How to Think Differently About Money This Year

Let me ask you a question.

Have you ever sat back and thought about how your mindset about money might be affecting the financial position that you’re in, or even the life position that you’re in?

Most mass media blogs only seem to talk about “saving money” “cutting back” “reducing costs” etc.

Why? Because it’s easy to optimize what you already have, and it’s incredibly easy for them to write about this.

Optimization is an important part of your personal finances, but cutting spending is not all there is to personal finance success.

But because that is the message we are bombarded with on a daily basis, that’s the trap a lot of people fall into believing.

The super basic formula for creating wealth

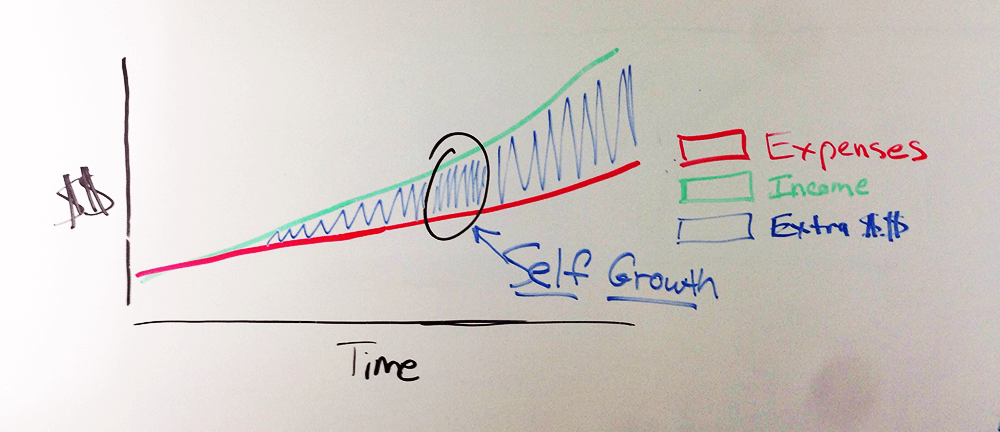

If we boil down creating wealth to it’s most basic formula, Income – Expenses = Wealth (or Extra $$), then it makes sense that in order to become wealthy you have to increase that gap.

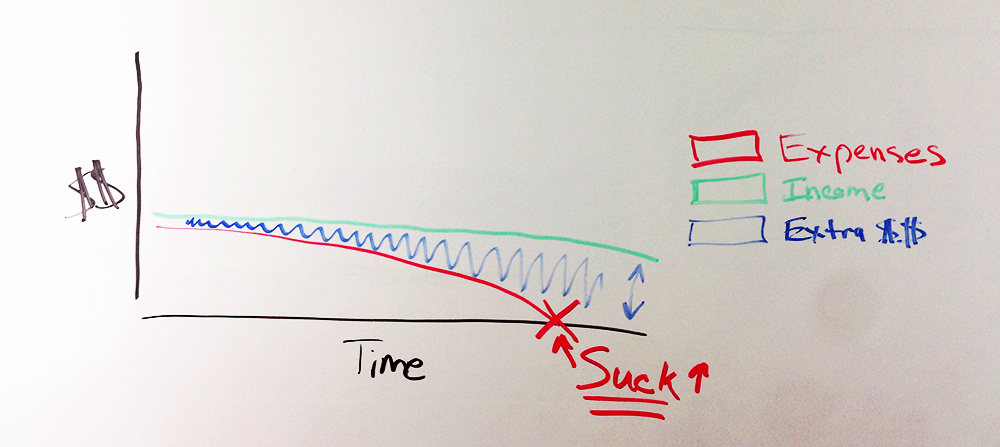

Reducing expenses is one way to do this. This is illustrated in the amazingly intricate graphic below (apparently shot with a slightly dirty camera lens).

Reducing expenses is an easy enough concept to grasp, but it’s only part of the wealth creation formula.

My point is this. Expense and spending optimization is awesome. In fact I highly recommend it.

But if all you do is cut-cut-cut, this creates a huge problem. You can’t cut spending past a certain point. You cannot go below the zero line and begin to get money back (do you hear that extreme coupon clippers!!).

While you might have a little bit larger of a surplus in the short-term, cutting back every little luxury that makes you happy also makes every day start to suck big time. You start to get into a really victimized and scarcity-oriented mindset, never shifting your focus at all on increasing income, which means your money is getting less and less valuable over time, and you’re probably driving a beat up rusted out Dodge Neon hating your life (do those still run?).

Take note of the suck from this scenario, which probably actually sets in far earlier than I show it on the graph.

But increasing earnings theoretically has an infinite amount of room to grow. Even the richest people in the world are still finding ways to get richer. There is absolutely no ceiling to earning more.

