on to more productive uses of your time and money.

Avoid shopping carts like the plague

It’s incredibly easy to rationalize buying things you don’t need when you have a huge chasm of debt producing plastic to put it all in, because there is no punishment of running out of space or carrying things.

Humans have this need to fill empty spaces. Unless we are trained to do so, we don’t like emptiness by nature.

If you grab a glass, you fill it. If you grab a plate, you fill it. If you have a big house, you fill it. It’s just instinctive. It actually makes us feel really weird not to.

The same is true for shopping carts, and this is also something that retailers know. If only those cart attendants knew how much money they were making the store, they might think about negotiating for a raise. 🙂

If at all possible – don’t get a shopping cart at all. It’s way too easy to just fill them up with things you don’t need.

Grab a carry basket or even two, and use those to house your purchases instead. You’ll get a nice arm workout, and you’ll limit your buying to only what you can fit in your baskets. This is a great way to use a finite system to drive a behavioral change.

And if you have kids, consider keeping them occupied by having them carry your basket. Surely nothing will go wrong with that. Just don’t give them the eggs 🙂

Ditch your store “loyalty” cards

One of the smartest decisions large retailers ever made was issuing “store” credit or debit cards. These cards can only be used at a specific store, and usually come with super small perks that are really just spending hooks in disguise.

Retailers will hook you with a decent initial offer, such as 10% off your first purchase, which can be nice for a large item, then they will make it all back because they can now advertise to you freely and relentlessly, and they absolutely will.

You’ll get “loyalty points” which give you super tiny discounts when you spend a certain amount, or coupons for your next purchase.

Don’t be fooled. These are nothing but advertisements in disguise. What looks like a $5 store credit is actually their way of saying, “We’re only going to take $40 from you when you come in to spend money, not $45.”

How nice of them…

It’s really difficult for people to pass up “coupons” for their favorites stores, and retailers know this. These coupons then get you back in the store, which then makes you spend even more, and get more coupons.

So you see how this goes now. It’s a well-designed never-ending spending cycle. It’s actually pretty brilliant.

And the worst thing is, you get no other rewards for using these cards. No travel points. No actual cash back. No perks outside of the store of any kind.

Personally, if I’m going to spend money I like to get a little bit of a reward for doing so.

Do yourself a favor and get rid of every store card in your wallet. Trust me, the hundreds of dollars you save by not falling for these crafty retailers tricks will well outweigh the “discounts” and “rewards” they offer you.

READ: Seven Silly Financial Myths That Are Making You Poor

—

There are plenty of other tricks retailers use, but these are the most common. If you can master recognizing these tricks when they’re being used against you, you’re well prepared to start changing your behavior.

Now let’s take a look at how you can begin to implement a few simple tactics, rules, and guidelines for yourself to continue to strengthen your defense against impulsive buying behavior.

Master Your Own Behavior and Psychology

Always shop from a list

This may be the biggest one of all since the definition of impulse buying is making unplanned purchases.

Simply enough, if you want to eliminate impulse buying altogether, always make a list before you go out, and always plan purchases in advance. If something is on your list, then buy it (make sure you keep a quantity on there as well).

Very simple.

Don’t let yourself say things like “oh, that’s a great deal” or “I needed one of those anyway.”

Even if it means passing up something that you do really need that isn’t on your list, get into the behavior of only buying things from your list. Otherwise you will stray from your list and you will not develop this habit properly.

Internalizing this behavior will save you at least $20 every time you go on a grocery run. And that’s only a small portion of your shopping endeavors.

Unhook all saved payment methods

Websites like Amazon, eBay, Wal-Mart, Target, Fab, and many of the other top online retailers make it ridiculously easy to spend money. Like, WAY too easy. It’s actually harder to not save your payment information on these sites.

These types of sites prey on impulse buyers. They understand human behavior on a very deep level, and their purchasing systems are built to take advantage of it.

All of the promotions, advertising, recommended listings, related purchases, add-ons, free shipping and other relentless upselling techniques that seem small can really add up.

By having your payment information saved in these sites, all it takes is the click of a few buttons on your smartphone to buy something you don’t need, or worse, 10 things you don’t need.

These urges can be tough to avoid. The solution is a simple principle of behavioral change.

The system then drives the behavior, not pure will power. You’ll be much more successful this way.

- If you want to lose weight, get rid of your junk food

- If you want to quit smoking, distance yourself from cigarettes

- If you want to stop spending money from your savings, create a maximum withdraw limit

The same goes for your online spending. Make it more difficult on yourself to do.

Delete all of your saved payment and shipping information from any of these websites completely.

This makes it much more difficult to make an impulse purchase. The act of digging out your credit card, typing in the number, and going through all of the steps to buy something online can be a little painful. This step in itself can be enough of a deterrent to make you think twice about making a purchase, which is sometimes all you need to come to your senses.

Coming from a web background where I do a lot of work with conversion optimization online, I know how drastically a simple change like this can affect online behavior. This is why retailers spend so much time and resources on their checkout systems.

I do most of my shopping online, so if you’re like me, this can be a huge win for you when you need to cut down your spending a bit.

Use the three day rule

You never want to make a buying decision based purely on excitement. This can happen quite often, and these decisions can sometimes be pretty expensive.

I have literally witnessed people buy cars, yes actual full-sized cars with four wheels and an engine, just because they got emotional and excited. That’s one hell of an impulsive purchase, but it happens all the time…

But what seems fun and exciting right now can often be no more than a novelty a few months later.

