Five Things Blackjack Taught Me About Money Management

Winner winner. Chicken dinner.

Blackjack is my game of choice when I’m feeling dumb enough to brave the casinos.

It’s pretty easy to learn, pretty inexpensive to play, and if you really know what you’re doing, you can usually come away with you sat down with and a few free drinks – or sometimes a lot more.

When I got married in Vegas a few years ago, I really didn’t know all that much about it, but it was always pretty interesting to me because it seemed pretty simple, or so I thought.

During our wedding trip, I sat down at a few tables and promptly lost a couple hundred bucks. Not cool.

But I also noticed that those who I was at the same table with were either winning, or breaking even. How were we playing the same game with such dramatically different outcomes?

I had to be doing something wrong, and it turns out I was.

Since then I studied the game, learned how to play correctly, have had a lot of fun, and even made some money doing it (you win some, you lose some).

As I began playing more and more, I started to notice a lot of similarities between the way I played my blackjack hands, and the way I manage my money. It even helped me see a bit of a new perspective on some of the things I was doing with my stock portfolio.

I thought it would be fun to explore those similarities here.

Here are five things blackjack has taught me about money.

If you play long enough, math always wins.

Depending on the table you’re sitting at, the house always has an advantage over you, even if you play perfectly to blackjack basic strategy.

Unless you’re counting cards and employing some very advanced betting strategies, there is no way around this fact. Casinos wouldn’t be in business otherwise.

Sure, you may go on a hot streak and win big for a short period of time, but statistically, you’re also just as likely to go on a cold streak and lose big. Just ask any good blackjack player about the heavy swings of the game.

So how does this relate to investing and personal finance?

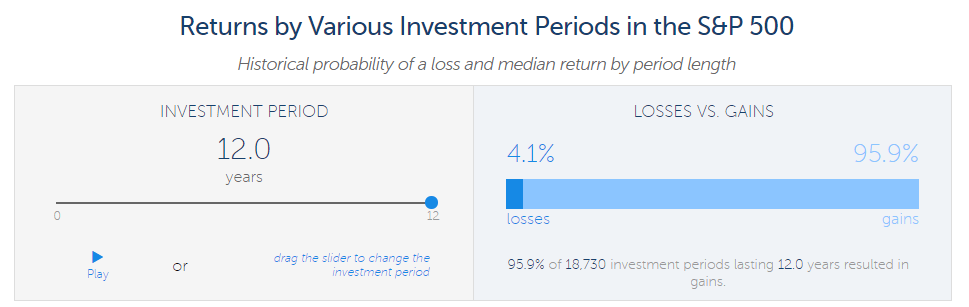

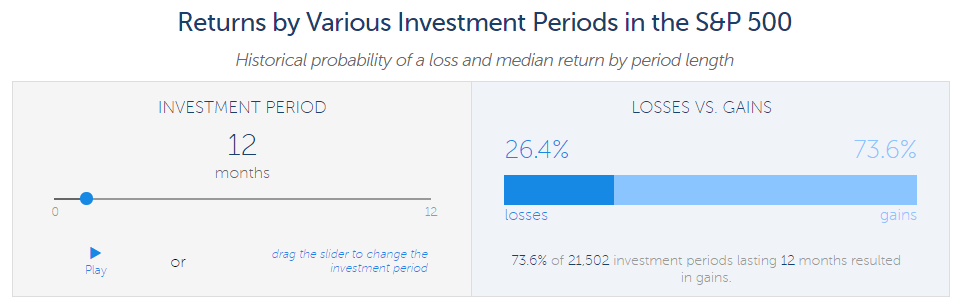

Dan Egan from Betterment recently wrote an excellent article on their blog about this exact subject. In his article, he uses historical data to illustrate returns based on the length of time an account is invested in the broad S&P market.

Without getting into the nitty gritty details, the longer you invest, the higher your chances are of making money, by like… A LOT.

In this example, an investment in the S&P has a 95.9% chance of making money over a period of 12 years.

But turn that dial down to just one year, and the chance of losing is quite a bit higher.

Behind all of the fancy graphics is just one simple mathematical lesson. The longer you stay invested in a broad and diversified market using funds with low fees (like Betterment does), the higher your chances are of earning a sizable return.

If you only invest for a year or two, maybe your account goes up quite a bit, or maybe it tanks completely. The chances of either are much more volatile with shorter periods of time.

The point is, just like blackjack follows the math over the long-term, an investor’s returns will do the same assuming he or she stays invested – at or around a growth rate of 7-8% annually, which really adds up over time.

The difference is, the house is on your side in this case.