The next step past cutting spending

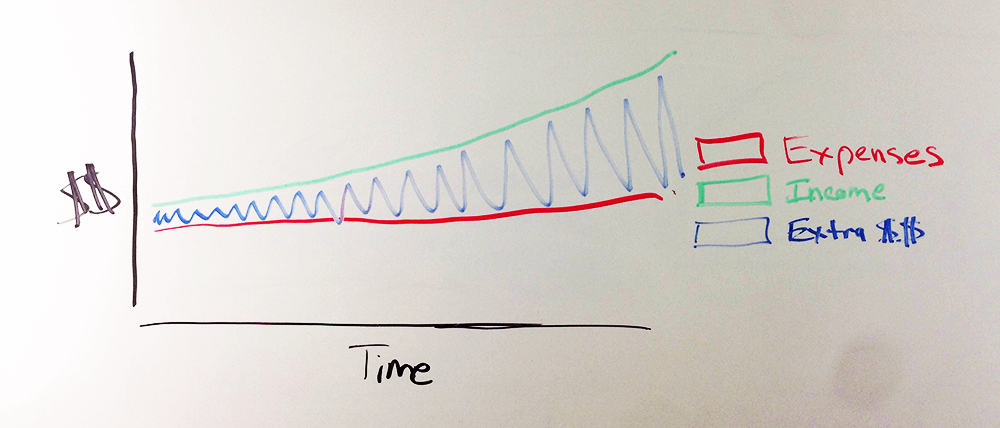

I want you to understand that to go beyond a life of constantly cutting back (and personal hell), you are going to have to increase the income line on your personal finance graph.

When you do this without adding too many expenses (be careful not to fall into the trap of “if I make more I can spend WAY more), you increase the gap between your expenses and income, and add another powerful element to the wealth you can create – extra cash.

Extra cash means savings, investing, and other wealth and life experience creating opportunities that just will not exist if all you do is focus on cutting expenses.

Notice the lack of suck in this graph.

This might sound incredibly obvious as you’re reading it, and I’m sure I’ll get plenty of people clicking away before reading past this line (I call these people the “too smart for their own good” bunch), but if you’re still here, let me ask you this.

Think back to the last time you said something like, “I’m totally broke right now” or “I don’t have any money.”

Going beyond your basic instincts

Your first instinct was probably to cut costs, because that’s what your conditioned to do, and that’s fine.

But did you also look for legitimate ways to earn extra money and increase your value to the world over the long-term?

- What if you can’t cut any more?

- What if you want a better lifestyle?

- What if you like your morning coffees and cable TV?

Once you’ve optimized your spending, what’s the other option other than earning more?

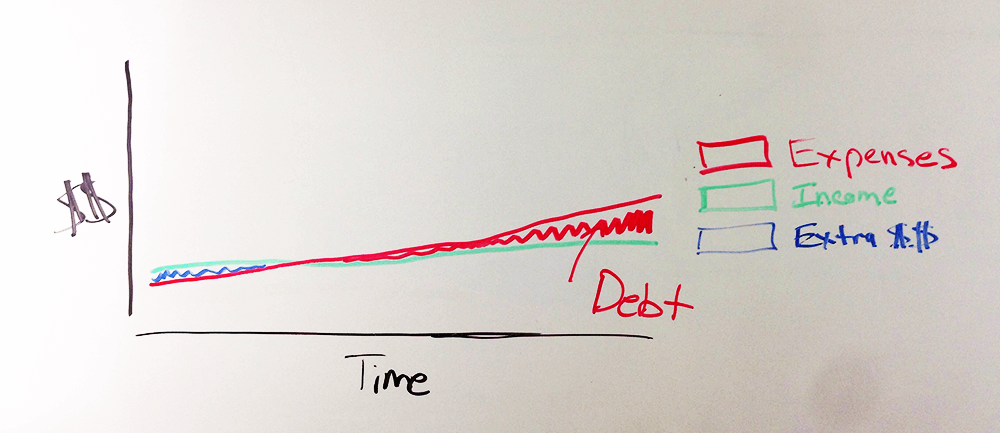

Going into debt…

Obviously you don’t want to go into debt further to increase your lifestyle, but unfortunately that’s what a lot of people do.

They want more out of life, and instead of optimizing spending and earning more, they take on credit card debt, lines of credit on their homes, large car loans, and do silly things like eliminate their 401k contributions or liquidate saving for the future altogether.

This is why the savings rate in the USA is currently only about 4%, with many people saving nothing at all.

People do this thinking “It’ll just be for a little while.”

But it never is. This ends up being the norm and instead of growing their financial prowess, they go in the opposite direction completely. Their chart ends up looking something like this, and once you’re in the kind of mindset that is needed to get here, you’re going in the hole every month, and you’re going to have a tough time recovering.

Just ask any of the nearly 2 million people that file for bankruptcy every year (please don’t be part of that statistic).

