Financial Automation: How to Not Screw Up Your System

I’m always talking about how important financial automation is to financial success.

This practice is one of the primary reasons I have been able to achieve so many of my own financial goals, but one of the things I haven’t addressed too heavily on the blog is some of the pitfalls of financial automation – or how it can bite you in the ass if you’re not careful.

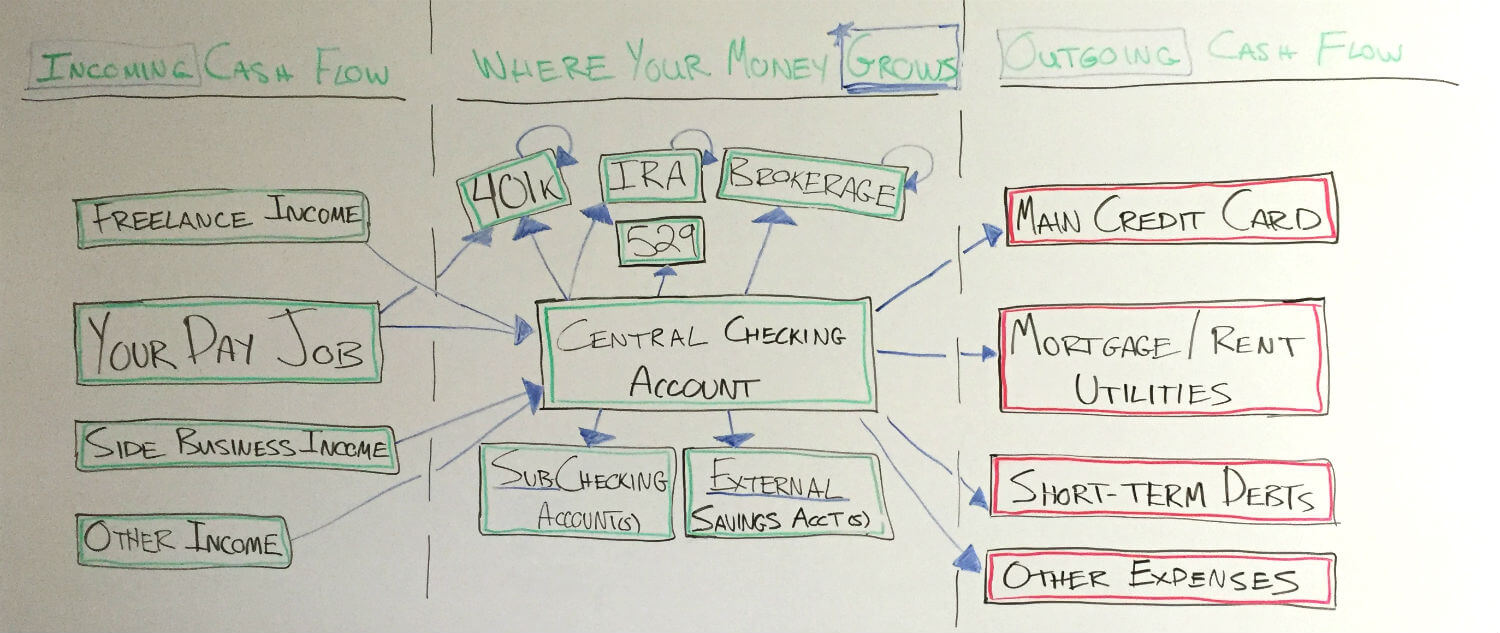

In all of its glory financial automation can help you automate debt payoff, savings, investing, and essentially any financial goal you want to reach.

But it can also get you in trouble if you aren’t disciplined and you lose control.

- If you don’t regularly review your expenses, investments, bank balance, etc – all of the things that you’re automating – these can easily drift away from your goals over time.

- Recurring fixed expenses such as your cell phone or internet bill can increase over time unknowingly

- Maybe your investments were killing in last year, but those market sectors are crashing this year and need adjusting

- You may have completely paid off a debt account and need to now move onto the next one to keep up your good momentum

- An automated savings plan you had set up may have expired, and now you’re not saving anything at all

For example, I recently I discovered that my ISP was overcharging me by $26 a month, and that $6 of that had been a mistake that had been on my bill for 2 years! I just never saw it. Shame on me!

This resulted in a monthly reduction of $20 a month going forward and a credit for over $100 for the 2 year mistake.

Just imagine if you find a few of those optimizations. All of that money can really add up.

As much as I wish it could be, all aspects of your finances can’t realistically be 100% automated for the rest of your life. You can automate a heck of a lot, but financial success still requires good decision making and the discipline to stay on top of the goals you’ve set.

I don’t say any of this to scare you or to convince you not to automate your financial behavior. I only caution you against this so you won’t get yourself in trouble along the way.

If you haven’t read it yet, be sure to check out this post on all of the apps, websites, and services that I use to automate my own finances. There are some gems in there, and this can really help give you a real life understanding of how all of this can work for you.

Talk soon!

PS: Grab a copy of my financial automation checklists if you haven’t set up your system yet.