- Betterment makes the “broad and diversified with low fees” part easy. If you want to get started growing your money, give them a shot. Here’s a link for six months without a single fee.

Math always wins, so stay invested, and like a good card player, make sure you learn how to play. 🙂

Education and experience is critical

Before you go all Teddy KGB and splash the pot with black chips every hand, you better learn what you’re doing first.

Before I learned how to play blackjack correctly to maximize my chances of winning (or more like minimize my chances of losing), I lost basically every time I sat down.

I had no experience or education. I just thought it looked fun and pretty easy to win money, so I sat down and took my chances like an idiot.

Bad idea, especially with real money on the line (the same thing happened with my first few months of investing).

After losing hundreds of dollars on a few different occasions, I knew if I was going to keep playing with my friends that I needed to learn how to play.

So I downloaded a few apps, read a few books, and practiced like you would any other skill you want to learn.

In a few weeks, I was talking the talk, walking the walk, and playing just as well as anyone.

Yes – That’s a poker movie reference. No one’s perfect!

While you can learn the basic smart plays of blackjack in just a few days, getting to the point where you’re playing perfect “Basic Strategy” can take months, and most people never take the time to learn. They just rely on luck alone.

The same thing is true for investing. Luck can be a big factor.

You can even pick up a few books and learn the ropes pretty easily, but until you get some experience actually making trades and spending some time in the market, you won’t get a true understanding of the ups and downs of investing, especially the emotions you go through on a day-to-day basis.

- If you want to get started without using an automated service like Betterment, check out this training resource I created about how to get started investing in stocks.

Bottom line is, don’t just dive in head first into something as complex as investing. Take the time to learn the skill, get some good advice from those more experienced than you, and then start small until you’re experienced enough to invest larger amounts of money.

Don’t lose money (minimize losses)

Warren Buffet is famously quoted as saying, “Rule No. 1 – Never Lose Money. Rule No. 2 – See Rule No. 1”

Pretty simple, but also pretty powerful when you think about it. If you find a way to minimize your losses, and a way to continue to grow your gains, then your money will always be growing.

But a lot of blackjack players have probably never heard this quote. 🙂

I see it time and time again – someone will sit down at the blackjack table with a few hundred bucks, burn through it in twenty minutes, and then run to the ATM only to come back to the table and do it again until they’re out of money.

I don’t have to tell you that this is a recipe for disaster.

But even if you’re the best card counter on the planet, you can fall victim to bad luck.

If you don’t want to go completely broke, you have to have a strategy that allows you to minimize your losses in the event that you have a bad run.

- For me, I have a rule to never visit the ATM at a casino, which means I only bring what I’m comfortable losing.

- Others I’ve seen have a strategy of never buying back in after they’ve lost their initial stack.

- Others routinely pocket chips as they get up so they walk away with at least something

- The best players track the cards so they know when to bet big, and when to back off (unfortunately I haven’t reached this level yet)

It’s next to impossible to avoid losing money at least some of the time, but these are all strategies that will help keep those bad runs to a minimum.

I do the same thing with every day money, but in a few different ways, and I’m always looking for more ways to do this.

Careful Spending – I have a rule not to spend money that I don’t have other than my mortgage on my home. If I’m going to go into debt for something large, it’s going to be short-term debt (2 years max) that I’m only using so I won’t eliminate all of my cash savings. Usually I don’t like to do this at all. Debt just makes me really uncomfortable and eliminates a lot of financial flexibility.

This practice protects against situations like steep income losses or significant expense increases.

Diversification – My investments are spread out across 30+ different equities across different sectors, so if one goes bust, the others are there to pick up the slack. I’ve lost thousands of dollars on a single investment on multiple occasions, but I’ve also made thousands as well. The goal is that the gains outweigh the losses, and to this point in my life, that has been the case.

Stop Loss Orders – This is another investment tactic I’ve started to use a lot more. A stop-loss order basically means that if a stock goes below a certain price it will sell automatically. This helps you limit your losses and keep emotions out of the equation because you can decide this in advance and not have to worry about it at all. It allows you to set a maximum loss amount, but keeps your ceiling infinite. This tactic can be extremely powerful if used correctly. I wish I would have started using it earlier in my investing career. Admittedly, I could still do a lot better with this one.

If you want to win, emotions are usually bad

The best friend of a casino is an emotional and unstable gambler – someone who sits down and loses all rational thought ability when they’re at a blackjack table.

- They ignore best practices

- They lose all ability to think logically

- They rationalize every single situation

- They bet big trying to win their money back (this rarely works with the win rate at a blackjack table)

- And overall they’re just out of control.

Once panic and negative emotions take over, it’s rare someone recovers. They normally walk away with nothing, and can even make those dreaded ATM trips a few times.