This is no way to live…

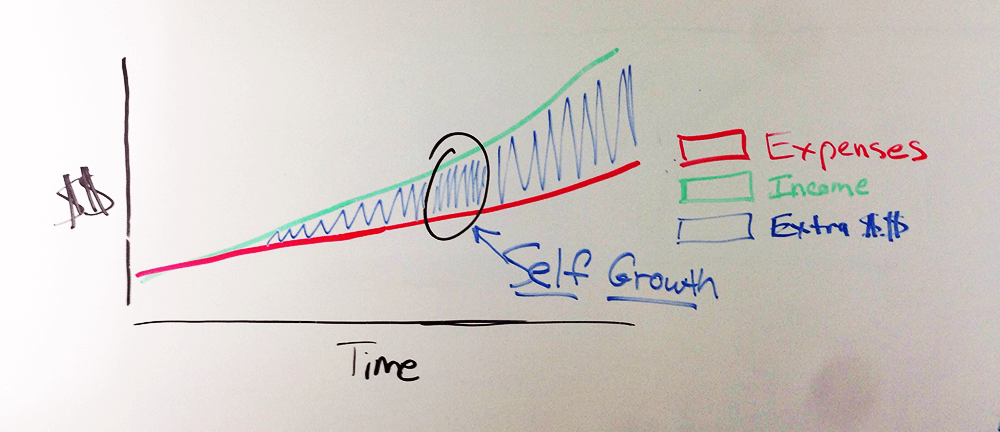

How constant cutting affects your mindset

On top of getting you into a downward sloping mindset, what else happens when all you’re thinking about is how to minimize how much money you spend, or if you’re constantly in debt?

It’s certainly not a mindset of self-improvement. It’s a mindset of self-limitation. And a mindset of self-destruction.

You never get to the point where you think about earning more and increasing your value. You just accept the world as it is, and think you’re doomed to a life of ever-increasing debt to get what you want.

You absolutely cannot grow yourself, your free time, your life experience, your savings, your investments, your skills, your knowledge, your health, and everything else that comes with being a better person – without the financial resources to do it.

That’s why getting to this point on the personal finance graph is so important. Because if you EVER want to become a better person than you are today without living your entire life in the perils of debt, you need to climb the graph to do it.

Once you’re here, that kind of life is possible, and that’s what you should strive for.

At this point, you’re beginning to think about your financial future through retirement accounts, stocks, savings accounts, etc. And you’re beginning to develop yourself with training like what you read on Academy Success, coaching to improve your skills, fitness to improve your body and energy, etc.

At this point, investing in yourself causes your income to raise even higher, and the wealth gap (extra $$) continues to grow.

And the cycles continues, as they say.

What to do now – takeaways

If you’re currently living life in a mode of constant debt – Start figuring out how to change your spending habits and get out from under that debt. Start by creating a positive cash flow and allocating the extra towards one line of debt until it’s paid off. Find other ways to earn more until your debt is paid. Then you can worry about the next steps.

I created the “getting out of debt” portion of the Financial Automation Checklist Collection just for this reason.

If you’re living a “flat life” where you’re just barely getting by each month, you’re actually in a decent spot. Start thinking about how to optimize spending where you’re still happy, as well as how to increase your income to the point where you have a wealth gap to start saving and investing.

This is easier than you think. Here are some ways to start doing it. Here’s how you can get started today.

At this point, you need to increase your knowledge and begin to change your behavior to reach your goals. Consider joining my Money Mindset course to begin to change your thinking, or you can also hire me as your coach to help you set up your financial systems.

If you have a nice wealth gap established already, make sure this money is being put to good use. Understand that possessions end up owning you. Think about creating more experiences with the people you care about. Think about how you’re going to live when you no longer want to work (this is closer than you think). Think about setting yourself up for success in the future and mitigating the risk of financial hardships.

Use the “stocks and investing, and retirement automation” portion of the Financial Automation Checklist Collection for this.

This is a great situation to be in, because you have extra cash to begin creating automated wealth. You may benefit the most of all from financial behavior coaching.

Feeling stuck?

If all of this is a little too much to stomach right now, it’s OK. Rome wasn’t built in a day and your financial mindset won’t be either.

Just think of it this way.

If you take away just one thing from this training, let it be this.

Strive for this picture for your personal finances. Keep this image in your mind and figure out what you need to do to get there. Seek help if you need to, but take action starting today to do it.

Once you get here, then begin to do things like saving, investing, and preparing yourself for the future.

The first step in your financial journey is to improve your financial mindset. My Money Mindset course is full of several detailed lessons just like this one to help you begin to think differently about your personal finances, and begin moving towards a life of personal finance freedom.

To check it out, visit AcademySuccess.com/Money-Mindset

Hey Naomi. I appreciate the kind words. Thanks for reaching out. Best of luck to you.

Wow, this is a great visual I’d never seen such a simple yet effective way of illustrating how to obtain long term wealth. Definitely will be passing this along!