Four Smart Ways to Use Your Tax Refund for Success

Alright – So a lot of you out there are probably getting big fat tax refunds rolling in about now (at least a couple Gs, right?). Maybe you’re not getting a big fat pile of cash like the one in the picture, but most people at least get a nice chunk of change that can be put to good use, one way or another.

So you’re probably hearing all kinds of BS right now about what to do with it, and I’m going to help give you some good long term ideas in a second (patience my friend), but first I want to dispel one common myth about tax refunds that you’ll hear a lot. You’ll probably hear this in any and every personal finance training you go to, and it’s dead wrong.

“A tax refund is just the government using your money for a year, then giving it back to you”

Ok, while that might be true, it actually benefits you quite a bit.

Why?

Well, let’s think about it. If you had that couple thousand bucks and earned a really generous 10% interest on it throughout the year, you’d be up $200 bucks, but that’s just not a reality. There is a human behavior element present here that the conspiracy theorists don’t think about.

People aren’t that disciplined!

If you have an extra few thousand bucks during the year, you’re WAAAAYYY more likely to spend it throughout the year than you are to put it away for a rainy day. It’s human nature. The more you make the more you spend. So, yes, while the government might be using your money for a year, it’s in your best interest.

You’re far more likely to use it wisely if you get it all in a big chunk, than just in small increments.

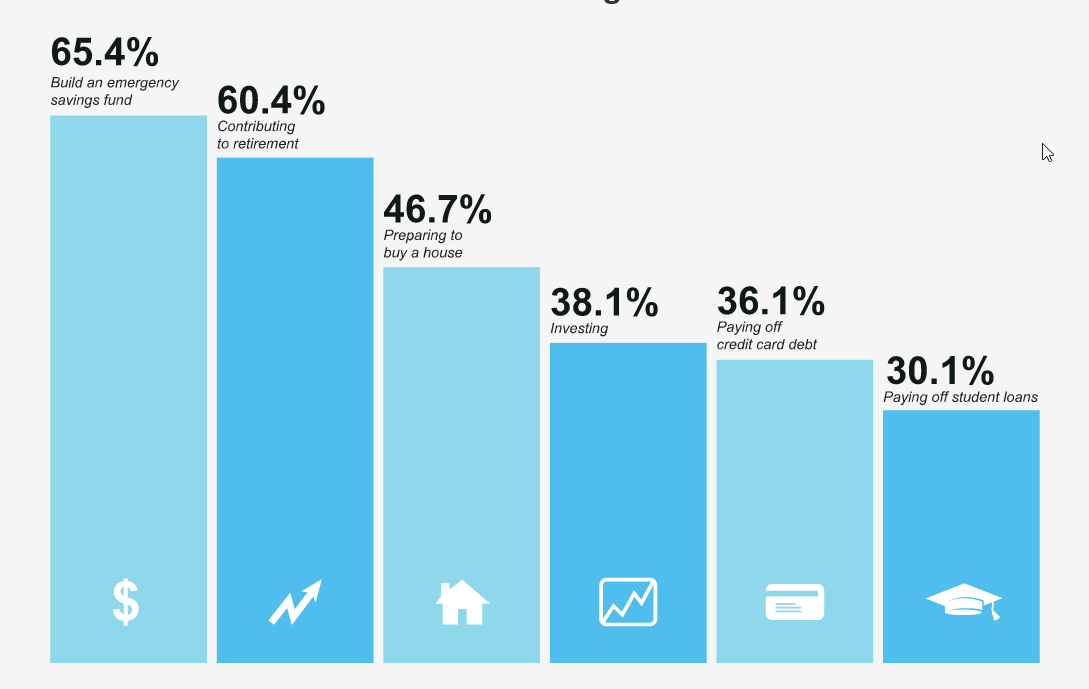

So that being said, what’s the smart thing to do with your tax refund?

What To Do With Your Tax Refund

I’d like to advise you to do one, a couple, or all of the things below with this upcoming or already received large chunk of cash

1.) Reward Yourself With Something (Small) You’ve Really Been Wanting

Some of you might think I’m nuts when I say this, but just bear with me. Hopefully I can make some sense.

Depending on how large your refund is, take a few hundred bucks of it, maybe 8-10% of it, and buy yourself something you’ve been wanting to buy, but haven’t been able to. Notice I say 8-10%, not half of it!

The psychology behind this is if you get yourself something small you’ve been wanting, you’ve rewarded yourself with your refund. You’ve spent it responsibly on something you want, but you’ve left yourself 90% of it or more to be smart with it, which is what comes next.

2.) Pay off Debt, Especially High Interest Debt

After you’ve experienced your tax refund reward, this one is a no-brainer for long term financial benefit. The sad things is, so many people just neglect to do this because they don’t see the losses they take by continuing to make small payments on high interest debt over time. Fact is, you end up spending A LOT more over the long term on high interest debt by paying it off now than you gain by not using your tax refund on it. That $5,000 bucks you decide not to pay off right now will end up costing you over an additional $1000 in 5 years at 5% interest – (sound like a student loan to some of you?)

