The 52 Week Money Challenge Debunked, And a Better Savings Strategy

If you’ve been following the financial blogosphere lately, you may have heard about a savings trend that a lot of people are jumping on called “The 52 Week Money Challenge.”

This has been featured on sites as popular as Lifehacker, as well as several other smaller financial blogs around the web

But with as much popularity as this method has been receiving, there are a few glaring problems with it that will cause it to fail for the vast majority of people.

Read on. I’m about to blow your mind with the pitfalls of this strategy, as well as a more efficient way to get the same result with an extraordinarily smaller amount of work.

—

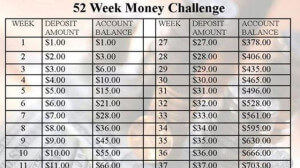

The basic idea of The 52 Week Money Challenge is to save a dollar in week one, two dollars in week two, three dollars in week three… and so on, all the way until you’re putting back 50, 51, and finally 52 dollars in the final week of the year.

All of this will eventually add up to $1,378, a significant sum for a lot of people.

Who couldn’t use $1,400 in their savings account, right?

It sounds awesome on paper, but when you take a moment to think about what is involved in actually executing this strategy, it begins to cave like Tony Romo in the 4th quarter (sorry Cowboys fans).

Manual Savings vs. Automated Savings

The first area where The 52 Week Money Challenge falls short is how manual it is. Let’s assume you’re going to do this through electronic transfers to a savings account (I don’t think you want $1,400 sitting around in a shoebox).

No personal banking system in the world is going to allow you to set up this strategy in an automated fashion, which means it’s very inefficient. 52 different amounts means 52 separate transactions, which increases your risk for failure each week. Forget to do it once, and you’re stuck making up for it the next week.

Even if you take a more productive approach and batch all of your work together in a single day, you’re still stuck setting up 52 transfers, which may not even be possible with some banks, and will eventually become a chore.

As Ramit Sethi often states on his blog, I Will Teach You to Be Rich, humans are cognitive misers, or we find ways to take shortcuts to function more easily. The temptation over the course of 52 weeks is going to lean heavily towards skipping this chore of making a manual deposit into your savings account each week.

You’ve got enough to worry about already, right? Why complicate it with another chore.

The Timing is… Really Bad

Additionally, if you’re trying this from the beginning of the year, think about how much more difficult those manual transactions are going to be towards the end of the year in the holiday season.

With this strategy, nearly half of your overall savings is going to be deposited in the last three months of the year, when holiday shopping season is at it’s peak. Do you think it’s going to be easy to keep those manual deposits going when you’re shelling out hundreds of dollars for gifts?

You’re essentially setting yourself up for failure.

And for anyone out there saying, “it just takes a little discipline,” – ok, fair enough – but I would have to challenge that by saying, why use your discipline reserves on something you can so easily automate?

More on that in a minute. First, let’s look at one last pitfall of this strategy, the failure to produce a psychological reward.

The Psychological Reward of Saving

People like to see their money grow. It’s addicting as hell.

Have you made a really good move in the stock market and doubled, or even tripled your money?

What happens? You want to do it again, right?

Seeing your money grow makes you feel really good.

And that’s another issue with The 52 Week Money Challenge. It fails to provide a psychological win to keep you motivated.

- After one month, you’ll have only $10

- After two months, you’ll have only have $36

- It’s literally going to take you 14 weeks to save just $100.

A huge part of success with making changes is achieving an early psychological win. Sorry money bloggers, but $36 in two months isn’t going to keep anyone motivated.

The Solution – The Set It And Forget It Savings Strategy

So how do you avoid the pitfalls of The 52 Week Money Challenge strategy?

Easy. Use a set it and forget it savings strategy. This allows you to automate one of the most important personal finance principles that exists to your advantage – pay yourself first.

We’re talking about a total sum of $1,378 over the course of 52 weeks, right?

So take $1,378 / 52 and we get a weekly target of $26.50.

Now pull up your bank account online and set up a weekly transaction of $26.50 for a period of 52 weeks. Any decent personal banking website should allow you to do this. If not, get a better bank – seriously.

The result will be $1,378 in your savings account after one year, with about 5 minutes of work.

- You eliminated the failure point of manual transactions

- After one month, you will have saved over $100 (which is a lot better than $10). That’s pretty motivating.

- You’ll adjust your spending to your new income level with $26.50 less per week, rather than having to implement a new habit of making a manual deposit.

What’s The Big Lesson Here?

Beyond just teaching you a better way to save, the big lesson here is that there is psychology in everything we do, especially saving money.

You have to understand the psychological implications of any strategy before you embark upon it.

- Where are its failure points?

- How can you make it better?

- How will it play out over the long term?

The 52 Week Money Challenge will fail for a lot of people because they did not think about those things in advance.

But as an Academy Success reader, you know that in order to have the best chance for success, you have to set yourself up to succeed from the beginning.

And now you have a better way.