How the FIRE Community is Rethinking the Definition of “Retirement Age”

For the last 10+ years, I’ve been working away at my day jobs, steadily building a 401k and Roth IRA, like many functional dudes in their 30s have done.

But being a financial writer, I’m also in a lot of circles that push the limits of traditional thinking when it comes to things like saving and retirement.

Something that has fascinated me in the last couple of years is something called the FIRE community, which you may or may not have heard of.

FIRE, in this sense, stands for Financial Independence, Retire Early, and basically means trying to redefine retirement. This community doesn’t see retirement as something you wait on until you’re 67, or 59 1/2, or whenever tax laws allow you to access your tax-deferred money.

They see it as a freedom that should be gained as early as possible.

They want to delay gratification, save as much as humanly possible, and retire as soon as they can. Some of them, like Mr. Money Mustache, whose thinking I’ve grown to be quite a fan of, have retired at ages as low as their mid 30s.

And they’re not doing this by using family money, hitting the lottery, or anything else. They do this by drastically cutting expenses to the point where some of them live in extremely modest houses, don’t even own vehicles, have very few possessions, and save as much as 70% of their income. Then they maximize the growth of their income as much as they can, by investing early and intelligently.

What they’re eventually building towards is hitting a critical mass of savings to where they can live off of savings and investment growth at a minimal withdraw rate, for an infinite amount of time. Mathematically, it’s very possible.

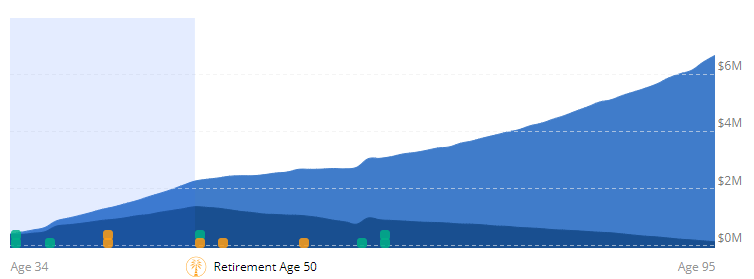

I’ve even done some of my own calculations that could allow my family to retire in our mid to late 40s, although it would be a very tight squeeze and I would have to do a lot of things I don’t want to do. 🙂 This FIRE stuff is cool, but probably not for me. At least not the eliminating every last expense part of it.

But How?

But how is this possible if I you can’t access your retirement money until at least 59 1/2?

A lot of people, including myself until a couple of years ago, don’t realize that you can create an income stream through after-tax investment accounts in the same way you can deferred tax accounts. The difference is you invest differently up front.

Instead of prioritizing investing in the deferred accounts, such as the 401k and Roth IRA, the FIRE community minimizes expenses, maximizes income, AND they load up on growth assets in taxable brokerage accounts.

Yes, they likely still invest in a 401ks and IRAs, because who wouldn’t want to avoid taxes, but they realize that since they won’t be able to access those funds until they’re almost 60, that there might be a 20+ year period where they will need to live in income from other buckets of money.

Tax on long-term capital gains is pretty cheap, so the sale of stock for income isn’t going to be that much in terms of taxes.

So the simplified math goes something like this.

If you’re able to grow your assets to $800,000 by the time you’re 40, and you have a perpetual 4% withdrawl rate, then you can have an infinite income of $32,000 per year, which for this community that values freedom over money and things, is easily enough to live on.

On top of that, that $800,000 will eventually hit 1 million and more, since it’ll likely grow at more than the 4% withdrawl rate.

What Will Happen?

With so much opportunity to create income, the ease of savings and investing automation, and the amount of information that is so easily available in today’s world, we’re only going to see this community continue to grow.

And I have to admit, retiring by 50 doesn’t sound so bad to me either, although that’s a long way off, a lot can change, and we’ll have to see what the future holds.