Shit… Where Did All of My Money Go…?

“Shit… where did all of my money go…???”

It’s a gut wrenching feeling, having earned tens of thousands of dollars and having no idea where it all went, and having little or nothing to show for it.

Have you ever gotten a bank statement, tax return, pay stub or some other document that shows how much money you made in a given period, but then you have little to no idea where all of that money went?

It sucks. I’ve been there before, and if you’ll stay with me for the next few minutes, I want to show you how to never have that feeling again.

No. I’m not talking about some ridiculously crazy way to track all of your spending down to the penny. I’m not talking about hiring an accountant to manage your money for you.

In fact, I’m not talking about actually tracking anything at all.

I’m talking about a way to make sure you know you’re putting money where it needs to go, and that way you don’t have to worry about the rest.

How I Save $27,600 Each Year on Complete Autopilot

As I write this post, I just pledged to become a member of the Budgets Are Sexy Million Dollar Club. This is a list of folks who have taken the time to sit down and plan out their path to becoming a millionaire.

My plan, assuming I stay on the same path I’m on now, has me there by the time I’m 43, or 13 1/2 years from now. If you want to see the details, check out this page.

But to me, the most awesome thing about this plan is not that it’ll make me a millionaire several times over, but that it happens almost 100% on autopilot. I set it up one time, and it keeps working for me each and every year. I don’t have to worry about a thing, and I spend less than an hour a month maintaining it.

I never have to worry about saying “where did all of my money go?”

- My 401k deposits are automatically deducted from my paycheck. I check this account a couple of times per year to up my contributions, and make sure I’m still invested properly.

- My profit sharing and employer match deposits are also 100% automated, and that’s free money to me. All I have to do is contribute enough to get the match

- My Roth IRA contributions are set up with Betterment to pull from a high yield savings account that I automatically deposit money to every two weeks. I have a system set up so I contribute a set amount each month that totals my annual goal. This way I don’t risk overdrafting my main checking account when the withdraws occur.

- My brokerage account is set up the same way, to pull money from a high yield savings account. I do invest manually from time to time with this account, as individual stocks are sometimes volatile.

- I have several dividend funds that are set up to automatically reinvest their earnings into solid blue chip growth stocks, making me a few thousand extra per year that grows on itself, and taking care of dollar cost averaging for me.

- Beyond that I have an account that pays my mortgage automatically, an account that pays my credit cards automatically, and have essentially all of my other bills auto-paid.

- I also used these same methods to pay off five figures worth of debt that I incurred through student loans, and other means earlier in my life

All of that is done automatically. I barely lift a finger to make it happen.

I’m not telling you all of this to boast. I’m telling you all of this because I want you to inspire you to take action for yourself as well.

What that allows me to do, and can allow you to do as well, is not ever have to worry about saving enough, where all of your money is going, if you’ll have enough to retire, etc. You’ll know it’s all going to the right places because you set it up in advance to go there.

Yes. You can do the exact same thing.

What this will mean for you is that the rest of your income can be safely spent if needed, with little to no worry about if you’re overspending, etc

And that’s where the next point comes in.

The Biggest Advantage of Financial Automation

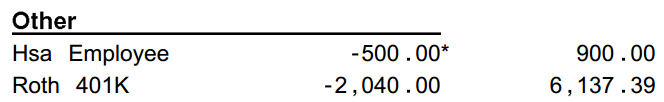

This is a screenshot of part of my pay stub from a recent bonus. It shows $500 going into an HSA (health savings account), and $2,040 going into my Roth 401k, as well as the annual totals for each.

I know what you might be thinking. That’s $2,540! That’s a lot of money!

Yes it is.

And that’s exactly why I choose to have it automatically saved and invested for me. Because if all of that money hit my personal checking account, I might succumb to the perils of human nature and be tempted to spend it on something silly that isn’t going to enhance my life that much anyway.

But the system protects me. It ensures that I never have to worry about making any manual transactions to save and invest. It makes it difficult for me to spend irresponsibly, and it keeps me on track towards my goals.

And that’s a recipe for success.

How You Can Build Your Financial Automation System

If you’re at all concerned about hitting your financial goals, overspending, undersaving, or anything of the like, I want you to make sure you have a high amount of automation built into your finances.

I created a step-by-step checklist that allows you to check off each step towards financial automation as you do it, for several different areas of your finances. This collection of worksheets covers saving, investing, paying bills, getting out of debt, and all of your other areas of personal finance that you can automate.

Go ahead and grab your copy of that here. I recommend starting with the savings automation checklist.

And just let me know if you have any questions. You can reply directly to this email or leave a comment on the blog. I read every single one.

PS: I’ll be helping you in further detail with the investing part of this in a few days. Look out for a special announcement next week. Until then, make sure to grab your checklists, and begin setting up your automation systems.

—