Eight Steps to an Organized Financial Life

With all of the different areas of personal finance we have to concern ourselves with, it quite literally pays to be organized. Today I want to welcome my friend Sarah Smith, a regular writer at personalincome.org, to talk with us about some of the best ways to get your financial life organized.

Take it away Sarah!

—

Some of us lack in organizational skills, but some of us don’t. But organizing ones finances is a whole other thing to deal with. Some people organize their finances on their own while few take external help, both ways are right but to organize your own financial life makes things comfortable as you are fully aware of your situation plus of course the confidentiality.

To make your life easy, here are the steps to organize your financial life yourself.

Budgeting

Budgeting is considered to be hard, but for me, it is worth the hard work. If you have a budget planned for you things will go so easy on you that you could not imagine. But for making a budget following items must be considered.

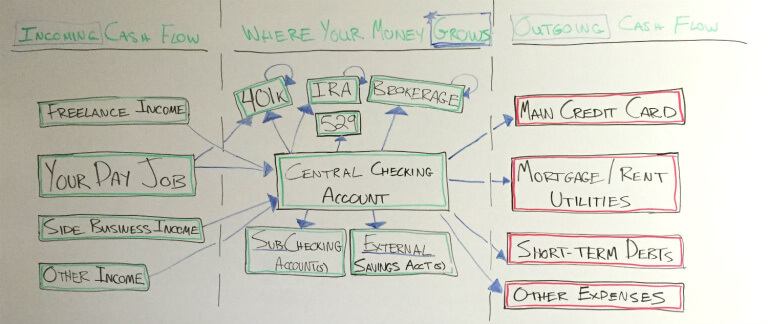

Know your income – One must be fully aware of the incoming cash flow. It may be just one medium that is producing the income or multiple. List down what is necessary and follow up the necessary steps.

Know your needs – Your needs are what you have to have, no questions asked. Your food, rent, transport, hospital bills these all are counted in your needs. Know them to plan your budget.

Know your wants – Be very careful with what you are calling a want. We sometimes call something our want, but it is not actually. Listing this does not mean you are getting it right away, but you can have it with your monthly allowance if necessary.

Emergency Fund

Yes, I know you have insurance policies for several different things, but an emergency fund can be very vital in case of need. Maybe it will act as a loan for a dear friend. But please keep this amount away from yourself, sometimes buying a cheeseburger sounds like having an emergency while we all know it is not.

Consider Using Cash Over Cards

We are so much gone into technology that we have almost forgotten that there is an option that is known as cash that would also be used. Why cash over cards? Because cash pays that very instant while cards allow you to buy stuff and pay afterward and all you are left with is debt.

Knowledge of Debts

Know how much you owe to someone, add an account in your budget that allows that person to get their payment back and get rid of it ASAP.

Remember the girl from the shopaholic? I know you do not want to give away all you bought like she did.

Cut Yourself Some Slack

When planning your budget, allow yourself some allowance to enjoy your life, after all, we are working for a reason.

Diversify with Multiple Investments

In the current time, our needs, and wants are rising day by day and to meet them the only answer is various channels where you could invest. There are many ways to invest in side channels you just have to know the market. It may be cheap stocks on the rise or real estate investment.

Plan Big

When you plan, plan bigger than before, a short-term goal may work for a week or so, but a big plan will allow you to have a dream house or a car or a vacation you have only imagined about.

Stick to It

Planning all the above is worthless if you are not going to stick to it. If you are hoping to skip any of this, then do not bother yourself with planning either because sticking to the plan is the essence.

—

Author Bio: Sarah Smith has been a personal finance author for the last five years. She is also an independent and very passionate finance and investment advisor. She regularly posts at www.personalincome.org.