The same can be true with investing, especially when stocks go down.

It’s pretty logical that the way to profit with investing is to buy stocks at a low price, and to sell them at a much higher price.

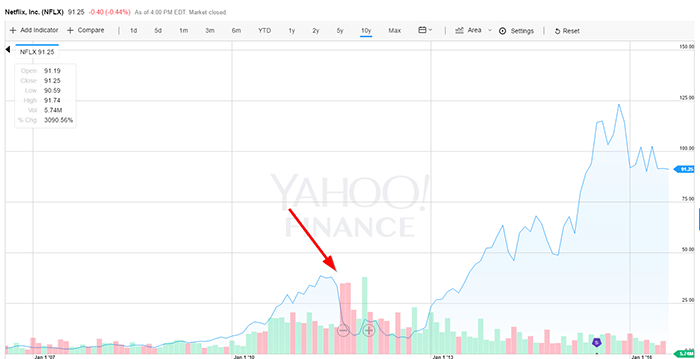

But when emotions kick in, people tend to do exactly the opposite. Back in 2011, when Netflix raised their prices by like… a few dollars a month and split their DVD / streaming plans, people flipped… the… fuck… out.

They cancelled their plans in an emotional uproar and Netflix’s stock price plummeted to historic lows as people freaked out and sold their shares at a huge loss.

Buy high and sell low? That’s not the way to profit.

Then… just over one year later, Netflix was again trading at it’s highest point ever, proceeded to execute a 7 to 1 split a couple of years after that, and to this day continues to be one of those most valuable companies in the world to own.

Any time you’re emotional, whether it’s in a money situation or not, take some time to sit down and really think about what you’re doing. Decisions made in an emotional state are almost always the wrong ones.

Double down when there’s a great opportunity

A “double down” in blackjack is when you double your bet that you originally placed on the table. Typically this is done when you have a very strong hand, and the dealer has a very weak hand. On average (not always), the more money you get on the table in these situations, the more you will profit over time.

Mastering the double down play is critical to keeping you even or ahead over time. If you don’t know how to do it correctly, you’ll almost certainly walk away with less than you sat down with.

Much like a double down hand in blackjack, these opportunities don’t come around often in the investing world, but if you can capitalize on them when they do they can be a big part of a winning strategy over time.

Warren Buffet is famous for saying “attempt to be fearful when others are greedy, and greedy when others are fearful.”

A few examples from recent history are:

- The Netflix example mentioned above

- A few weeks after the Facebook IPO (high profile IPOs are infamous for crashing after an initial surge, which is a great time to get them cheap)

- The “Brexit” debacle

Similar to doubling down with a 10 vs. a 7 (always a good play, although many people won’t do it), most of these situations would make the novice investor a bit nervous.

But even semi-skilled investors like myself that know how to recognize great opportunities see these types of situations as almost no-brainers.

- Netflix plummeted to historic lows, then management pivoted, and the stock rebounded, split, and is still climbing higher

- Facebook opened at over $30 a share, dipped to nearly $17, and has since gone up over 6x to nearly $100 / share. This stock alone will probably pay for my next car, as long as it’s not a Tesla. 🙂

- The Dow fell 600 points during the huge Brexit scare. This was a great buying opportunity across the board, and stocks are back to record highs.

But just like the dealer can always get a 21, these types of bets can sometimes backfire. I’m not recommending always trying to time the market. You should never base your entire strategy on market timing, but it can certainly be a small part of a larger strategy if you can win more than you lose with these types of bets.

My point is that these types of situations don’t happen often, and they can represent unique buying opportunities to get in on some great companies at discounted rates.

Let’s Review

Whew. So that was a lot. Let’s hit the high points again.

- Math always wins. It’s about the long-game. Get invested and stay invested for the long haul.

- Education and experience is critical. Get some play time in low risk situations before betting big.

- Don’t lose money (or minimize your losses). Find ways to hedge your risk such as diversification, investments with guaranteed payouts, and insurance.

- If you want to win, emotions are bad. Don’t make decisions in an emotional state, whether it’s in a happy state, or an angry state. Think and use logic.

- Double down when there’s a great opportunity. Keep an eye out for rare money-making opportunities, consider them carefully, and capitalize on them when they happen.

From here, it’s on you to get some experience with money and investing and to learn these lessons yourself.

Although… unlike myself, I don’t recommend playing blackjack as your learning mechanism. 🙂

—-

Disclaimer: I do not condone or recommend gambling unless you’ve got a really potent money tree, in which case I would like some of its seeds. If you’re going to invest, talk to a registered financial planner, which I am not, and I don’t play one on the Internet.