Maybe it’s not a car in your case, but I can almost guarantee you have things laying around your house that you bought because you got excited about them that you rarely use.

Consider if the excitement of what you’re about to buy will really last and add long-term value to your life, or if you’re just excited about it in the moment.

I have a rule of thumb that I use when I’m about to drop money on something significant. I call this my “three day rule.”

- I’ll consider what I’m about to purchase for a period of three days.

- I’ll weigh it logically against the rest of my financial needs and goals.

- I’ll consider if I really need it, or if it’s just another thing I’ll end up stuffing in a drawer or closet.

Then, if it still makes sense three days later after I’ve discovered all of my initial rationalizations, then I’ll usually go ahead and buy it. By then, I’ve had plenty of time to think about it and usually move onto other more important things.

This stops me from making impulsive purchases about 70% of the time.

Sell, donate, or throw away existing stuff

This might seem like a fish out of water in this list of behavior altering tactics, but hear me out for a minute. This is actually a very powerful tactic.

If you go through all of the things that you don’t use and either sell them, give them away, throw them away, or donate them – what do you think is going to make up the large majority of those items?

You guessed it. Impulse buys!

I’ll warn you. This is going to be hard to do. You’ll have trouble getting rid of things because you paid money for them. You won’t want to throw things in the trash because you feel like they have some value, you might use them some day, or someone else might use them.

If something is only worth a few dollars, just chuck it. The last thing you want to do is have to have a yard sale where you spend an entire day haggling denominations in the sub dollar range with old ladies to make $39 bucks.

Your time is worth more than that.

Just make it easier on yourself and clear it all out.

On top of helping you claim back some of your much needed space, this is an exercise in how much stuff you can easily accumulate if you don’t control your impulsive buying behavior. It can be a really effective wake-up call.

Just be careful not to get into the mindset that you now need to replace all of these things. If you do, you’re missing the point of this exercise.

READ: Spring Cleaning Sucks, and The $212 Yard Sale

READ: Wow Lady… Was That Really Worth Your Time?

Recognize that one large purchase is often far better than many small ones

There’s a great principle that I like to live by. This might actually be on my tombstone.

“You can have anything you want. You just can’t have everything you want.”

So what does this mean? This means you have to prioritize your spending towards what you want the most. This often means avoiding small impulsive buying decisions.

I like nice things as much as the next guy, so I learned from an early age that to be able to buy the things that I want, I often have to pass up otherwise smaller purchases along the way to that goal.

I don’t have a lot of little $20-ish items around my house. Why?

Because I would rather pass on 50 $20 items and buy something for $1,000 that I’m really going to enjoy for a long time to come. Those $20 items are nothing but clutter that is going to get thrown away. They call it stuff because it gets stuffed in a drawer or a closet you know. 🙂

Do you want a new pair of expensive shoes? That’s awesome.

Start modifying your behavior and start saving.

- Be smart enough to pass on a few meals out

- Take a pass on drinks out with friends

- Think twice before you buy a few new shirts on a whim

- Look in the mirror before you buy those $15 sunglasses from the mall kiosk

Each time you pass on something your previous self would have bought, take note of it, and put that money into a separate account. You’ll be amazed at how quickly it adds up.

Review recurring subscriptions

Some impulse buys can happen once, but then can ding your bank account every single month. These are known as recurring payments, or subscriptions. In this case these are recurring impulse buys.

Some of these are as small as $5, $10, $20, maybe $25 a month, which doesn’t seem like a lot, but can really add up if you have enough of them.

If you have one of each of those, that’s $60 a month you could be putting towards something else.

In about 10 minutes, you can do a quick sweep of all of the recurring subscriptions you have. Just check a few bank statements and look for anything that occurs each month. If you’re not using that service or product anymore, get it cancelled immediately, especially if it’s Time Warner Cable.

Tip: Look for free or lower cost substitutions if you enjoy your subscription, but still want to save money.

READ: Get Control of Your Subscriptions

Let’s Do a Quick Review

That was a lot to take in all at once, so if you made it here, you’re obviously serious about making a significant financial change in your life. Here’s a quick review of what we covered.

Tricks Retailers Use

- Recognize the Mark-up, Mark-down strategy

- Listen to your internal dialogue and rationalizations about spending

- Be wary of super easy retailer return policies and give yourself a “no return policy”

- Shopping carts must be filled

- Understand the back-handed nature of store loyalty programs

Tactics to Change Your Behavior

- Always shop from a list and plan purchases in advance

- Unhook all of your saved payment methods

- Use the three day rule to make buying decisions

- Sell, donate, or throw away existing stuff

- Prioritize your spending (one large purchase is often better than many small ones)

- Review your recurring subscriptions

Understanding psychology is the first step here. Once you do that, all it takes is a few simple tactics to modify your behavior, and you’re well on your way to cracking your impulsive spending habits.

So if you read this far (nearly 5,000 words later), first I just want to say thank you for the support. Would you mind doing me a favor by sharing it with your friends using the social sharing buttons on this page?

You can also email it to your friends just by clicking here.

I would really appreciate it.

I’m happy you stopped by and are teaching your daughter to be smart with money. Really I am. A lot of parents avoid this entirely.

But if you can’t tolerate some PG-13 language, this website and its hundreds of completely free and mildly profane resources probably aren’t for you.

Your language needs to be cleaned up here. I have a daughter I’m teaching these things to. Be profession and leave out the profanity.