Ok. So let’s take a moment to review. So far:

- We’ve blown away the common belief that you can’t get rich working for someone else, by showing you that even an average salary can create a portfolio that will generate millions and more

- We’ve destroyed the limiting belief that you have to be a math genius, or a money person to invest by understanding that wealth creation is more about your behavior than your knowledge

- And we’ve obliterated the myth that the stock markets are just like gambling by outlining a simple, long-term and strategic approach to money management

Creating this course has been really fun for me, and I hope going through it has been really eye-opening to you.

In this lesson, we’re going to talk about the one thing that we all want, and how to make sure you get it – financial freedom, and more importantly, whose job it is to make it happen.

The Difference Between a Goal and a Wish

Before I get into the final myth today, I want to share a quote with you. This is a quote that not only applies to your personal finances, but to any kind of result you want to create in your life.

A goal without action is nothing but a wish…

Think about that for a minute. How many times have you said:

- “I wish this”

- “I need to do that”

- “If I could just do xyz”

You know what? You can.

There’s no reason you can’t achieve the goals you wish for. We’ve talked about that plenty already.

But with as strong of an emotion as desire is, all of the wishing, desire and want in the world won’t get you any further than you are right now.

Whatever result you are hoping for, whatever wishes and goals you have for yourself financially and otherwise, whatever picture you have painted for yourself in the near and far future, if you want that result to become a reality, you need to take action to make it happen.

No One Else Is Going to Do It For You

After we talk about Lesson and Myth #4, I will be opening up my 401k Millionaire course at the end of this video.

I would be thrilled if you chose to take action and invest in it for yourself, but even if you don’t, I strongly urge you to take action with the lessons I have shared with you.

Understanding any one of these lessons can mean the difference between a life of wealth and freedom, and a life of wishing and hoping for something good to happen.

And that’s a perfect segue into the myth that someone else will handle your financial future for you.

Let’s get started.

Someone Else Will Take Care Of My Future, Right?

Work is the new retirement

Working your entire life? Sounds awful doesn’t it?

According to a study done by BankRate.com, 74% of people in their 40s and 50s plan to continue working during their “retirement” years because they feel they won’t have enough money.

Do you want that to be you?

It sure as hell isn’t going to be me.

So let’s explore this. I want you to take a moment to think about something for me.

Think about how many people you know who are in their 50s, 60s, or even 70s, who are still working every single day. These people likely have decent lifestyles, nice things, and good jobs, but there is one issue that plagues them all.

They can’t retire because they don’t have enough money.

- They still have mortgages over their heads

- They still have cars to pay off

- They still have and all kinds of other financial liabilities that are preventing them from hanging it all up.

Sure, different circumstances happen to different people, but one thing is common among all of them – their thought process.

What was their thought process throughout their lives that caused them to arrive in this situation?

A Dangerous Thought Process

They didn’t take control. They thought someone else would handle it all for them, and one day they woke up thinking “I want to retire, but I can’t…”

And this is the same thought process that a lot of people have right now, maybe even you.

- “Social security will take care of me”

- “My company has a good pension” (50% of these are now gone – don’t trust money that isn’t in your name directly)

- “I’ve got an inheritance coming”

- “My family will support me”

- “Something will come up”

- “I’ll figure it out later”

All of these phrases represent a complete lack of control.

Social security is due to run out in less than 20 years. Pensions are already being slashed, if not completely eradicated. Unions are as unstable as ever. And the delusion that “I’ll figure it out later” is just absurd. Later never comes.

If you aren’t saving and investing in your own name, you don’t have a plan.

Bottom line is, many of today’s baby boomers are working well into their 60s, and some into their 70s because they failed to plan correctly, thought someone else would take care of them (the government, a union, a pension, their family, etc), or just came to the conclusion of “I’ll figure it out later.”

They created lifestyles that they could afford on their salary well enough, but when it came time to save money for the future, they had absolutely nothing left over.

I don’t want this to happen to you.

In order to save for your future goals, you have to have something left over to invest and grow, and you have to plan for that to happen.

Your money is not going to take care of itself, and no one else is going to do it for you.

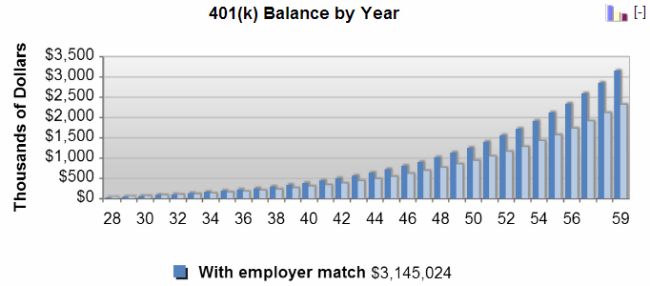

As we talked about earlier, you absolutely can get rich working for someone else. You can create millions of dollars of wealth actually.

Yes, it might mean you buy a slightly smaller house, it might mean you buy a slightly less expensive car, it might mean you budget differently, and it might mean that you need to improve yourself and continue to grow your income throughout your life, but what it will all amount to in the future is the ability to create seven figures of wealth for yourself to retire on in your 50s, while you watch others work into their 60s and 70s, and even to their death beds.

And most of all… it will amount to freedom.

Freedom that will occur 10 to 15 years sooner. Freedom that you will be able to thoroughly enjoy because you will still have plenty of life left in you.

If you’re in your 20s or 30s, you’re in an awesome position to make this happen, and I strongly consider you to take action starting right now. You have to save far less than someone in their 40s or 50s.

But however old you are, it’s never too late to take control and plan. Something is always better than nothing.

So now I want you to consider this question.

When Do You Want to Stop Working?

Almost everyone will say “early, sometime in my 50s.”

And that’s a great goal to have, and is achievable even for moderate income families.

But the harsh reality is only a very small minority of people will change their behaviors to make that goal a reality.

As we talked about earlier, a goal without action is nothing but a wish. If you want to retire in your 50s, you’re going to have to change your behavior to achieve it.

The point I’m trying to drive home here is that for this to happen, YOU HAVE TO MAKE IT HAPPEN.

You have to deliberately take control of your finances in your life to make sure your debt is paid off, to make sure you are saving enough, to make sure your money is growing over time, to make sure you consider your goals for your future BEFORE maxing out your expenses, among many other things.

As much as you might hope, no one else is going to do this for you, not even me. I can be your guide, but it’s ultimately up to you to change your behavior.

You cannot afford to risk your financial future on the idea that you do not have to worry about your finances.

It’s up to you and you only take care of.

I know this is a little bit of tough love, but you know I’m not here to feed you lies. This is 100% real. Take control now, or risk working for your entire life.