You also sleep a lot better at night, which is extremely valuable to success and another post in itself 🙂

By high interest debt I mean anything over 6% or so. Preferably you’ll want to focus on your piece of debt with the highest interest, then move on down the line. Credit cards are the worst. Some credit cards can have over 20% interest rates, which end up costing you literally thousands if not tens of thousands if they are poorly managed. Pay those suckers down as quickly as possible, and try to negotiate a lower interest rate while you’re at it!

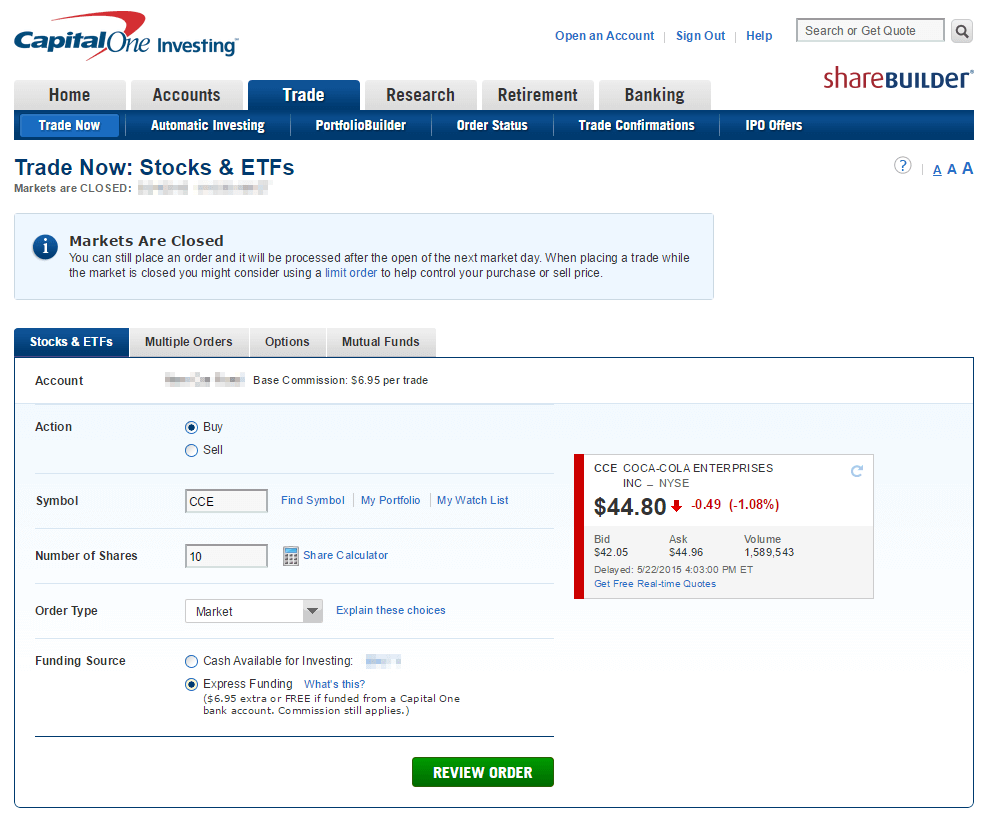

3.) Invest In an Appreciable Asset

A lot of people spend their tax refunds on things like cars, jewelry, expensive home electronics, etc. Most things like this aren’t ever going to give you any return on the money you spend on them. Cars depreciate, jewelry usually just ends up sitting in a box, and expensive personal electronics are some of the fastest depreciating objects in the world. If you’re going to indulge on any of this kind of stuff, keep it cost effective. Anything over a few hundred bucks is probably excessive for the average person.

Besides, the opportunity cost of this stuff is more than you think.

Instead, consider spending your tax return on things that can yield a positive return, like home improvements, low risk index funds, or even your health by outlining a workout plan and joining a gym.

4.) Start a Side Business

Do you have a marketable skill that you can bring in some extra cash with? A nice chunk of change like a tax refund can be a great kickstart to get a new business off the ground.

With online promotion tools like blogs, social media, simple online checkout and storefronts to use to sell products online, and the world of communications in the flat state that it’s in right now, it’s never been easier to make extra money on the side. A tax refund can be the chunk of change you need to get your marketing momentum flowing.

5.) Sharpen the Saw

The 7th Habit of Highly Effective People is “Sharpen the Saw.” Part of this habit is always improving yourself in some way. A tax refund can contribute to the mental part of sharpening your saw by allowing you to invest in your education. Take a training course and learn a few new skills. Take a few classes towards that degree you never finished. Buy a few books and commit to reading them.

The Golden Rule With Your Tax Refund

In a nutshell, the 1,000 words above can be summed up in a few sentences.

- Get yourself something cool, but don’t spend too much on things that are just going to get tossed in a closet or thrown out in a year

- Use your tax refund, and any large chunk of change for that matter, to set yourself up for future success by eliminating debt, relieving some stress, improving your lifestyle by improving your home, or start a side business of your own to make some extra money and maybe even follow your life passion

- Sharpen your saw by investing in your education, learning a few new skills, and improving your mental capacity

Try out these few strategies with your tax refund this year and you’ll be a lot better off in the long term. If you can think of anything else, please share in the comments below!

To Your Success!

Cody