What to Learn About Money Management – Knowledge is Power

Money plays a huge role in the lives of people all over the world. It is relied on for most of the things we do and, until it runs out just before payday, many of us take it for granted. On top of this, debt has become a ‘normal’ part of modern society – it’s simply more acceptable now to be thousands of dollars in the red than it ever has been before. This, however, can cause major problems further down the line.

While owing money, whether to banks, family members, or friends, is becoming increasingly normal, it doesn’t have to be the way. By being disciplined and organized with the money you earn and the money you spend, there’s no reason why you can’t remain financially comfortable.

Gaining the motivation to be disciplined

Being disciplined with the money you do have is not easy at first; it’s crucial to get into the right frame of mind. Think about the benefits that come with being financially sensible: you’ll know what you’re spending and where it’s going – which means you can avoid overspending. Not only will this help you to avoid life-hindering debt in the future, it should also mean you have monetary backup should something go wrong. You could, for example, be made redundant at any given time, and with rent or a mortgage to pay, this could be hugely troublesome without the right funds in place.

Most of all, though, disciplined financial behavior will give you a sense of control over your life and the ultimate peace of mind in knowing that you’re always covered should an emergency occur or a life-changing opportunity arise.

Learning about money

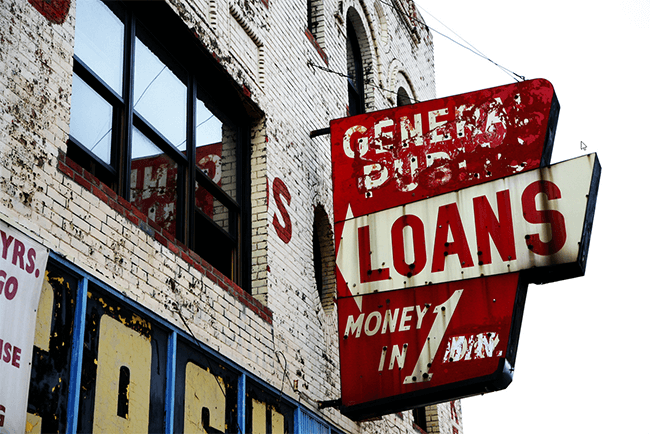

Finance may seem like a minefield but it pays to brush up on your knowledge to ensure you’re in the best position. Understanding how banks work will help you to stay in control of the ways in which you use them. This also goes for credit cards and loans.

There are thousands of different credit cards advertised to us every day, each accompanied by a range of figures and percentages. Even if you’ve never even considered applying for a credit card before, by taking some time to learn what all of these numbers mean and how they’d affect you as an individual, you may just realise that you’re missing out on something extremely helpful. It’ll also stop you signing up for something which sounds like a good deal at first but later turns out to be more of a burden.

Taking your knowledge one step further

There are plenty of ways to increase your knowledge of the financial world. Some people choose to learn at their own pace with the help of books, while others prefer to learn in the classroom environment offered by the many readily available courses on basic financial management. Bear in mind that, with the right qualifications, you may be able to put yourself into the position to help others and not just yourself.

Many small businesses choose to outsource their bookkeeping to self-employed people who work from home. While this may seem ambitious at first, it may be just something else to work towards in your quest for financial knowhow.

The time and effort it can sometimes take to learn about money and how it affects your life really can be justified in the long run. Once you begin to improve your knowledge, create a plan of where you want to be financially in a year’s time, five years’ time, and even 10 years’ time – you’ll soon notice these targets being met as you’re able to apply your new skills to your own life.

—

Michael Jones works for Beacon Financial Training, a company in the North West of England which offers CeFA training and CeRER training to people from across the UK. For more information, visit https://www.beaconfinancialtraining.co.uk/